16. Blue Guardian

- Maximum balance of standard account up to $400,000

- Overnight and weekend holding allowed

- News trading allowed

- A large variety of trading instruments

- Leverage up to 100:1

- Unlimited evaluation free retries

- 5 Minimum trading day requirement

- No free trial

- Slippage

At Blue Guardian, we believe in the importance of having both adequate capital and a well-crafted strategy to gain an advantage in the financial markets. Our traders are motivated to excel in their careers, and we place a strong emphasis on discipline, risk management, and long-term consistency. By providing the opportunity to manage account sizes of up to $200,000 and offering a generous profit split of 85%, we enable our clients to earn substantial profits. Our trading options encompass forex pairs, commodities, indices, and cryptocurrencies, allowing for diversified trading opportunities.

Who are Blue Guardian?

Blue Guardian is a proprietary trading firm that was established in June 2019. In September 2021, they transitioned to a public company and began providing traders with the opportunity to operate with a balance of up to $2,000,000, while enjoying 85% profit splits. They have formed strategic partnerships with brokers Eightcap and Purple Trading Seychelles. Operating under the official name Iconic Exchange Limited, trading as Blue Guardian, their headquarters are situated at 2 Highlands Court, Cranmore Avenue, Solihull, West Midlands, England, with the postal code B90 4LE.

Who is the CEO of Blue Guardian?

Sean Baiton is the CEO of Blue Guardian

Funding program options

Blue Guardian provides traders with a selection of two funding program accounts to choose from:

- Standard Guardian Evaluation

- Unlimited Guardian Evaluation

Standard Guardian evaluation program accounts

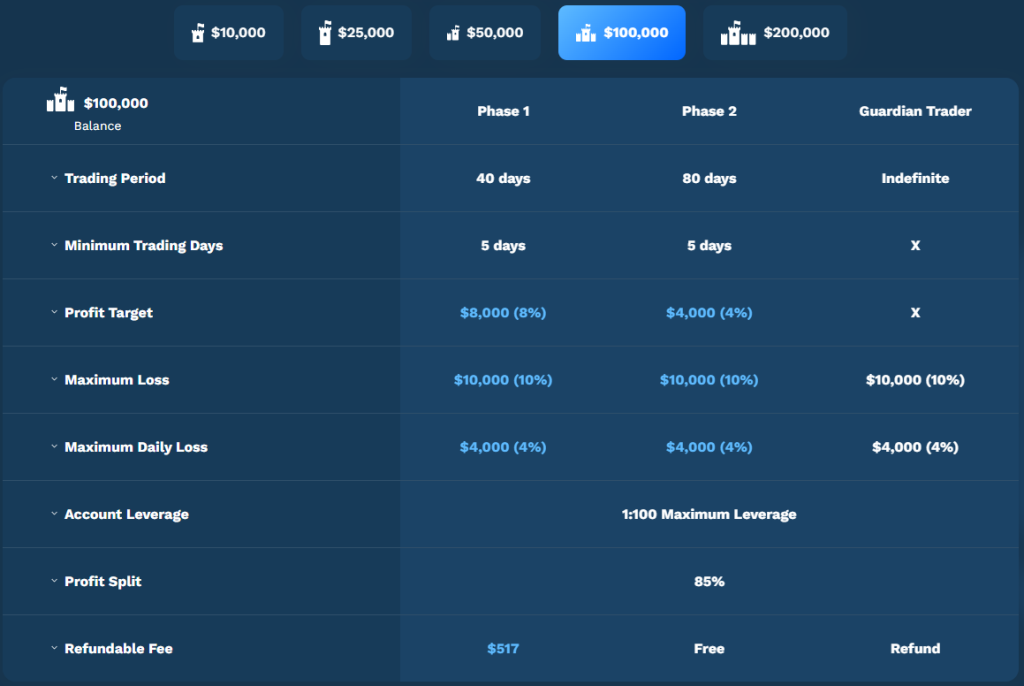

Blue Guardian's standard guardian evaluation program account is designed to discover dedicated and skilled traders who demonstrate consistent performance during the two-phase evaluation period. By opting for the standard guardian evaluation program account, traders gain the opportunity to trade with leverage of 1:100.

