18. FTUK

- Reliable support

- Profit share of 80%

- Leverage up to 1:100

- Weekend and overnight positions allowed

- Single-phase evaluation process

- One-time fee

- Starting leverage of 1:10

- 2% Max stop loss risk limit

- Lot size consistency rule

- Slippage

In February 2021, FTUK was established with the objective of enhancing the realm of proprietary trading. Their aim is to provide improved services to profitable traders across the globe.

FTUK motivates its traders to excel in their professional journeys by providing opportunities to increase their earnings through three trading accounts, each with a balance of up to $5,760,000, with the potential for a 3x increase. Traders have the choice between two programs: an instant funding program or an evaluation program. To obtain funding through the evaluation program, traders need to successfully pass the 1-Phase Evaluation Process. Once funded, traders are assigned specific Profit Targets that they must achieve in order to expand their account balance. Upon accomplishing these targets, traders are rewarded with an 80% profit split and a doubling of their account balance.

Who are FTUK?

FTUK, a proprietary firm headquartered in London, UK, provides traders with the opportunity to access up to three accounts, each with a substantial balance of $5,760,000. They utilize Eightcap as their broker for trading operations.

Registered as FTUK Ltd with the company number 13793849, FTUK was established on December 10, 2021. Their official registered address is Kemp House, 160 City Road, EC1V 2NX, London, UK.

Funding program options

FTUK provides a selection of two distinct programs for traders to choose from:

