23. Goat Funded Trader

- Leverage up to 1:100

- Overnight and weekend holding allowed

- News trading allowed

- A large variety of trading instruments

- Maximum allocation capital up to $800,000

- Two two-step funding program options

- Default 75% profit share

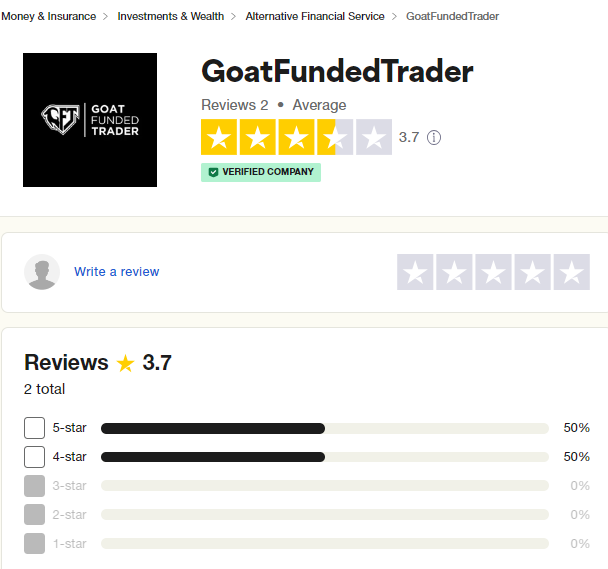

- Lack of community feedback

- No scaling plan

- Relatively low UX

- Relatively new prop firm

- High commission

Goat Funded Trader is a trading firm that prioritizes a trader's success and provides them with an outstanding trading experience as part of their commitment.

Goat Funded Trader is a proprietary trading firm that is dedicated to ensuring the success of traders while providing them with an exceptional trading experience. They extend their services globally, offering 24/7 customer support, refundable fees, low profit targets, top-notch trading tools, competitive commissions, and tight spreads. Traders have the opportunity to earn substantial profits by managing account sizes of up to $400,000 and taking home up to 95% profit splits. Goat Funded Trader achieves this by facilitating trading in a diverse range of assets, including forex pairs, commodities, indices, equities, and cryptocurrencies.

Who are Goat Funded Trader?

Goat Funded Trader, established on May 17, 2023, is a proprietary trading firm that provides traders with the opportunity to work with a capital balance of up to $800,000 while enjoying up to 95% profit splits. They have formed a partnership with ThinkMarkets, who serves as their broker. Goat Funded Trader's headquarters are situated in the Canary Islands, Spain.

Who is the CEO of Goat Funded Trader?

Edoardo Dalla Torre is the CEO of Goat Funded Trader

Funding program options

Goat Funded Trader provides traders with a selection of two two-step evaluation funding programs to choose from.