Account Size - Price

$10,000 - $97

$25,000 - $197

$50,000 - $307

$100,000 - $517

$200,000 - $997

In the first evaluation phase, traders are expected to achieve an 8% profit target while adhering to the 4% maximum daily loss and 10% maximum loss rules. The profit target must be reached within 40 calendar days from the day the trader initiates their first position on the evaluation account. Additionally, a minimum of 5 trading days is required to progress to phase two.

During the second evaluation phase, traders are required to reach a 4% profit target while staying within the 4% maximum daily loss and 10% maximum loss rules. The profit target should be achieved within 80 calendar days from the initiation of the first position on the evaluation account. Similarly, a minimum of 5 trading days is necessary to advance to a funded account.

Upon successfully completing both evaluation phases, traders are granted a funded account where there are no specific profit targets. However, they are expected to adhere to the 4% maximum daily loss and 10% maximum loss rules. The first payout from the funded account is scheduled 14 calendar days after the trader places their initial position. The profit split on the funded account is set at 85% based on the profits generated.

Standard Guardian evaluation program account scaling plan

The standard guardian evaluation program accounts also incorporate a scaling plan. To qualify, traders must achieve a profit target of 12% or more within a three-month period, with at least two out of the four months being profitable. Successful completion of this requirement results in an account balance increase of 30% based on the original account balance.

For instance:

After 3 months: If you have an account balance of $200,000, your balance will increase to $260,000.

After the following 3 months: The balance of $260,000 will increase to $320,000.

After the subsequent 3 months: The balance of $320,000 will increase to $380,000.

And so on...

In the standard guardian evaluation program accounts, traders have the opportunity to trade various instruments, including forex pairs, commodities, indices, and cryptocurrencies.

Standard Guardian evaluation program account rules

-

A profit target refers to a predetermined percentage of profit that traders must achieve in order to successfully complete an evaluation phase, withdraw profits, or scale their account. In phase 1 of the evaluation, the profit target is set at 8%, while in phase 2, the target is 4%. However, funded accounts do not have specific profit targets and offer more flexibility in terms of profit generation.

-

The maximum daily loss is the threshold for the highest allowable loss that a trader can incur within a single day before the account is considered in violation. For all account sizes, the maximum daily loss limit is set at 4%. This means that traders must ensure their losses do not exceed this percentage in a given day to remain within the account's compliance guidelines.

-

The maximum loss refers to the highest permissible overall loss that a trader can incur before the account is deemed in violation. Across all account sizes, there is a standard maximum loss limit of 10%. This means that traders must ensure their cumulative losses do not exceed this percentage in order to remain within the account's compliance parameters.

-

The minimum trading days refer to the mandatory duration for which traders are required to engage in trading before they can successfully complete an evaluation phase or request a withdrawal. In both evaluation phases, there is a minimum requirement of 5 trading days. However, funded accounts do not have any minimum trading day obligations, providing traders with greater flexibility in their trading activities.

-

The maximum trading days represent the time limit within which traders are expected to achieve a specific profit target or withdrawal target. In phase 1 of the evaluation, there is a maximum period of 40 trading days allotted to reach the target. Similarly, in phase 2, traders have a maximum of 80 trading days to achieve the desired outcome. These limits ensure that traders have a defined timeframe to work towards their objectives during each evaluation phase.

-

When it comes to third-party copy trading, there is a risk to consider. If you decide to utilize copy trading services from a third-party provider, it's important to be aware that there may be other traders already using the same service and adopting the exact trading strategy. By opting for a third-party copy trading service, there is a potential risk that if you exceed the maximum capital allocation rule, it could result in denial of a funded account or withdrawal. It's crucial to keep this risk in mind when engaging in third-party copy trading.

-

When it comes to using third-party Expert Advisors (EAs), it's important to consider the associated risks. If you plan to utilize a third-party EA, it's worth noting that there could be other traders who are already using the same EA and implementing the exact trading strategy. By opting for a third-party EA, there is a potential risk that exceeding the maximum capital allocation rule could result in the denial of a funded account or withdrawal. It's crucial to be mindful of this risk when employing third-party EAs in your trading activities.

