20. Fidelcrest

- Unlimited evaluation free retries

- Multiple add-on options

- Multilingual Customer support

- Overnight holding and news trading allowed

- Leverage up to 1:200

- Up to 2,000,000 capital

- 15% up to 20% profit targets on Aggressive accounts

- High prices

- Lack of community payout feedback

Fidelcrest extends an invitation to regular traders to undertake their verification challenge, granting them the opportunity to oversee a capital of up to $1,000,000 regardless of their geographical location. Fidelcrest actively supports the success of their traders and empowers them to maximize their profits by trading with balances of up to $2,000,000. To qualify for funding, traders must successfully navigate a two-step trading challenge. Upon accomplishing this feat, they are rewarded with profit splits ranging from 80% to 90% on all their earnings.

Who are Fidelcrest?

Established in 2018 by a team of forex traders and industry experts, Fidelcrest is a proprietary trading firm with its main office situated in Nicosia, Cyprus. Additionally, their IT department is based in Tallinn, Estonia. Fidelcrest provides traders with the opportunity to operate with capital of up to $2,000,000, utilizing Fidelcrest Markets as their preferred brokerage. Their headquarters are conveniently located at Arch. Makariou III & 1-7 Evagorou, MITSI 3, 1st floor, office 102 C, in Nicosia, Cyprus.

Funding program options

Fidelcrest presents traders with a selection of two distinct programs to consider:

- Micro Trader evaluation program accounts

- Normal Micro Trader evaluation program accounts

- Aggressive Micro Trader evaluation program accounts

- Pro Trader evaluation program accounts

- Normal Pro Trader evaluation program accounts

- Aggressive Pro Trader evaluation program accounts

Micro Trader evaluation program accounts

- Normal Micro Trader evaluation program accounts

Account Size - Price

$15,000 - €99

$30,000 - €199

$60,000 - €299

In the evaluation phase one, traders are expected to achieve a profit target of 10% while staying within the limits of a 5% maximum daily loss and 10% maximum loss. The target should be reached within 60 calendar days from the first position taken on the evaluation account. There are no minimum trading day requirements to proceed to evaluation phase two.

Moving on to evaluation phase two, traders need to aim for a profit target of 5% while adhering to the same maximum daily loss and maximum loss rules. The profit target should be reached within 60 calendar days from the first position taken on the evaluation account. Similarly, there are no minimum trading day requirements to advance to a funded account.

Successful completion of both evaluation phases grants traders a funded account without specific profit targets. The focus shifts to respecting the 5% maximum daily loss and 10% maximum loss rules. The first payout is scheduled for ten calendar days after placing the first position on the funded account, provided certain criteria are met. During this time, traders are required to trade for a minimum of 10 calendar days while maintaining profitability to be eligible for the first withdrawal. The profit split on the funded account is set at 80% based on the profit generated.

Normal Micro Trader evaluation program account scaling plan

At present, there is no scaling plan offered for Normal Micro Trader evaluation program accounts.

Normal Micro Trader evaluation program account rules

-

Traders must achieve a specific percentage of profit, known as the profit target, in order to successfully complete an evaluation phase, withdraw profits, or scale their account. During phase 1, the profit target is set at 10%, while phase 2 requires a profit target of 5%. However, funded accounts do not have any profit targets to meet.

-

The maximum daily loss refers to the highest allowable loss that a trader can incur within a single day before the account is considered in violation. For all account sizes, the maximum daily loss is set at 5%.

-

The maximum loss represents the maximum allowable loss that a trader can experience overall before the account is deemed in violation. For all account sizes, the maximum loss limit is set at 10%.

-

The maximum trading days refer to the maximum duration within which you are expected to achieve a specific profit target or withdrawal target. Both Phase 1 and Phase 2 of the evaluation program have a maximum trading period of 60 calendar days.

-

Traders are prohibited from utilizing any form of martingale strategy during their trading activities.

-

The risk desk team is responsible for evaluating traders' trading strategies to determine if they align with the prop firm's requirements. If they determine that your trading strategy does not meet the criteria, you will receive a refund for your evaluation account.

-

When it comes to third-party copy trading, it's important to consider the risk involved. By utilizing a third-party copy trading service, it's possible that other traders are already using the same trading strategy. Consequently, there is a potential risk of being denied a funded account or withdrawal if you surpass the maximum capital allocation rule.