- No Time Limit Evaluation

- Classic Evaluation

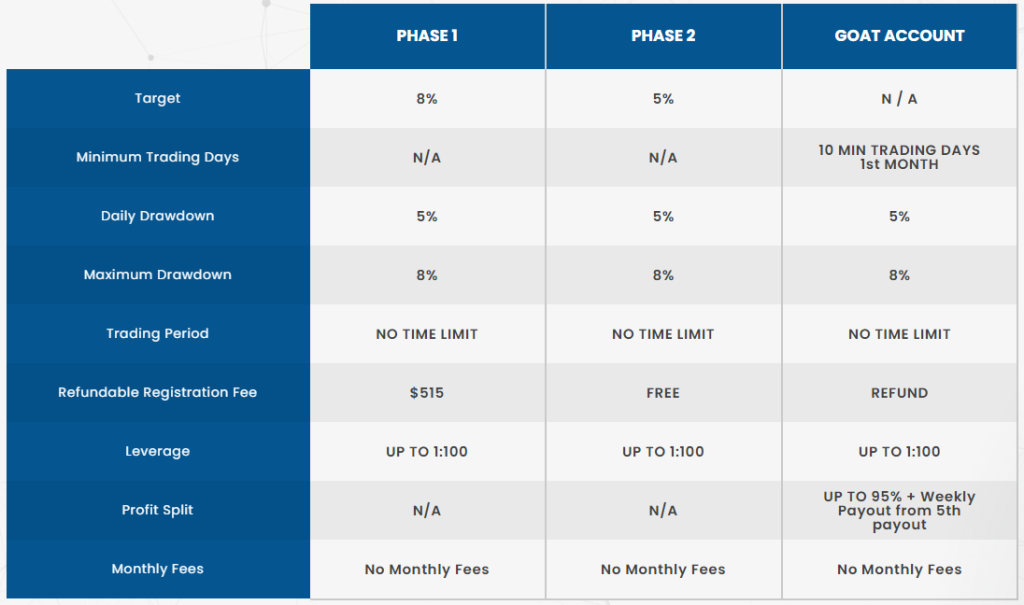

No Time Limit Evaluation program accounts

Goat Funded Trader offers a no time limit evaluation program account designed to identify dedicated and skilled traders who demonstrate consistency throughout the two-phase evaluation period. This program rewards traders and allows them to trade with leverage of up to 1:100.

Account Size - Prices

$10,000 - $150

$25,000 - $200

$50,000 - $295

$100,000 - $515

$200,000 - $930

To successfully complete evaluation phase one, traders must achieve an 8% profit target while staying within the limits of a 5% maximum daily loss and 8% maximum loss. The only requirement is to reach the profit target, and there is no specific time limit imposed. Additionally, there are no minimum trading day requirements to advance to phase two.

For evaluation phase two, traders need to reach a 5% profit target while adhering to the 5% maximum daily loss and 8% maximum loss rules. Again, the sole requirement is to hit the profit target within any time limit.

Upon successfully completing both evaluation phases, traders receive a funded account with no profit targets. The only rules to follow are the 5% maximum daily loss and 8% maximum loss rules. The first payout is scheduled 30 calendar days after the initial position is taken in the funded account. Traders must trade for a minimum of 10 calendar days during this 30-day period.

The first profit split amounts to 75% of the profits made on the funded account. Subsequent payouts—second (80% profit split), third (85% profit split), and fourth (90% profit split)—can be requested bi-weekly. Following the fifth payout, traders have the option to request weekly payouts. Additionally, traders can inquire about increasing their profit split to 95%, subject to specific criteria and approval from the firm's support team.

No Time Limit Evaluation program account scaling plan

The no time limit evaluation program accounts do not include a scaling plan.

