25. Lux Trading Firm

- Free Trial

- Scaling up to 10 million USD

- Fast email support

- No time limit on profit target

- Weekend holding allowed

- Profit share 75%

- 4% maximum relative drawdown and maximum loss limit

- Low leverage 1:1, 1:5, and 1:10

- High minimum trading day requirements

- Limited to one segment of trading

Lux Trading Firm was established with the purpose of bringing together highly experienced individuals to explore trading and investment opportunities. As a well-capitalized firm, they prioritize the execution, analysis, and growth of their traders' strategies. Lux Trading Firm is dedicated to empowering traders to thrive in their careers, offering them the opportunity to trade on accounts with balances of up to $10,000,000. To qualify for funding, traders must successfully navigate the firm's unique two-step evaluation process. Once funded, traders have specific profit targets to achieve in order to scale their account balances. Upon successfully meeting these targets, traders are rewarded with a 75% profit split and an increase in their account balance.

Who are Lux Trading Firm?

Lux Trading Firm operates as a proprietary trading firm with offices located in London and Bratislava, Slovakia. They offer traders the opportunity to trade with account balances of up to $10,000,000. As their broker, they utilize After Prime, a well-established brokerage firm based in Australia. Lux Trading Firm Ltd is a registered UK company with the company number 131609991. It was incorporated on January 27, 2021, and is located at Kemp House, 160 City Road, EC1V 2NX, London, UK. Additionally, Lux Trading Firm has another registered company called Lux Trading Firm s. r. o. based at Dunajská 8, Bratislava, Slovakia. Lux Trading Firm s. r. o. was registered on February 12, 2020.

Funding program options

Lux Trading Firm provides traders with a selection of two distinct programs to consider:

- Two-step evaluation program

- One-step evaluation program

Two-step evaluation program accounts

Lux Trading Firm's evaluation program accounts are designed to identify and reward consistent and skilled traders who demonstrate their abilities during the unique two-phase evaluation period. These evaluation program accounts provide traders with the opportunity to trade with leverage of up to 1:10.

Phase one, known as the Evaluation stage, requires traders to achieve a profit target of 6% while ensuring that their losses do not exceed 5% according to the maximum loss rules. During this stage, there are no specific time limitations for reaching the profit target. However, a minimum trading period of 29 calendar days (or 15 calendar days for swing traders) must be completed to proceed to phase two. Upon successful completion of the Evaluation stage, traders are eligible for a 50% refund of their initial one-time fee.

Phase two, referred to as the Advanced stage, involves traders reaching a profit target of 4% while adhering to the 5% maximum loss rules. Similar to the Evaluation stage, there are no minimum or maximum time limitations for achieving the profit target. The sole requirement is to reach the profit target without violating any rules in order to advance to a live funded account. Upon completing the Advanced stage, traders are eligible for a second 50% refund of their initial one-time fee.

Upon successfully completing both the Evaluation and Advanced stages, traders are granted a live funded account, also known as the Professional account, which does not impose any profit target requirements for withdrawals. The only rule to abide by is the 4% maximum loss limit. The first payout from the funded account is scheduled for 30 calendar days after the initial position is placed, and traders are entitled to a profit split of 75% based on the profits generated in their live funded account. It's important to note that subsequent payouts are made on a monthly basis, with a 75% profit split based on the profits achieved in the funded account.