- Evaluation program accounts

- Instant funding program accounts

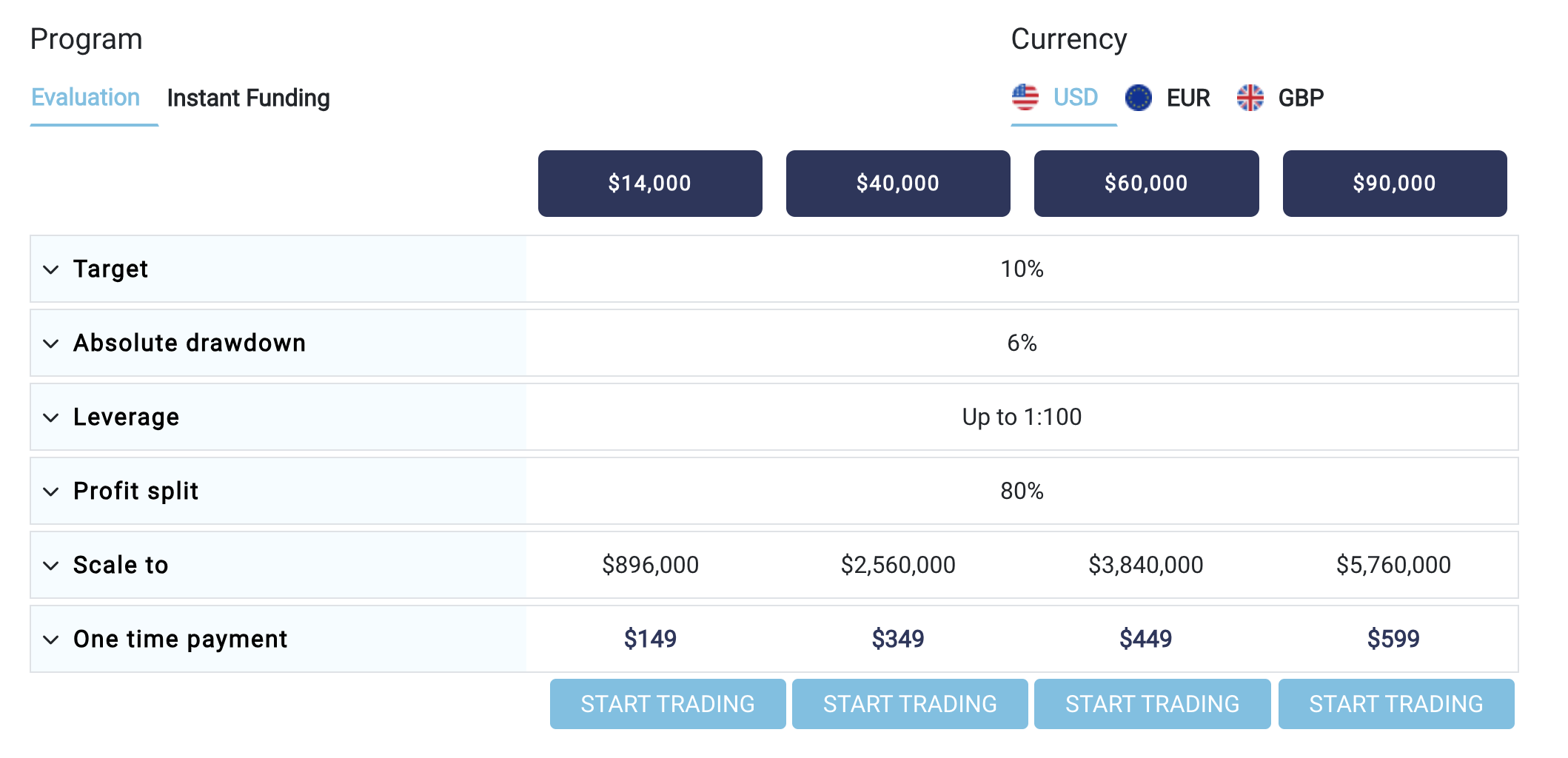

Evaluation program accounts

FTUK's evaluation program provides traders with the flexibility of an unlimited timeframe to meet evaluation requirements, with the option to trade using leverage of up to 1:100. Traders have the freedom to choose their account funding currency from USD, EUR, or GBP.

During the evaluation phase, traders are tasked with achieving a profit target of 10% while adhering to a maximum loss limit of 6%. There are no specific minimum trading day requirements, and traders can continue trading for an indefinite period. It's important to set a maximum stop loss risk of 2% per position while conducting trades.

Successful completion of the evaluation phase grants traders a funded account where profit targets are no longer applicable. Traders are only obligated to observe the 6% maximum loss rule and maintain a maximum stop loss risk of 2% per position. Payouts can be requested at any time starting from level two or higher. Importantly, withdrawing funds does not impact account growth, nor does it necessitate compensation for the previously paid out profits. Traders receive an 80% profit split based on the profits generated.

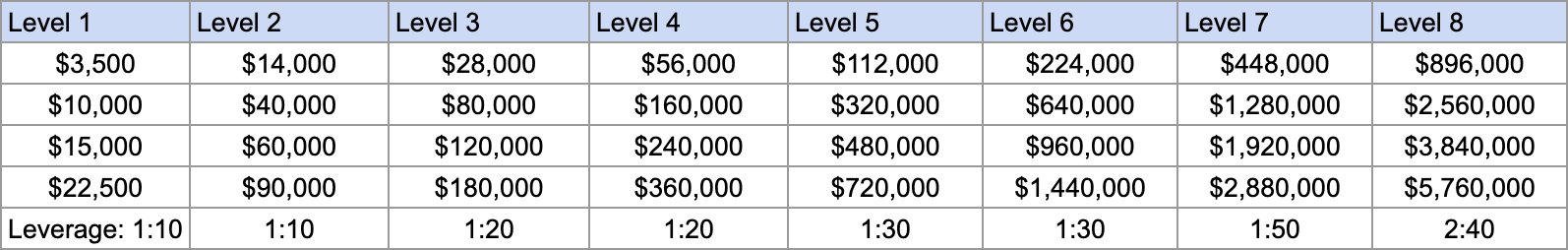

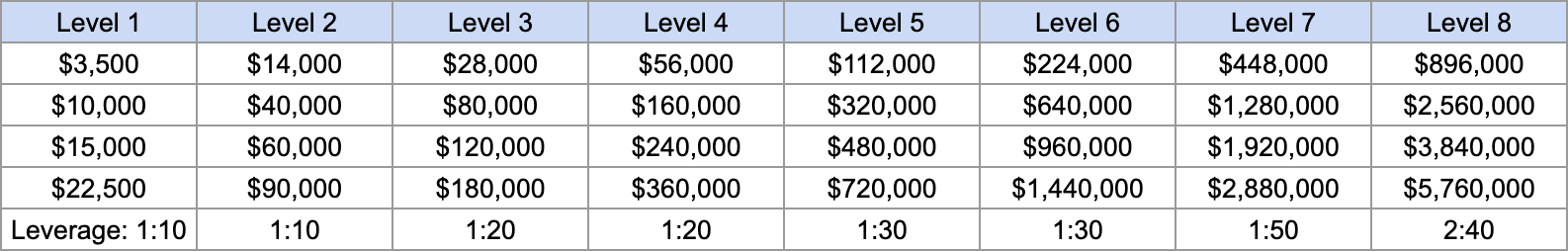

Evaluation program account scaling plan

Level 8 is only available as an add-on

Evaluation program accounts offer a scaling plan, which is outlined in the provided spreadsheet. To qualify for scaling your account, the only requirement is to achieve a profit target of 10%. Once you reach this target, your account becomes eligible for scaling. A noteworthy aspect to consider is that withdrawing funds from your account does not hinder its ability to scale up. As long as your total profits reach the 10% profit target, your account is eligible for scaling.