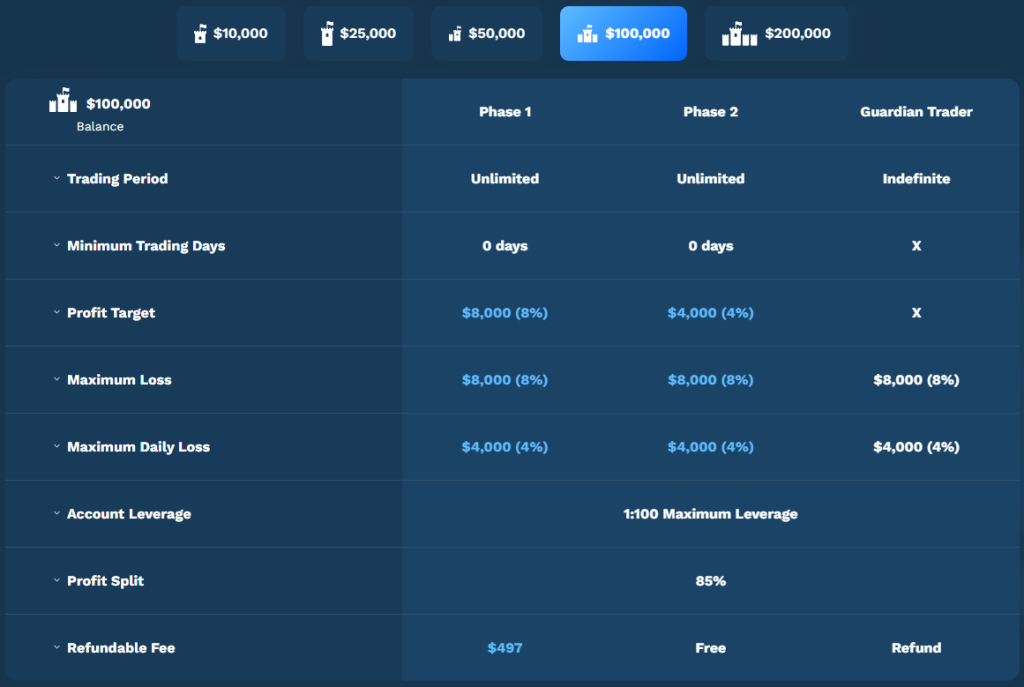

Unlimited Guardian evaluation program accounts

Blue Guardian's unlimited guardian evaluation program account is designed to identify skilled and disciplined traders who consistently demonstrate their expertise during the two-phase evaluation period. By opting for the unlimited guardian evaluation program account, traders have the opportunity to trade with leverage of 1:100. The focus is on recognizing experienced traders who exhibit discipline and consistency in their trading activities.

Account Size - Price

$10,000 - $87

$25,000 - $187

$50,000 - $297

$100,000 - $497

$200,000 - $957

In evaluation phase one, traders are expected to achieve a profit target of 8% without exceeding the 4% maximum daily loss or the 8% maximum loss rules. It is important to note that there is no time constraint during this phase, allowing for an unlimited trading period. Additionally, there are no minimum trading day requirements to proceed to phase two.

Moving on to evaluation phase two, traders must reach a profit target of 4% while adhering to the 4% maximum daily loss and 8% maximum loss rules. Similar to phase one, there is no specific time limit, and the trading period remains unlimited. There are no minimum trading day requirements to become eligible for a funded account.

Upon successfully completing both evaluation phases, traders are rewarded with a funded account that does not have profit targets. The only requirements are to adhere to the 4% maximum daily loss and 8% maximum loss rules. The first payout from the funded account is scheduled 14 calendar days after placing the first position. The profit split on the funded account is set at 85% based on the profits generated.

Unlimited Guardian evaluation program account scaling plan

The unlimited guardian evaluation program accounts also incorporate a scaling plan. To qualify, traders must achieve a profit target of 12% or more within a three-month period, with at least two out of the four months being profitable. Successful completion of this requirement results in an account balance increase of 30% based on the original account balance.

For example:

After 3 months: If you have an account balance of $200,000, your balance will increase to $260,000.

After the subsequent 3 months: The balance of $260,000 will increase to $320,000.

After the following 3 months: The balance of $320,000 will increase to $380,000.

And so on...

In the unlimited guardian evaluation program accounts, traders have the opportunity to trade various instruments, including forex pairs, commodities, indices, and cryptocurrencies.