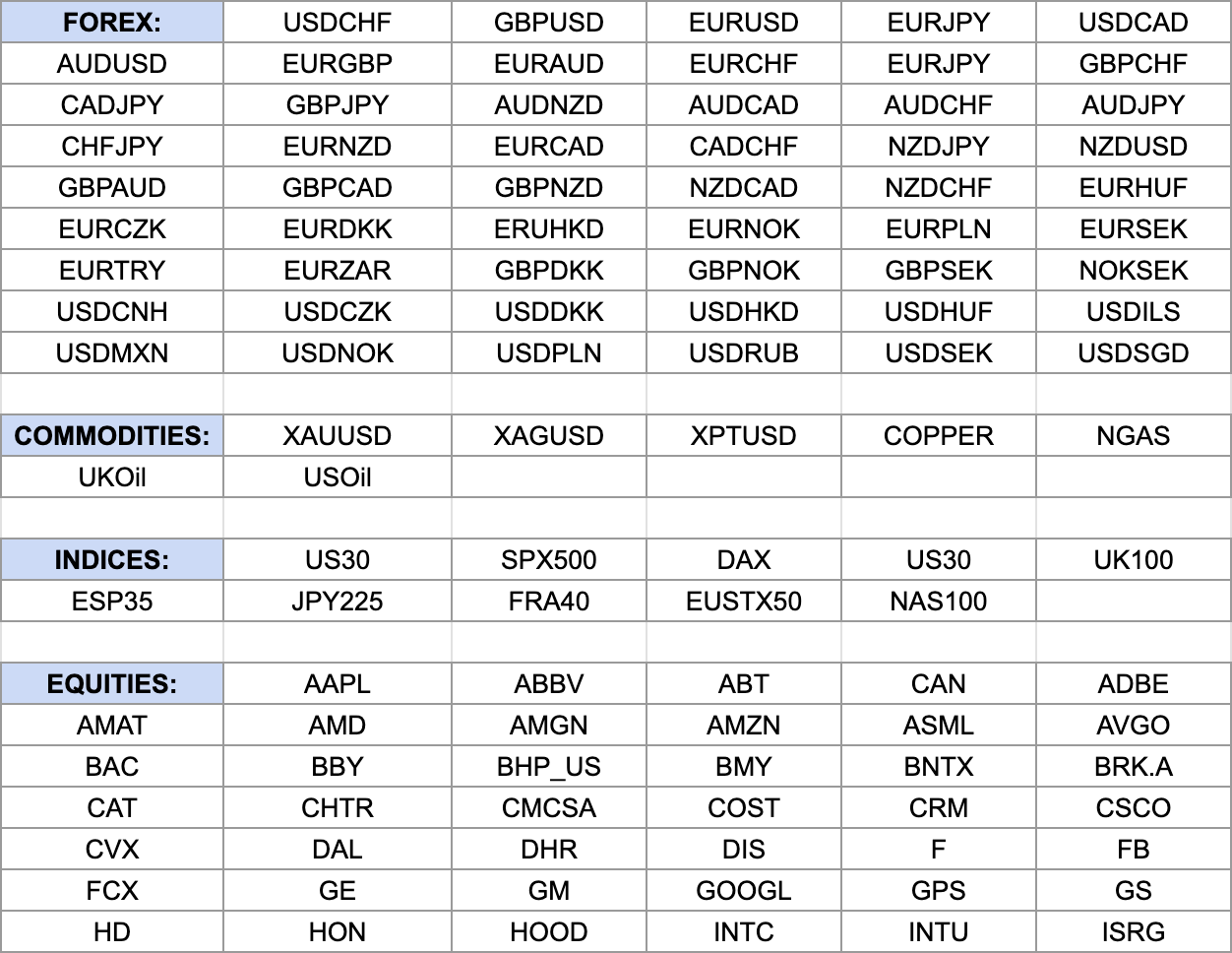

Forex pairs, commodities, indices, equities, and cryptocurrencies are the available trading instruments for the no time limit evaluation program accounts.

No Time Limit Evaluation program account rules

-

A profit target refers to a predetermined percentage of profit that traders must achieve in order to complete an evaluation phase, withdraw profits, or scale their account. During phase 1, the profit target is set at 8%, whereas in phase 2, it is reduced to 5%. Funded accounts, however, do not have any profit targets associated with them.

-

The maximum daily loss represents the highest amount of loss that a trader can incur in a single day without violating their account. For all account sizes, the maximum daily loss is set at 5%.

-

The maximum loss refers to the highest allowable loss that a trader can incur in their account before it is considered violated. For all account sizes, the maximum loss limit is set at 8%.

-

Minimum trading days represent the minimum duration for which traders are obligated to engage in trading before completing an evaluation phase or requesting a withdrawal. Evaluation phases do not impose any minimum trading day requirement. However, in the case of a funded account, traders must trade for a minimum of 10 trading days to qualify for their initial payout.

-

When it comes to third-party copy trading, it's important to consider the associated risks. If you decide to utilize a third-party copy trading service, there is a possibility that other traders are already using the same service, employing identical trading strategies. By opting for a third-party copy trading service, you may face the risk of being denied a funded account or withdrawal if you surpass the maximum capital allocation rule.

-

Using a third-party EA carries a risk known as "third-party EA risk." It's essential to consider that when employing a third-party EA, there is a possibility that other traders are already utilizing the same EA, implementing an identical trading strategy. By relying on a third-party EA, there is a potential risk of being denied a funded account or withdrawal if the maximum capital allocation rule is exceeded.