2. Aggressive Micro Trader evaluation program accounts

Fidelcrest's Aggressive Micro Trader evaluation program account is designed to identify dedicated and skilled traders who demonstrate consistent performance throughout the two-phase evaluation period. This program offers the opportunity to trade with leverage of up to 1:200.

Account Size - Price

$15,000 - €199

$30,000 - €299

$60,000 - €399

During evaluation phase one, traders are expected to achieve a 15% profit target within 60 calendar days of initiating trades on their evaluation account. It is important to avoid exceeding the 10% maximum daily loss or the 20% maximum loss rules. There are no minimum trading day requirements to proceed to evaluation phase two.

In evaluation phase two, traders need to attain a 15% profit target within 60 calendar days from the day they begin trading on the evaluation account. Again, the 10% maximum daily loss and 20% maximum loss rules must not be surpassed. There are no specific minimum trading day requirements for advancing to a funded account.

Successful completion of both evaluation phases rewards traders with a funded account, where there are no profit targets. However, it is essential to adhere to the 10% maximum daily loss and 20% maximum loss rules. The first payout from the funded account occurs ten calendar days after initiating trades, provided certain criteria are met. Within this time frame, traders must trade for a minimum of 10 calendar days and be profitable to be eligible for their first withdrawal. The profit split is set at 90%, based on the profits earned on the funded account.

Aggressive Micro Trader evaluation program account scaling plan

At present, there is no scaling plan accessible for Aggressive Micro Trader evaluation program accounts.

Aggressive Micro Trader evaluation program account rules

-

A profit target refers to a predetermined percentage of profit that traders must achieve in order to successfully complete an evaluation phase, withdraw their profits, or scale their account. In phase 1, the profit target is set at 15%, and phase 2 also requires a profit target of 15%. However, funded accounts do not have any profit targets associated with them.

-

The maximum daily loss represents the highest allowable amount of loss a trader can incur in a single day before their account is considered violated. For all account sizes, the maximum daily loss limit is set at 10%.

-

The maximum loss refers to the maximum overall loss that a trader can experience before their account is considered violated. Across all account sizes, the maximum loss limit is set at 20%.

-

The maximum trading days represent the duration within which you are expected to achieve a designated profit target or withdrawal target. Both Phase 1 and Phase 2 have a maximum trading period of 60 calendar days.

-

The prohibition of martingale strategies indicates that traders are restricted from employing any form of martingale strategy during their trading activities.

-

The risk desk team plays a crucial role in evaluating whether a trader's trading strategy aligns with the requirements of the prop firm. If the team determines that your trading strategy is not eligible, you will receive a refund for your evaluation account.

-

When it comes to third-party copy trading risk, it's important to consider that if you choose to utilize copy trading services from a third-party provider, there is a possibility that other traders are already using the same service, employing identical trading strategies. By opting for a third-party copy trading service, there is a potential risk of being denied a funded account or withdrawal if you surpass the maximum capital allocation rule.

Pro Trader evaluation program accounts

1. Normal Pro Trader evaluation program accounts

The objective of Fidelcrest's Normal Pro Trader evaluation program account is to recognize dedicated and skilled traders who demonstrate consistent performance throughout the two-phase evaluation period. This program provides the opportunity to trade with leverage of up to 1:200.

Account Size - Price

$250,000 - €999

$500,000 - €1,899

$1,000,000 - €2,999

During evaluation phase one, traders must achieve a profit target of 10% within 60 calendar days of initiating trades on their evaluation account. It is crucial to stay below the 5% maximum daily loss and 10% maximum loss rules. There are no specific minimum trading day requirements to proceed to evaluation phase two.

In evaluation phase two, traders need to attain a profit target of 10% within 60 calendar days from the day they begin trading on the evaluation account. Once again, it is important to adhere to the 5% maximum daily loss and 10% maximum loss rules. There are no specific minimum trading day requirements to qualify for a funded account.

Successful completion of both evaluation phases rewards traders with a funded account, where no profit targets are set. The only requirements are to abide by the 5% maximum daily loss and 10% maximum loss rules. The first payout from the funded account occurs ten calendar days after initiating trades, provided certain criteria are met. Within this time frame, traders must trade for a minimum of 10 calendar days and be profitable in order to request their first withdrawal. The profit split is set at 80%, based on the profits earned on the funded account.

Normal Pro Trader evaluation program account scaling plan

At present, there is no scaling plan accessible for Normal Pro Trader evaluation program accounts.

