22. Funded Academy

- A real account with real funds

- Bi-weekly payouts

- Profit splits of 70% up to 90%

- Extended account balance up to $1,000,000

- 1:100 leverage on Standard challenge accounts

- Overnight holding allowed

- Add-on features for Extended challenge accounts

- Lots size limits

- No free trial

- 1:10 leverage on Extended challenge accounts

- Monthly payouts on Extended challenge accounts

- Slow payout process

The objective of Funded Academy is to revolutionize the online prop funding sector, with the goal of creating a more competitive landscape that enables traders to secure optimal funding opportunities.

Funded Academy promotes the development of successful traders who exhibit disciplined risk management and prioritize long-term consistency. They provide traders with the opportunity to earn substantial profits by allowing them to manage account sizes of up to $1,000,000 and offering a profit split of 70%. This is made possible through trading various assets such as forex pairs, metals, indices, and cryptocurrencies.

Who are Funded Academy?

Established on July 29th, 2021, Funded Academy is a proprietary firm based in St Ives, New South Wales, Australia. They provide traders with access to capital balances of up to $1,000,000 and offer profit splits of up to 90%. As for their broker partnerships, they collaborate with Eightcap for their Extended challenge accounts and work with IronFX for standard challenge accounts. The company's headquarters can be found at 68 TOROKINA AVENUE, St Ives, New South Wales, 2075, Australia.

Funding program options

Funded Academy provides traders with a selection of two distinct funding programs to opt for:

- Standard challenge accounts

- Extended challenge accounts

Standard challenge accounts

The Funded Academy standard challenge account is designed to attract skilled and disciplined traders who are acknowledged and rewarded for their consistent performance during the two-phase evaluation period. With the standard challenge account, traders have the opportunity to trade with a leverage of 1:100.

Account Size - Prices

$10,000 - $80

$25,000 - $165

$50,000 - $265

$100,000 - €499

$200,000 - $480

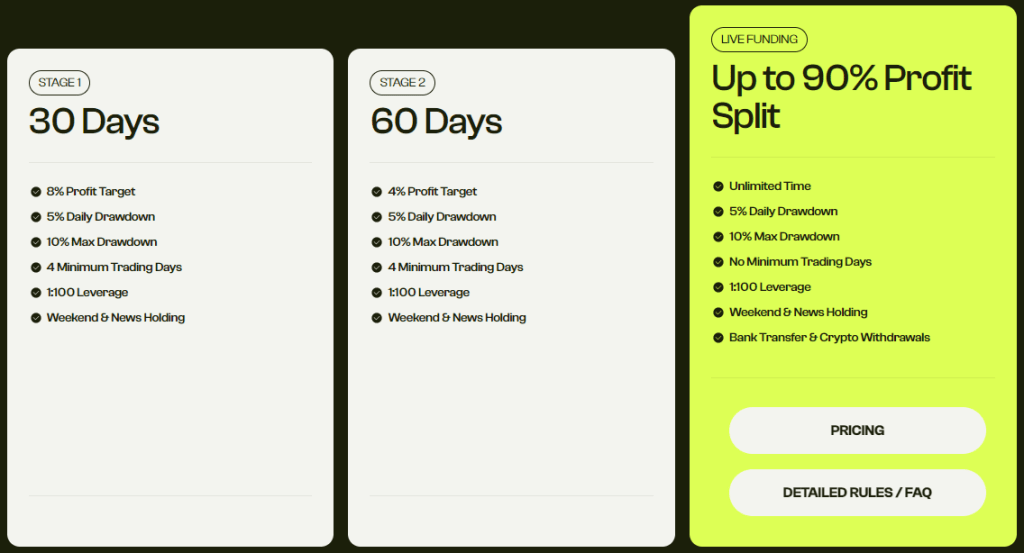

In the evaluation phase one of Funded Academy, traders are required to achieve an 8% profit target within 30 calendar days from their first position placement on the evaluation account. They must ensure that their daily losses do not exceed 5% or their overall losses do not surpass 10% based on the specified rules. Additionally, traders need to meet a minimum trading day requirement of 4 days to progress to phase two.