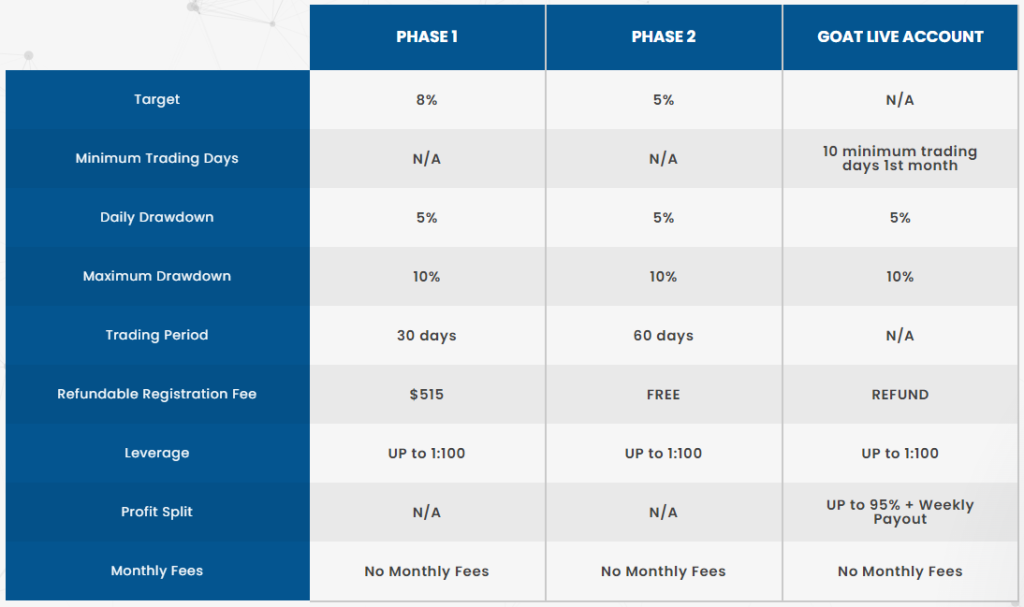

Classic Evaluation program accounts

The classic evaluation program account offered by Goat Funded Trader is designed to identify dedicated and skilled traders who demonstrate consistency throughout the two-phase evaluation period. Traders who participate in the classic evaluation program are rewarded for their commitment. This account allows traders to leverage up to 1:100 for their trades.

Account Size - Prices

$10,000 - $145

$25,000 - $185

$50,000 - $295

$100,000 - $515

$200,000 - $985

During evaluation phase one, traders must achieve an 8% profit target within 30 calendar days from the day they place their first position on the evaluation account. They should also ensure that their maximum daily loss does not exceed 5% and their maximum loss does not exceed 10%. No minimum trading day requirements need to be fulfilled to proceed to phase two.

For evaluation phase two, traders must reach a profit target of 5% within 60 calendar days from the day they place their first position on the evaluation account. Similar to phase one, they need to adhere to the 5% maximum daily loss and 10% maximum loss rules. There are no minimum trading day requirements to move on to a funded account.

Upon successfully completing both evaluation phases, traders are granted a funded account without profit targets. The only rules to follow are the 5% maximum daily loss and 10% maximum loss limits. The first payout is scheduled 30 calendar days after the first position is placed on the funded account. Traders are required to trade for a minimum of 10 calendar days during this 30-day period.

The initial profit split is set at 75% based on the profits generated from the funded account. Subsequent payouts—second (80% profit split), third (85% profit split), and fourth (90% profit split)—can be requested on a bi-weekly basis. After the fifth payout, traders have the option to request weekly payouts. Additionally, traders can apply for a profit split increase to 95% by meeting specific criteria and obtaining approval from the firm's support team.

Classic Evaluation program account scaling plan

Classic evaluation program accounts do not include a scaling plan for traders.

The trading instruments available for classic evaluation program accounts encompass forex pairs, commodities, indices, equities, and cryptocurrencies.