Normal Pro Trader evaluation program account rules

-

A profit target represents a designated percentage of profit that traders must achieve in order to successfully complete an evaluation phase, withdraw profits, or scale their account. In phase 1, the profit target is set at 10%, and phase 2 also requires a profit target of 10%. However, funded accounts do not have any profit targets associated with them.

-

The maximum daily loss refers to the highest allowable amount of loss that a trader can incur in a single day before their account is considered violated. For all account sizes, the maximum daily loss limit is set at 5%.

-

The maximum loss signifies the highest permissible amount of overall loss that a trader can reach before their account is deemed violated. For all account sizes, the maximum loss limit is set at 10%.

-

The maximum trading days represent the prescribed timeframe within which traders are expected to achieve a specific profit target or withdrawal target. Both Phase 1 and Phase 2 have a maximum trading period of 60 calendar days.

-

The restriction on martingale strategies implies that traders are prohibited from employing any form of martingale strategy during their trading activities.

-

The risk desk team is responsible for assessing whether a trader's trading strategy aligns with the preferences of the prop firm. If the team determines that your trading strategy is not eligible, you will receive a refund for your evaluation account.

-

When it comes to the risk associated with third-party copy trading, it is important to consider that by using such services, there is a possibility that other traders are already utilizing the same service and implementing an identical trading strategy. Consequently, utilizing a third-party copy trading service exposes you to the potential risk of being denied a funded account or withdrawal if you exceed the maximum capital allocation rule.

2. Aggressive Pro Trader evaluation program accounts

The primary objective of Fidelcrest's Aggressive Pro Trader evaluation program account is to recognize dedicated and skilled traders who demonstrate consistent performance throughout the two-phase evaluation period. This program provides the opportunity to trade with leverage of 1:200.

Account Size - Price

$250,000 - €1,999

$500,000 - €3,499

During evaluation phase one, traders are expected to achieve a profit target of 20% within 60 calendar days from the initiation of trades on their evaluation account. It is crucial to stay below the 10% maximum daily loss and 20% maximum loss rules. There are no specific minimum trading day requirements to proceed to evaluation phase two.

In evaluation phase two, traders need to attain a profit target of 20% within 60 calendar days from the day they begin trading on the evaluation account. Once again, it is important to adhere to the 10% maximum daily loss and 20% maximum loss rules. There are no specific minimum trading day requirements to qualify for a funded account.

Successful completion of both evaluation phases rewards traders with a funded account, where no profit targets are set. The only requirements are to abide by the 10% maximum daily loss and 20% maximum loss rules. The first payout from the funded account occurs ten calendar days after initiating trades, provided certain criteria are met. Within this time frame, traders must trade for a minimum of 10 calendar days and be profitable in order to request their first withdrawal. The profit split is set at 90%, based on the profits earned on the funded account.

Aggressive Pro Trader evaluation program account scaling plan

At present, there is no scaling plan accessible for Aggressive Pro Trader evaluation program accounts.

Aggressive Pro Trader evaluation program account rules

-

A profit target represents a defined percentage of profit that traders must achieve before they can successfully complete an evaluation phase, withdraw profits, or scale their account. In phase 1, the profit target is set at 20%, and phase 2 also requires a profit target of 20%. However, funded accounts do not have any profit targets associated with them.

-

The maximum daily loss refers to the highest amount of loss that a trader can incur within a single day before their account is considered violated. For all account sizes, the maximum daily loss limit is set at 10%.

-

The maximum loss represents the highest allowable amount of overall loss that a trader can experience before their account is considered violated. For all account sizes, the maximum loss limit is set at 20%.

-

The maximum trading period denotes the specified timeframe during which traders are required to attain a particular profit target or withdrawal target. In both Phase 1 and Phase 2, the maximum trading period is set at 60 calendar days.

-

The restriction on martingale strategies implies that traders are prohibited from utilizing any form of the martingale strategy during their trading activities.

-

The Risk Desk team evaluates traders' strategies to determine if they align with the prop firm's requirements. If your trading strategy is deemed ineligible, you will receive a refund on your evaluation account.

-

By engaging in third-party copy trading, it is crucial to consider the associated risks. When relying on such services, it is possible that other traders are already implementing the exact same trading strategy. Consequently, using a third-party copy trading service increases the likelihood of being denied a funded account or withdrawal if the maximum capital allocation rule is exceeded.