Moving on to evaluation phase two, traders must reach a 4% profit target within 60 calendar days from their initial position placement on the evaluation account. Similar to phase one, they must adhere to the maximum daily loss limit of 5% and the maximum loss rule of 10%. The minimum trading day requirement of 4 days also applies before advancing to a funded account.

Upon successfully completing both evaluation phases, traders are granted a funded account where profit targets are no longer mandatory. Instead, they are only required to abide by the maximum daily loss limit of 5% and the maximum loss rule of 10%. The first payout is scheduled for 14 calendar days from the day the first position is placed on the funded account. This initial payout comprises 80% of the profit made on the funded account, along with an additional 20% profit earned during the phase two evaluation. Furthermore, traders receive a refund of 125% of their initial paid fee.

After the first payout, subsequent payouts are issued on a bi-weekly basis. The profit split for traders increases to 85% after scaling their account for the first time and further rises to 90% after scaling their account for the second time. It is important to note that the maximum loss rule is gradually increased by +1% with each successful withdrawal received, reaching a maximum of 15%.

Standard challenge account scaling plan

The standard challenge accounts at Funded Academy also include a scaling plan. To qualify for scaling, traders must achieve a profit target of 10% or more within a four-month period, with at least two of those months being profitable. Upon meeting this requirement, their account balance will be increased by 25% of the original account balance.

For instance:

After 4 months: If you have a $100,000 account, your account balance will be raised to $125,000.

After the next 4 months: The balance of $125,000 will increase to $150,000.

After the subsequent 4 months: The balance of $150,000 will be raised to $175,000.

And so on...

When it comes to trading instruments, the standard challenge accounts allow traders to engage in trading activities involving forex pairs, metals, indices, and cryptocurrencies.

Standard challenge account rules

-

profit target refers to a predetermined percentage of profit that traders must achieve in order to fulfill certain requirements such as completing an evaluation phase, withdrawing profits, or scaling their account. In the first evaluation phase, the profit target is set at 8%, while the second evaluation phase has a profit target of 4%. It's important to note that funded accounts do not have any profit targets imposed on them.

-

The maximum daily loss is the highest allowable loss that a trader can incur within a single day before their account is considered to be violated. For all account sizes, the maximum daily loss is set at 5%. This means that traders should ensure that their losses do not exceed this threshold during any given trading day to remain within the account's defined limits.

-

The maximum loss refers to the maximum allowable cumulative loss that a trader can reach before their account is considered to be violated. Regardless of the account size, the maximum loss for all accounts is set at 10%. This implies that traders need to ensure that their total losses do not exceed this limit to maintain compliance with the account's stipulated guidelines.

-

The minimum trading days represent the minimum duration for which you must engage in trading before being eligible to complete an evaluation phase or make a withdrawal. In both evaluation phases, there is a requirement of at least 4 minimum trading days. This means that traders must actively trade for a minimum of four days before they can progress to the next phase or make a withdrawal request.

-

The maximum trading days represent the upper limit of time within which traders are expected to achieve a specific profit target or meet a withdrawal target. In the first evaluation phase, there is a maximum period of 30 trading days, while the second evaluation phase allows for a maximum of 60 trading days. This means that traders are required to reach their respective targets within these specified timeframes to fulfill the requirements of each phase.

-

When it comes to third-party copy trading risk, it's important to be aware that utilizing a copy trading service provided by a third-party entails the possibility of other traders employing the same trading strategy through that service. By opting for a third-party copy trading service, there is a potential risk of being denied a funded account or facing limitations on withdrawals if you surpass the maximum capital allocation rule.

-

When it comes to third-party EA risk, it's important to consider that if you plan to use an EA (Expert Advisor), there is a possibility that other traders are already utilizing the same EA and employing an identical trading strategy. By utilizing a third-party EA, there is a potential risk of being denied a funded account or facing limitations on withdrawals if you exceed the maximum capital allocation rule.