Classic Evaluation program account rules

-

A profit target is a predetermined percentage of profit that traders must achieve in order to successfully complete an evaluation phase, withdraw profits, or scale their account. In phase 1, the profit target is set at 8%, while in phase 2, it is lowered to 5%. However, once traders transition to funded accounts, there are no specific profit targets to be met.

-

The maximum daily loss refers to the highest allowable loss that a trader can incur within a single day before the account is considered violated. For all account sizes, the maximum daily loss is set at 5%. This means that traders should ensure that their losses do not exceed this threshold during any given day of trading.

-

The maximum loss refers to the highest permissible overall loss that a trader can experience before their account is considered violated. Regardless of the account size, the maximum loss allowed is 10%. It is essential for traders to manage their trades and ensure that their cumulative losses do not exceed this limit to maintain compliance with the account requirements.

-

Minimum trading days refers to the mandatory duration that traders must engage in trading before they can successfully complete an evaluation phase or make a withdrawal request. Evaluation phases do not impose any minimum trading day requirement. However, for funded accounts, traders are obligated to trade for a minimum of 10 trading days before becoming eligible for their first payout. This condition ensures that traders actively participate in trading activities for a specified period before receiving their initial payout from the funded account.

-

Maximum trading days represent the upper limit of time within which traders must achieve a particular profit target or withdrawal target. Phase 1 of the evaluation program allows a maximum trading period of 30 days, while Phase 2 allows a maximum trading period of 60 days. During these respective time frames, traders are expected to work towards meeting their targets.

-

When considering third-party copy trading, it is important to be aware of the associated risks. By utilizing a third-party copy trading service, it is possible that other traders are already employing the same trading strategy. Consequently, there is a potential risk of being denied a funded account or withdrawal if you exceed the maximum capital allocation rule.

-

When considering the use of a third-party EA (Expert Advisor), it is important to be aware of the associated risks. By utilizing a third-party EA, it is possible that other traders are already employing the same trading strategy through the EA. Therefore, using a third-party EA poses a potential risk of being denied a funded account or withdrawal if you exceed the maximum capital allocation rule.

What makes Goat Funded Trader different from other prop firms?

Goat Funded Trader stands out from other top prop firms in the industry by allowing you to trade without imposing restrictions on your trading style. You have the freedom to trade during news events, hold positions overnight, and even trade on weekends. Additionally, there are no minimum trading day limitations, meaning that as soon as you achieve your profit targets, you become eligible for funding.

The Goat Funded Trader's no time limit evaluation program consists of two phases that must be completed before payouts can be received. In phase one, the profit target is set at 8%, while in phase two, it is 5%. Both phases have maximum daily loss limits of 5% and a maximum overall loss limit of 8%. Importantly, there are no minimum trading day requirements in either phase before you become funded. It's worth noting that the no time limit evaluation programs offered by Goat Funded Trader do not include a scaling plan. Compared to other leading prop firms in the industry, Goat Funded Trader sets relatively lower profit targets and does not impose maximum or minimum trading day limitations.

A comparative example between Goat Funded Trader and Funded Trading Plus:

A comparative example between Goat Funded Trader and Finotive Funding:

A comparative example between Goat Funded Trader and My Forex Funds:

Is getting Goat Funded Trader capital realistic?

When exploring prop firms that align with your forex trading style, it is crucial to assess the realism of their trading requirements. While it may sound appealing to come across a company offering a high profit split on a well-funded account, it becomes less favorable if they expect substantial monthly gains with minimal maximum drawdowns, making your chances of success nearly impossible.

Obtaining capital through the no time limit evaluation programs is generally realistic due to their relatively lower profit targets (8% in phase one and 5% in phase two) and reasonable maximum loss rules (5% maximum daily and 8% maximum loss). Moreover, these programs do not impose any maximum or minimum trading day limitations.

Similarly, receiving capital through the classic evaluation programs is also realistic as they feature comparable profit targets (8% in phase one and 5% in phase two) and moderate maximum loss rules (5% maximum daily and 10% maximum loss). Furthermore, there are no minimum trading day requirements in these programs.