Unlimited Guardian evaluation program account rules

-

A profit target represents a predefined percentage of profit that traders need to achieve in order to successfully complete an evaluation phase, withdraw profits, or scale their account. In phase 1 of the evaluation, the profit target is set at 8%, while in phase 2, the target is 4%. However, funded accounts do not have specific profit targets. This means that once traders have entered the funded account stage, they are not bound by any predetermined profit percentage requirements.

-

The maximum daily loss refers to the highest permissible amount of loss that a trader can incur within a single day before the account is considered in violation. It is important to note that across all account sizes, there is a standardized maximum daily loss limit of 4%. This means that traders must ensure that their losses do not exceed this percentage in any given day to maintain compliance with the account's rules and regulations.

-

The maximum loss refers to the highest allowable amount of cumulative loss that a trader can reach before the account is deemed in violation. Regardless of the account size, there is a uniform maximum loss limit of 8%. This means that traders must ensure that their overall losses do not exceed this percentage to remain within the account's compliance guidelines.

-

When considering third-party copy trading, it is important to be aware of the associated risks. By opting for a third-party copy trading service, it is possible that other traders are already using the same service and employing identical trading strategies. Utilizing such a service may expose you to the risk of being denied a funded account or withdrawal if you exceed the maximum capital allocation rule. It is essential to keep this risk in mind and exercise caution when engaging in third-party copy trading to ensure compliance with the relevant rules and regulations.

-

When it comes to third-party EA usage, it is important to consider the associated risks. By opting for a third-party EA, it is possible that other traders are already utilizing the same EA and employing the exact trading strategy. This introduces a risk factor wherein the use of a third-party EA may result in the denial of a funded account or withdrawal if you exceed the maximum capital allocation rule. It is crucial to keep this risk in mind and exercise caution when using third-party EAs to ensure compliance with the applicable rules and regulations.

What makes Blue Guardian different from other prop firms?

Blue Guardian sets itself apart from other industry-leading proprietary firms by offering two distinct two-step funding programs and allowing traders to maintain their preferred trading styles without imposing restrictions. This means you have the freedom to trade during news events, hold positions overnight, and even over weekends.

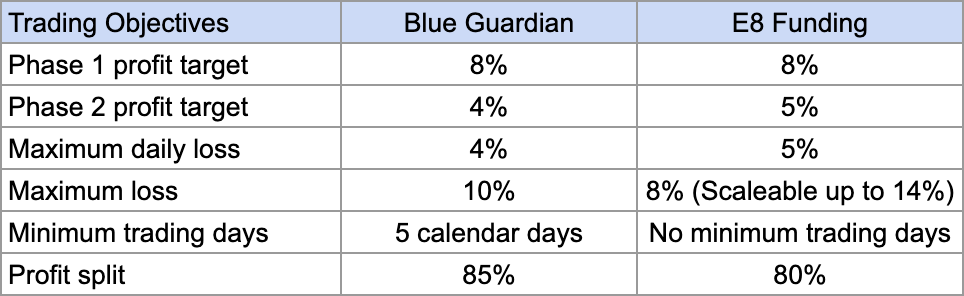

One of the funding programs available at Blue Guardian is the standard guardian evaluation program, which consists of two phases that traders must complete to become eligible for payouts. In phase one, the profit target is set at 8%, while in phase two, it is 4%. Traders must adhere to the 4% maximum daily loss and 10% maximum loss rules during both phases. Additionally, a minimum of 5 trading days is required in each phase before advancing to the funded stage.

It's worth noting that the standard guardian evaluation program at Blue Guardian also incorporates a scaling plan. In comparison to other prominent prop firms in the industry, Blue Guardian sets relatively lower profit targets and minimum trading day requirements, allowing for a more accessible and flexible evaluation process.