For instance:

The profit target for this particular account type is set at 10%.

Week 1: You achieve a gain of 4.2% and withdraw your profits.

Week 2: You achieve a gain of 5.8% and withdraw your profits.

By the end of these two weeks, your total profits amount to 10%, thus meeting the 10% profit target and making you eligible for a scale-up.

The evaluation program account allows trading in forex pairs, commodities, and indices as available trading instruments.

Evaluation program account rules

-

A profit target refers to the predetermined percentage of profit that traders need to achieve in order to fulfill various requirements such as completing an evaluation phase, withdrawing profits, or scaling their account. In the evaluation phase, the profit target is set at 10%.

-

The maximum loss represents the highest allowable overall loss that a trader can incur before their account is deemed violated. For all account sizes, the maximum loss limit is set at 6%.

-

Traders are required to set a stop-loss on each position prior to initiating a trade, indicating that a stop-loss is mandatory.

-

Before initiating a trade, traders are required to establish a specific percentage-based stop-loss for each position. This is known as the stop-loss risk per position. It is mandatory to set a stop-loss risk of 2% for every individual position before opening a trade.

-

Lot size consistency is a regulation that necessitates traders to maintain uniformity in the lot sizes of their opened positions. Typically, this rule includes a specified percentage that determines the acceptable differentiation limit between lot sizes.

-

The restriction of "no martingale allowed" signifies that traders are prohibited from utilizing any form of martingale strategy during their trading activities.

-

The concept of "third-party copy trading risk" indicates that when considering the utilization of copy trading services, it is important to be aware that such services may already be employed by other traders who are implementing the exact same trading strategy. Engaging in third-party copy trading carries the potential risk of being denied a funded account or withdrawal if the maximum capital allocation rule is exceeded.

Add-on options for FTUK’s evaluation program accounts

- Unlock scaling level 8: 10% price increase when purchasing your evaluation account

- No mandatory stop-loss: 20% price increase when purchasing your evaluation account

- Joining fee refund: 25% price increase when purchasing your evaluation account

- Evaluation retake: 50% price increase when purchasing your evaluation account

Please note that you have the flexibility to select one or multiple add-on options based on your personal preference!