Considering all of these factors, Goat Funded Trader emerges as an excellent choice to secure funding. Both their no time limit and classic evaluation program accounts offer realistic trading objectives and payout conditions to adhere to.

Payout proof

As Goat Funded Trader was established on May 17, 2023, there is currently no available information or evidence regarding payout proofs from their traders. At this time, there are no records of traders having received payouts.

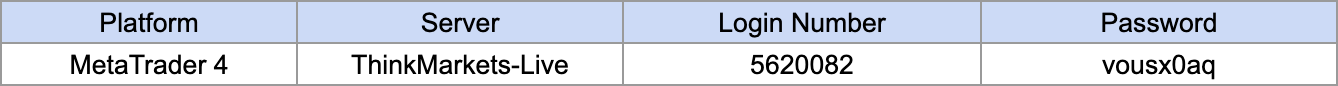

Which broker does Goat Funded Trader use?

Goat Funded Trader has chosen ThinkMarkets as their broker, a reputable multi-asset online brokerage with headquarters in London and Melbourne. ThinkMarkets offers convenient access to various markets and is known for providing well-established trading platforms such as MetaTrader 4, MetaTrader 5, and their proprietary ThinkTrader platform. If you opt for Goat Funded Trader, you will have the opportunity to trade using either MetaTrader 4 or MetaTrader 5 as your trading platform.

Trading instruments

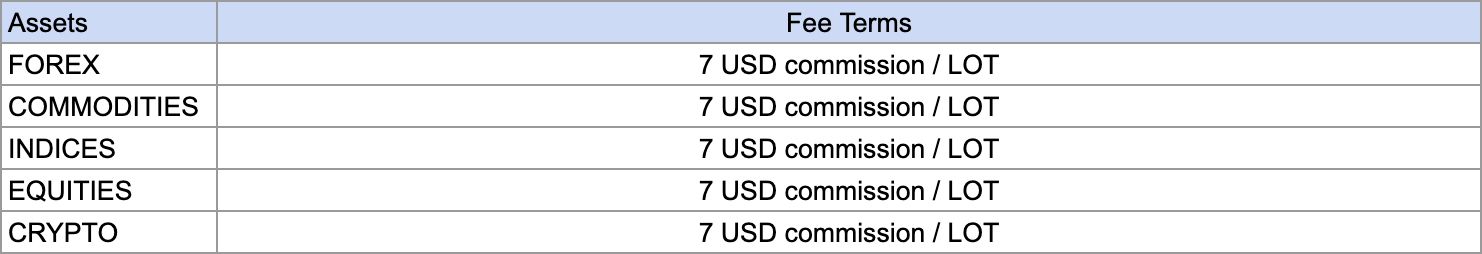

Trading fees

Spread

To review the live spreads, please log in to the trading account provided below:

Support

If you need further assistance, their support team can be reached via social media or by email at support@goatfundedtrader.com. Additionally, their website features a live chat support team ready to provide you with any necessary information.

Summary

In summary, Goat Funded Trader is a new proprietary trading firm that provides traders with two options for their two-step evaluation funding programs: no time limit and classic evaluations.

The no time limit evaluation programs follow the industry-standard two-phase evaluation process, requiring traders to achieve profit targets of 8% in phase one and 5% in phase two to become funded. These targets are realistic and align with the 5% maximum daily and 8% maximum loss rules. Profit splits ranging from 75% to 95% are available, but it's important to note that there is no scaling plan provided.

Similarly, the classic evaluation programs also follow the industry-standard two-phase evaluation process, with profit targets of 8% in phase one and 5% in phase two. The trading objectives are realistic, considering the 5% maximum daily and 10% maximum loss rules. Profit splits ranging from 75% to 95% are available, and like the no time limit evaluation programs, there is no scaling plan.

I would recommend Goat Funded Trader to traders who seek a prop firm with clear trading rules and have developed a consistent trading strategy. Despite being relatively new, they offer favorable conditions for a wide range of traders with different styles. Taking everything into account, Goat Funded Trader has the potential to become one of the top proprietary trading firms in the industry.