Extended Challenge accounts

The objective of Funded Academy's extended challenge account is to identify dedicated traders and provide them with the opportunity to generate higher profits from their trading endeavors. Traders are rewarded for their consistent performance during the single-phase evaluation period. The extended challenge account permits trading with leverage of up to 1:10, offering traders greater flexibility and potential returns.

Account Size - Prices

$25,000 - $200

$50,000 - $265

$100,000 - €499

$250,000 - $480

$500,000 - $480

$1,000,000 - $480

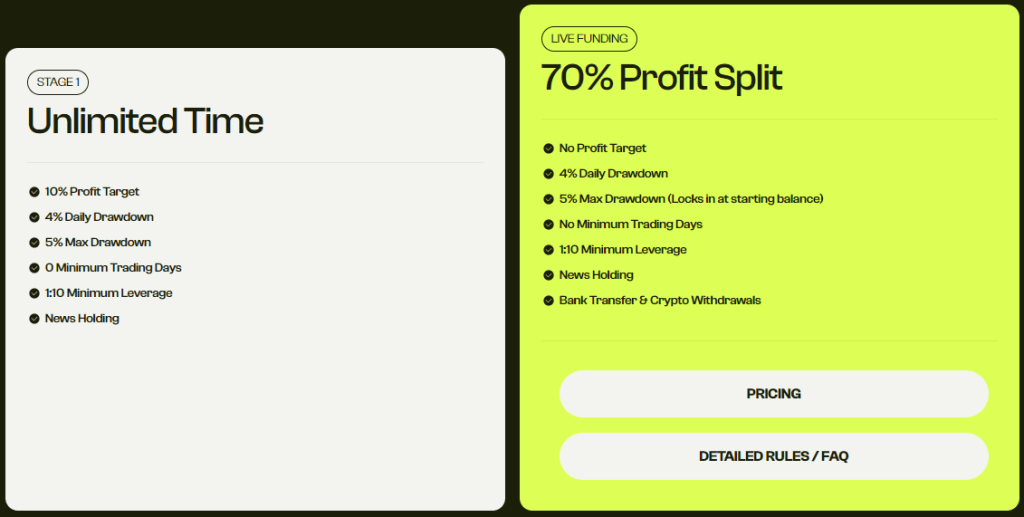

To progress through the evaluation phase and become funded at Funded Academy, traders are expected to achieve a profit target of 10% without exceeding the specified maximum daily loss of 4% or the maximum trailing drawdown of 5%. During the evaluation phase, there are no specific requirements regarding the minimum or maximum number of trading days. The sole requirement for advancing to a funded account is reaching the profit target.

Upon successfully completing the evaluation phase, traders are granted a funded account where profit targets are no longer in place. Instead, they are only obligated to adhere to the maximum daily loss of 4% and the maximum trailing drawdown of 5%. The first payout, representing a 70% profit split, can be requested after 30 calendar days. Subsequent payouts are also based on a monthly schedule.

Extended challenge account scaling plan

There is no scaling plan available for the extended challenge accounts.

The trading instruments available for the extended challenge accounts include forex pairs, metals, indices, stocks, and cryptocurrencies.

Extended challenge account scaling plan

-

A profit target represents a designated percentage of profit that traders must achieve in order to successfully complete an evaluation phase, make profit withdrawals, or scale their account. In the evaluation programs, the profit target is set at 10%. However, funded accounts do not impose any profit targets, providing traders with more flexibility in their trading activities.

-

The maximum daily loss refers to the highest permissible amount of loss that a trader can incur within a single day before their account is considered to be in violation. For all account sizes, there is a consistent maximum daily loss limit of 4%. This means that traders should ensure that their losses do not exceed this threshold during any given trading day to remain compliant with the account's regulations.