A comparative example between Blue Guardian and E8 Funding:

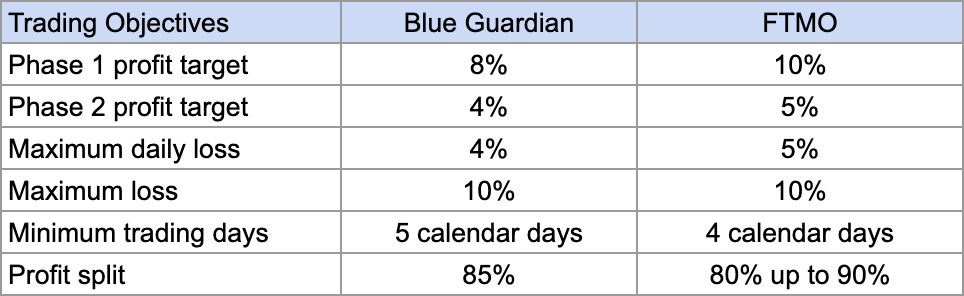

A comparative example between Blue Guardian and FTMO:

Is getting Fidelcrest capital realistic?

When exploring prop firms that align with your forex trading style, it is crucial to assess the realism of their trading requirements. While a company offering a high percentage profit split on a well-funded account may initially seem appealing, it becomes crucial to evaluate whether their expectations of high monthly gains coupled with low maximum drawdowns are achievable, as these factors significantly impact your chances of success.

Receiving capital through standard guardian evaluation programs is generally realistic, primarily due to their relatively modest profit targets of 8% in phase one and 4% in phase two. These programs also entail average maximum loss rules of 4% maximum daily loss and 10% maximum loss.

Likewise, obtaining capital through unlimited guardian evaluation programs is typically realistic, as they feature similar profit targets of 8% in phase one and 4% in phase two, along with average maximum loss rules of 4% maximum daily loss and 8% maximum loss. Additionally, these programs offer an unlimited maximum trading day period to complete both evaluation phases.

Taking these considerations into account, Blue Guardian emerges as an excellent choice for securing funding, given the availability of two-step evaluation program accounts with realistic trading objectives and conditions for receiving payouts.

Which broker does Blue Guardian use?

Blue Guardian has established partnerships with two reputable brokers, namely Eightcap and Purple Trading Seychelles. Eightcap is an ASIC-regulated broker located in Melbourne, Australia. Founded in 2009, their primary objective is to deliver exceptional financial services to their clients. With offices in five different locations worldwide and regulatory compliance in multiple jurisdictions, Eightcap enables clients from around the globe to engage in trading across various markets, including FX, indices, commodities, and shares.

On the other hand, Purple Trading Seychelles focuses on providing fair business conditions and leveraging state-of-the-art technologies to establish equitable partnerships with their clients. They prioritize offering advanced trading platforms, including MetaTrader 4 and MetaTrader 5, which empower traders with robust tools and features for a seamless trading experience.

Summary

In conclusion, Blue Guardian stands as a reputable proprietary trading firm that provides traders with the flexibility to choose between two distinct two-step evaluation program accounts, all while allowing them to maintain their preferred trading style without imposing restrictions. This means you can freely engage in trading activities during news events, hold positions overnight, and even throughout the weekends.

The standard guardian evaluation programs offered by Blue Guardian follow the industry-standard two-phase evaluation structure. Traders must successfully complete both phases to become funded and qualify for profit splits. To achieve this, participants are required to reach realistic profit targets of 8% in phase one and 4% in phase two. These objectives align with the firm's trading philosophy, which promotes risk management through a maximum daily loss limit of 4% and a maximum overall loss limit of 10%. Additionally, traders must fulfill a minimum trading day requirement of five days in each evaluation phase. By meeting these criteria, traders can earn profit splits of 85% and also have the opportunity to scale their trading accounts.

Alternatively, the unlimited guardian evaluation programs offered by Blue Guardian present another avenue for traders to pursue. Similar to the standard guardian programs, these evaluations consist of two phases, and successful completion leads to funding and profit splits. Traders aiming for an unlimited guardian account need to attain profit targets of 8% in phase one and 4% in phase two, aligning with the firm's commitment to realistic trading objectives. The maximum daily loss limit remains at 4%, while the maximum overall loss limit is reduced to 8%. Notably, there are no specific maximum or minimum trading day requirements during each evaluation phase. With unlimited guardian programs, traders can enjoy profit splits of 85% and also have the opportunity to scale their accounts based on their performance.

Considering the straightforward trading rules and the emphasis on consistent trading strategies, I highly recommend Blue Guardian to traders seeking a reputable prop firm. They offer favorable conditions for a diverse range of individuals with unique trading styles, solidifying their position as one of the leading proprietary trading firms in the industry.