Special add-on options upon purchase of an evaluation program

-

Add insurance – Receive a second account for free if you fail your first Challenge phase (Available for all account sizes and types) – (+30% on the one-time fee)

-

Double your capital – Receive a second account for free after you have made a profit with your funded account – (+50% on the one-time fee)

-

Double your leverage – Receive a chance to work with up to 1:200 leverage while trading on your trading account, meaning that you can control much larger position sizes than you normally would (Available for all account sizes and types) – (+20% on the one-time fee)

-

Unlimited retry – Receive an opportunity to make unlimited retirees on your evaluation phases if you are in profit at the end of your trading period – (Free for all account sizes and types)

What makes Fidelcrest different from other prop firms?

Fidelcrest sets itself apart from other leading prop firms by offering straightforward trading rules that allow you to trade freely during news events, hold positions overnight, and even during weekends.

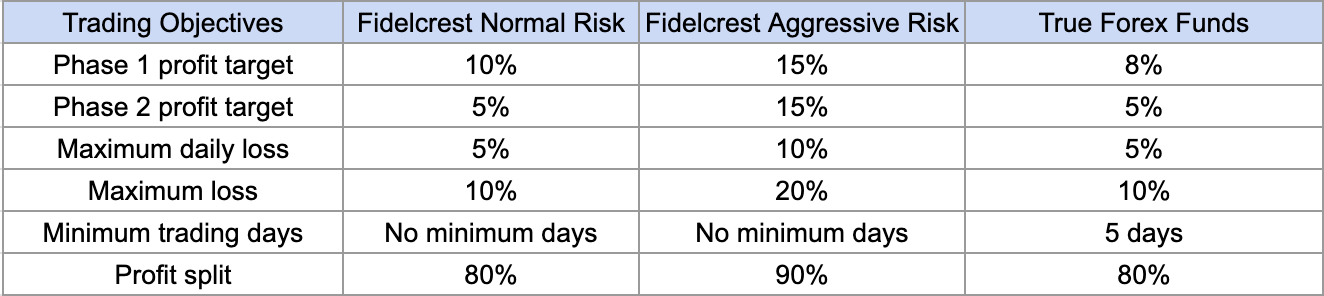

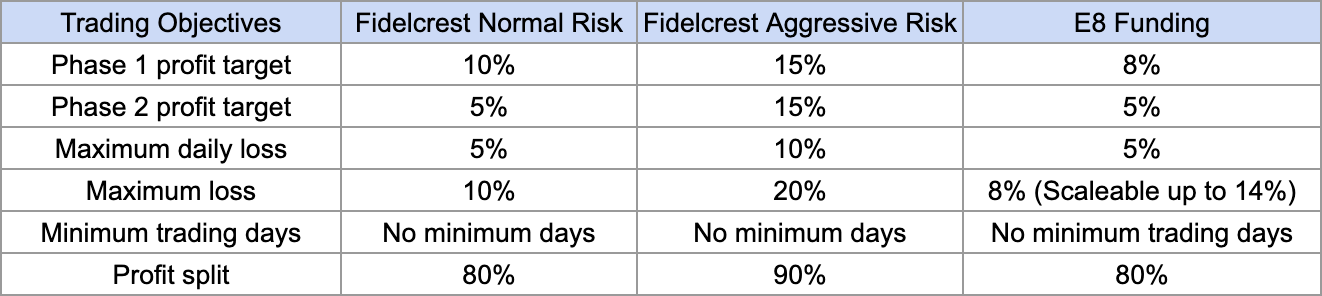

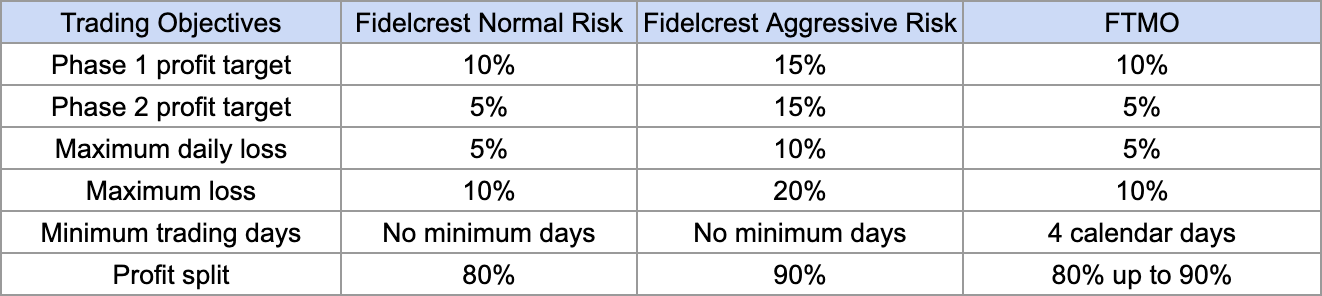

In contrast to other prop firms, Fidelcrest's Micro Trader evaluation program account follows a two-phase evaluation process, ensuring traders complete both phases to become eligible for payouts. In phase one, normal risk accounts have a profit target of 10%, while aggressive risk accounts have a higher target of 15%. In phase two, both account types aim for a 5% profit target (normal risk) and 15% profit target (aggressive risk). Throughout the evaluation phases and even after reaching funded status, normal risk accounts have a maximum daily loss limit of 5% and a maximum loss limit of 10%. Aggressive risk accounts have a higher maximum daily loss limit of 10% and a maximum loss limit of 20%. Additionally, there are no minimum trading day requirements for both account types during the evaluation phases. However, Micro Trader evaluation program accounts do not offer a scaling plan for growth. Compared to other top prop firms in the industry, Fidelcrest's trading objectives align with industry averages.

Is getting Fidelcrest capital realistic?

When evaluating prop firms for your forex trading style, it's crucial to assess the realism of their trading requirements. While a company may offer a high percentage profit split on a well-funded account, it's important to consider if they expect unrealistically high monthly gains with minimal drawdowns, as this greatly diminishes your chances of success.

Fidelcrest's Micro Trader evaluation program accounts provide a realistic path to receive capital, offering both normal and aggressive risk account types. Normal risk accounts have moderate profit targets of 10% in phase one and 5% in phase two, accompanied by reasonable maximum loss rules of 5% maximum daily loss and 10% maximum loss in both evaluation phases. Aggressive risk accounts, on the other hand, have higher profit targets of 15% in both phases and slightly more lenient maximum loss rules of 10% maximum daily loss and 20% maximum loss in both evaluation phases.