-

The maximum trailing drawdown represents the highest allowable reduction in the account balance, calculated as the difference between the highest balance achieved and the lowest point due to drawdown. For all account sizes, there is a uniform maximum trailing drawdown limit of 5%. This means that traders should ensure that their drawdowns do not exceed this threshold to remain within the specified limits of the account.

-

The requirement for a stop-loss means that traders are obligated to set a predetermined stop-loss level for every position they open before initiating a trade.

-

The lot size limit mandates that traders adhere to predetermined lot sizes for specific trading instruments. These lot sizes are typically determined based on the initial account balance of the prop firm account. The maximum number of open lots a trader can have across all pairs at any given time is set at 1 lot per $10,000 of capital.

-

The policy of "no weekend holding" indicates that traders are prohibited from maintaining open positions over the weekends.

-

When it comes to the risk associated with third-party copy trading, it's important to consider that if you plan to utilize copy trading services from a third-party provider, there is a possibility that other traders are already using the same service and employing an identical trading strategy. By opting for a third-party copy trading service, there is a potential risk of being denied a funded account or facing limitations on withdrawals if you surpass the maximum capital allocation rule.

-

When it comes to the risk associated with third-party EAs (Expert Advisors), it's important to consider that if you plan to use an EA provided by a third-party, there is a possibility that other traders are already using the same EA and employing an identical trading strategy. By utilizing a third-party EA, there is a potential risk of being denied a funded account or facing limitations on withdrawals if you surpass the maximum capital allocation rule.

Add-on options for your extended challenge accounts

- Trade over the weekend: 10% price increase when purchasing your evaluation account

- Double leverage: 25% price increase when purchasing your evaluation account

- No stop-loss required: 10% price increase when purchasing your evaluation account

What makes Funded Academy different from other prop firms?

Funded Academy stands out among leading prop firms by offering two distinct funding programs: standard challenge and extended challenge accounts. One notable aspect is the minimal restrictions imposed on traders' trading styles. They allow trading during news events, holding trades overnight, and even on weekends (extended accounts with an add-on).

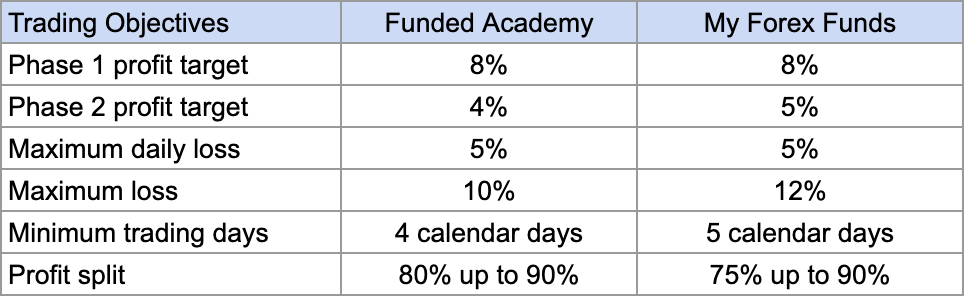

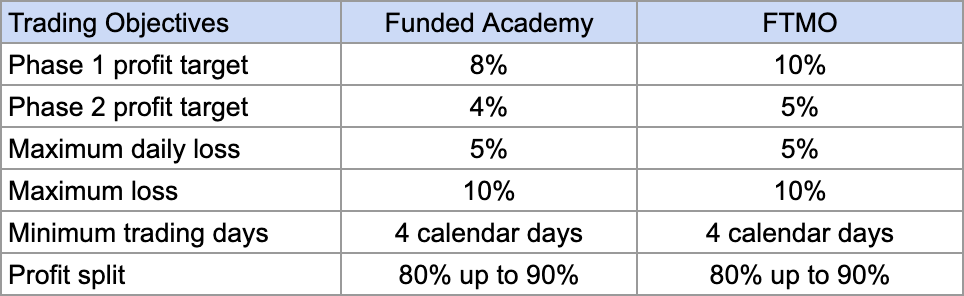

In contrast to other prop firms, Funded Academy's standard challenge is a two-phase evaluation program that necessitates completion of both phases to qualify for payouts. The profit target for phase one is 8%, followed by 4% in phase two, while adhering to maximum daily loss and maximum loss rules of 5% and 10% respectively. Additionally, traders must meet a minimum trading day requirement of four days in each phase before becoming funded. It's worth noting that standard challenge accounts also include a scaling plan. In comparison to other leading prop firms, Funded Academy sets relatively lower profit targets while maintaining average drawdown limitations.