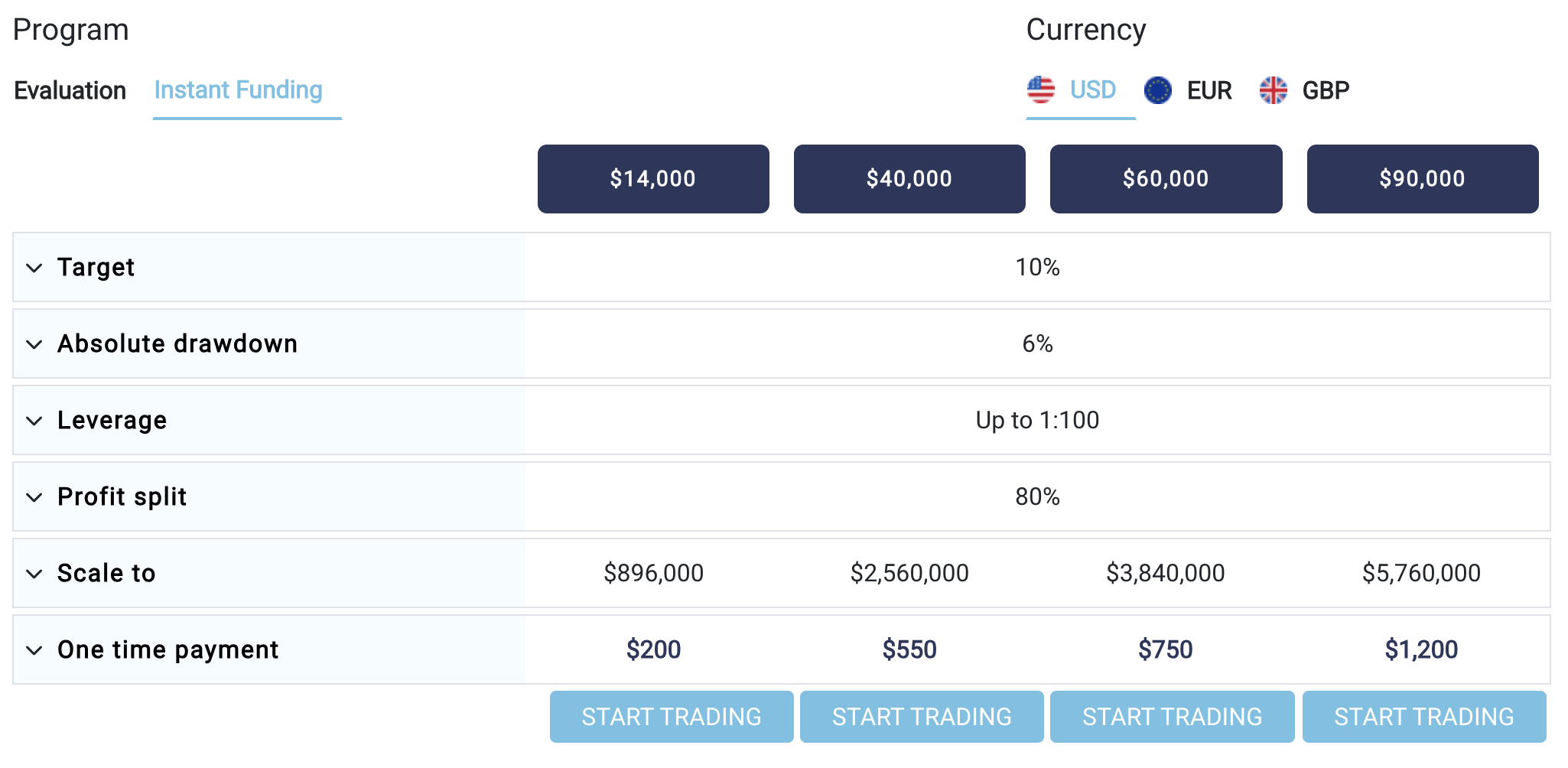

Instant funding program accounts

Through FTUK's instant funding program account, traders have the opportunity to bypass the evaluation process entirely and commence earning right away. While trading with leverage of up to 1:100, traders are rewarded with 80% profit splits based on their trading profits. Additionally, traders have the flexibility to select their preferred account funding currency from USD, EUR, or GBP.

Instant funding program account scaling plan

Level 8 is only available as an add-on

The instant funding program accounts provided by FTUK feature a scaling plan, which is accessible in the spreadsheet provided above. To qualify for scaling your account, the sole requirement is to attain a profit target of 10%. Once you reach this profit target, you become eligible to scale your account. It is worth noting that withdrawing funds from your account does not impede its ability to scale up. As soon as your total profits reach the 10% profit target, your account becomes eligible for scaling.

For instance:

The profit target for this specific account type is set at 10%.

Week 1: You achieve a gain of 4.2% and withdraw your profits.

Week 2: You achieve a gain of 5.8% and withdraw your profits.

With the cumulative profits reaching 10%, you become eligible for scaling up since you have successfully reached the 10% profit target.

Forex pairs, commodities, and indices are the available trading instruments for the instant funding program account.

Instant funding program account rules

-

The profit target refers to a predetermined percentage of profit that traders must achieve before they can successfully complete an evaluation phase, withdraw profits, or scale their account. In the case of the scaling plan, the profit target is set at 10%.

-

The maximum loss represents the highest allowable overall loss that a trader can incur before their account is considered violated. For all account sizes, there is a uniform maximum loss limit of 6%.

-

The requirement of "stop-loss required" implies that traders are obligated to set a stop-loss order for each position prior to initiating a trade.

-

Stop-loss risk per position refers to the obligation of traders to establish a position-specific stop-loss based on a specific percentage before they can initiate a trade. It is mandatory to set a stop-loss risk of 2% for each individual position before opening a trade.

-

Lot size consistency is a regulation that mandates traders to maintain uniformity in the lot sizes of the positions they open. Typically, this rule is defined by a specific percentage that determines the allowable differentiation limit between lot sizes.

-

The prohibition of "no martingale allowed" indicates that traders are forbidden from employing any form of martingale strategy during their trading activities.