Likewise, Fidelcrest's Pro Trader evaluation program accounts offer realistic conditions for receiving capital, allowing you to choose between normal and aggressive risk account types. Normal risk accounts have average profit targets of 10% in both phases, along with reasonable maximum loss rules of 5% maximum daily loss and 10% maximum loss in both evaluation phases. Aggressive risk accounts, on the other hand, have higher profit targets of 20% in both phases, accompanied by slightly more flexible maximum loss rules of 10% maximum daily loss and 20% maximum loss in both evaluation phases.

Considering these factors, Fidelcrest stands out as an excellent choice for obtaining funding, as their evaluation program accounts offer realistic trading objectives and payout conditions that align with industry standards.

Which broker does Fidelcrest use?

Fidelcrest operates its own brokerage called Fidelcrest Markets.

Trading instruments

Fidelcrest provides a diverse selection of trading instruments that include Forex, Commodities, Indices, Stocks, and Cryptocurrency.

Summary

In summary, Fidelcrest is a reputable proprietary trading firm that provides traders with two funding programs to choose from: Micro Trader and Pro Trader programs.

The Micro Trader evaluation programs follow a standard two-phase evaluation process, where traders must complete both phases to become funded and eligible for profit splits. Traders can select from normal and aggressive risk account types. Normal risk accounts have profit targets of 10% in phase one and 5% in phase two, with average maximum loss rules (5% maximum daily loss and a maximum loss of 10%). Aggressive risk accounts have profit targets of 15% in both phases, along with maximum loss rules of 10% daily loss and a maximum loss of 20%. With Micro Trader evaluation programs, traders can earn profit splits ranging from 80% to 90% based on their chosen risk type.

Similarly, the Pro Trader evaluation programs follow a two-phase evaluation process, requiring completion of both phases to become funded and eligible for profit splits. Traders can choose between normal and aggressive risk account types. Normal risk accounts have profit targets of 10% in both phases, with average maximum loss rules (5% maximum daily loss and a maximum loss of 10%). Aggressive risk accounts have profit targets of 20% in both phases, along with maximum loss rules of 10% daily loss and a maximum loss of 20%. With Pro Trader evaluation programs, traders can earn profit splits ranging from 80% to 90% based on their chosen risk type.

For individuals seeking a proprietary trading firm with clear trading rules and a consistent trading strategy, I highly recommend considering Fidelcrest. They are a well-established firm offering favorable conditions for a diverse range of traders. After thorough evaluation, Fidelcrest stands out as one of the top choices among proprietary trading firms in the industry.