A comparative example between Funded Academy and My Forex Funds:

A comparative example between Funded Academy and FTMO:

Funded Academy stands out from other prop firms with its extended challenge, a streamlined evaluation program consisting of a single phase where traders must achieve a profit target to become eligible for payouts. The evaluation program sets a profit target of 10% and enforces rules such as a 4% maximum daily loss, 5% maximum trailing drawdown, required stop-loss, and lot size limit. Notably, there are no specific requirements for minimum or maximum trading days.

In summary, Funded Academy distinguishes itself by offering two distinct funding programs compared to other leading prop firms. Furthermore, they provide traders with straightforward trading rules and minimal restrictions. For instance, traders have the flexibility to engage in trading activities during news events, hold trades overnight, and even on weekends (with an add-on available exclusively for extended accounts).

Is getting Funded Academy capital realistic?

When evaluating prop firms that align with your forex trading style, it is crucial to assess the feasibility of their trading requirements. While a prop firm may offer a high percentage profit split on a well-funded account, it is important to consider whether their expectations for monthly gains and maximum drawdowns are realistic. Otherwise, your chances of achieving success may be minimal.

In the case of Funded Academy's standard challenge accounts, the prospect of receiving capital is more attainable due to their relatively modest profit targets (8% in phase one and 4% in phase two) and reasonable maximum loss rules (5% maximum daily and 10% maximum loss).

Similarly, the extended challenge accounts at Funded Academy present a realistic opportunity to receive capital, as they feature an average profit target of 10% alongside sensible maximum loss rules (4% maximum daily loss and 5% maximum trailing drawdown).

Taking all of these factors into consideration, Funded Academy emerges as an excellent choice for obtaining funding, thanks to the availability of two funding programs with achievable trading objectives and favorable conditions for receiving payouts.

Which broker does Funded Academy use?

Funded Academy has partnered with two reputable brokers for its funding programs. For standard challenge accounts, they work with IronFX, a renowned broker that was established in 2010. IronFX has gained recognition in the industry and caters to both retail and institutional clients in more than 180 countries. Their services are available across Europe, Asia, the Middle East, Africa, and Latin America.

On the other hand, Eightcap serves as the broker for Funded Academy's extended challenge accounts.

Summary

To sum up, Funded Academy is a reputable proprietary firm that provides traders with two funding options: standard challenge and extended challenge accounts.

Standard challenge accounts follow a well-established two-phase evaluation process. Traders must successfully complete both phases, achieving profit targets of 8% in phase one and 4% in phase two, in order to become funded. These profit targets are realistic and aligned with the industry standards, considering the accompanying 5% maximum daily loss and 10% maximum loss rules. With standard challenge accounts, traders have the opportunity to earn profit splits ranging from 80% to 90% and can also scale their accounts.

Extended challenge accounts, on the other hand, involve a single-phase evaluation program. Traders need to reach a profit target of 10% to become funded. Similar to the standard challenge, the profit target is realistic, complemented by a 4% maximum daily loss and 5% maximum trailing drawdown rules. Profit splits of 70% can be earned with extended challenge accounts, but it's important to note that there is no scaling plan associated with them.

Considering the straightforward trading rules, generous account sizes of up to $1,000,000, and the realistic conditions offered, Funded Academy is highly recommended for individuals seeking a prop firm. While they may not be the most prominent name in the industry, they provide excellent opportunities for traders. Overall, Funded Academy is an outstanding choice for forex traders aiming to work with substantial account sizes of up to $1,000,000.