-

Third-party copy trading risk refers to the potential risks associated with utilizing copy trading services provided by external parties. When opting for a third-party copy trading service, it is important to consider that there may be other traders already using the same service and implementing identical trading strategies. Engaging in such services exposes you to the possibility of being denied a funded account or withdrawal if you exceed the maximum capital allocation rule.

Add-on options for FTUK’s instant funding program accounts

-

Unlock scaling level 8: 10% price increase when purchasing your instant funding account

-

No mandatory stop-loss: 20% price increase when purchasing your instant funding account

-

Joining fee refund: 25% price increase when purchasing your instant funding account

Please be aware that you have the flexibility to select one or multiple add-on options based on your personal preference!

What makes FTUK different from other prop firms?

FTUK stands out from other industry-leading prop firms due to its distinctive feature of offering two distinct funding programs: Evaluation and instant funding. Notably, FTUK does not impose any maximum or minimum trading day requirements, allowing traders the flexibility to engage in trading during news releases, hold trades overnight, and even over weekends.

When comparing FTUK's evaluation program accounts to those of other prop firms, they feature a streamlined one-phase evaluation process. Traders must successfully complete the evaluation phase and achieve a profit target of 10% to become eligible for payouts. The evaluation program entails adhering to a 6% maximum loss rule, implementing required stop-loss orders, maintaining stop-loss risk per position, and ensuring lot size consistency. Additionally, evaluation program accounts include a scaling plan. Unlike some other industry-leading prop firms, FTUK does not impose specific maximum or minimum trading day requirements, affording traders the opportunity to navigate the evaluation period without the added pressure of meeting time-related objectives.

In addition to the evaluation program, FTUK offers instant funding program accounts. Similarly, these accounts maintain a profit target of 10%, adhere to a 6% maximum loss rule, require stop-loss orders, enforce stop-loss risk per position, and emphasize lot size consistency. Instant funding program accounts also incorporate a scaling plan. Notably, traders have the option to bypass the evaluation process entirely and begin earning from the outset.

In summary, FTUK distinguishes itself from other industry-leading prop firms through the provision of two funding programs. Furthermore, the absence of strict maximum or minimum trading day limitations enables traders to engage in trading activities during news events, hold trades overnight, and operate throughout weekends, fostering a more flexible trading experience.

Is getting FTUK capital realistic?

When evaluating prop firms that align with your forex trading style, it is crucial to assess the realism of their trading requirements. While the prospect of a prop firm offering a high percentage profit split on a well-funded account may initially seem appealing, it becomes essential to consider if they expect impractical high percentage gains per month coupled with low maximum drawdown percentages. Such requirements can significantly diminish your chances of success.

The evaluation program accounts, which have an average profit target of 10% and adhere to an average maximum loss rule of 6%, present a realistic opportunity to receive capital. Meeting these criteria positions traders favorably for funding, given the attainable objectives and sensible risk management guidelines.

Similarly, the instant funding program accounts provide a realistic avenue to secure capital as they function as direct funding programs, allowing traders to commence earning from the outset. In the first level of the instant funding program, achieving a profit target of 10% results in a quadrupling of your initial capital. Moreover, the 6% maximum loss rule imposed in these accounts maintains a practical approach to risk management.

Considering these factors, FTUK emerges as an excellent choice for securing funding. The availability of two distinct funding programs, each with realistic trading objectives and conditions for receiving payouts, enhances the appeal and viability of FTUK as a funding option for traders.

Summary

To summarize, FTUK is a legitimate proprietary trading firm that provides traders with the flexibility to choose between two funding programs: evaluation and instant funding.

The evaluation program accounts necessitate achieving a profit target of 10% while ensuring not to exceed the 6% maximum loss rule. There are no specific requirements for the number of trading days, allowing traders the freedom to trade at their own pace. However, it is essential to adhere to certain rules, including setting a required stop-loss, implementing stop-loss risk per position, and maintaining lot size consistency.

In the case of instant funding program accounts, there are no profit target requirements to request withdrawals from level two or higher at any time. Similar to the evaluation program, there are no restrictions on the number of trading days. Traders must, however, comply with the required stop-loss, stop-loss risk per position, and lot size consistency rules.

Considering FTUK's well-established reputation as a proprietary trading firm, it is recommended for individuals seeking a firm with transparent and straightforward rules. With its diverse funding options, FTUK caters to a wide range of traders with varying trading styles. Taking everything into account, FTUK stands out as an appealing choice among proprietary trading firms.