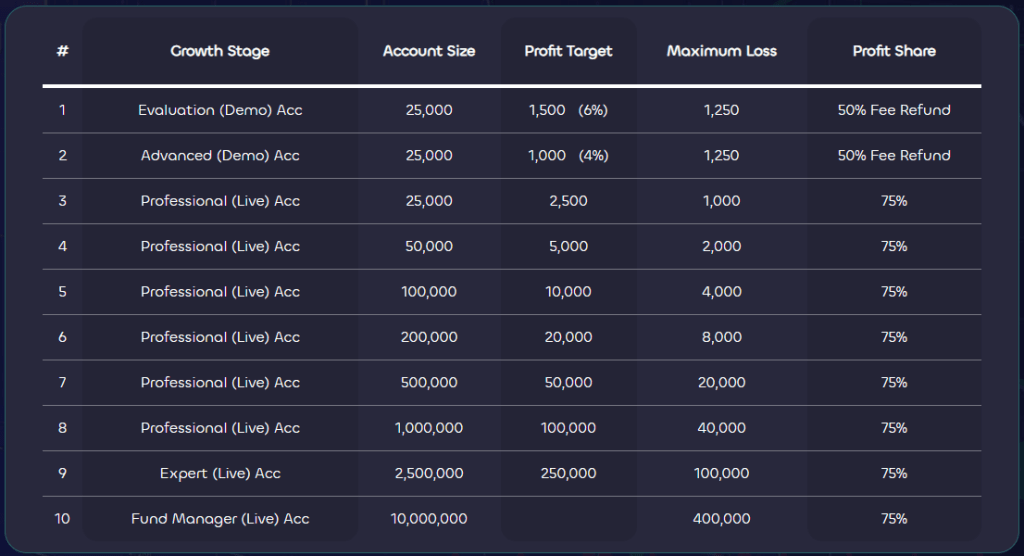

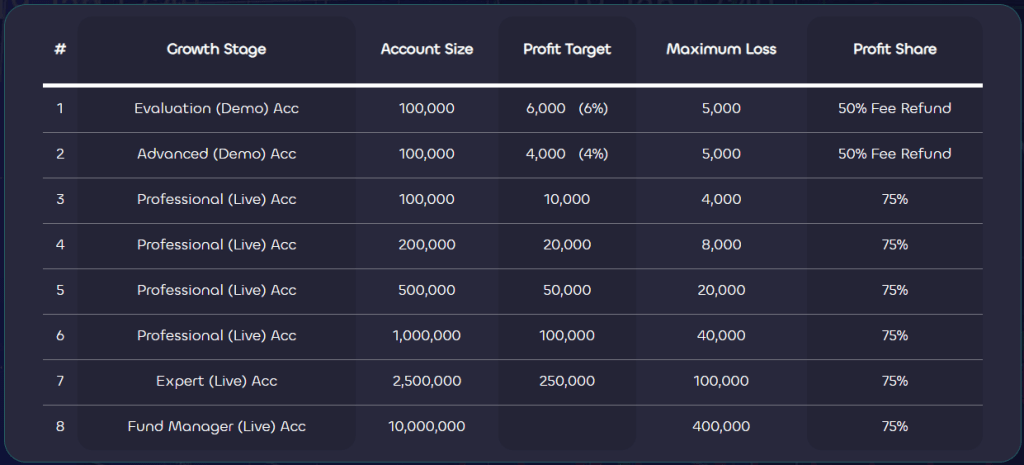

Two-step evaluation program account scaling plan

The two-step evaluation program accounts also include a scaling plan. To advance to the next growth stage and increase your account size, you must achieve a profit target of 10%. This scaling opportunity allows you to gradually grow your account balance up to a maximum capital of $10,000,000.

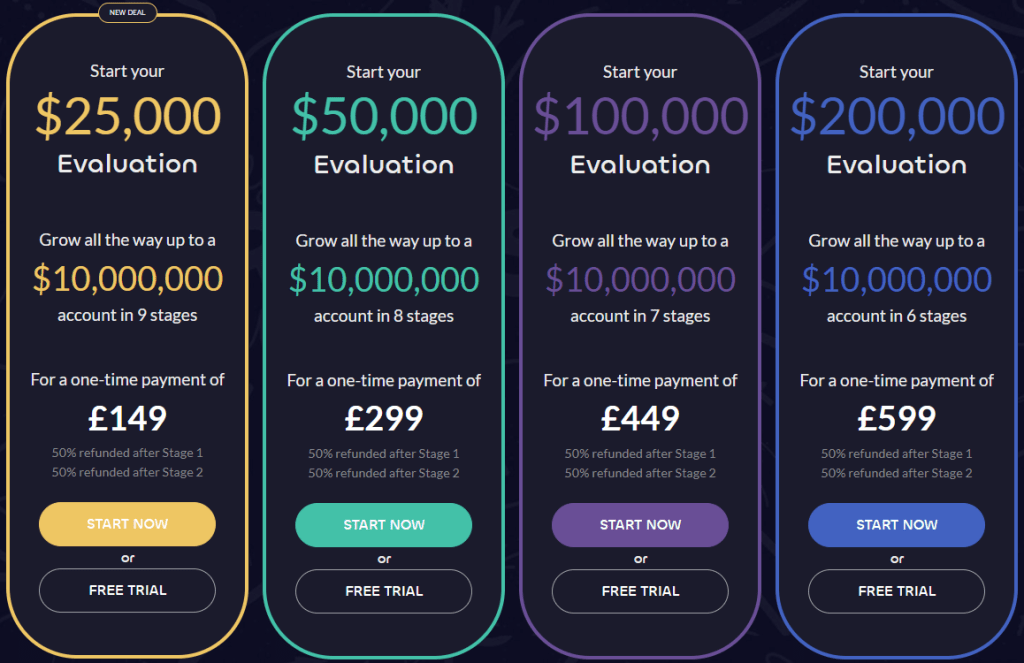

$25k Evaluation account scaling plan

$50k Evaluation account scaling plan

$100k Evaluation account scaling plan

$200k Evaluation account scaling plan

The two-step evaluation program accounts offer a wide range of trading instruments, including forex pairs, commodities, indices, bonds, and shares.

Two-step evaluation program account rules

-

A profit target is a predetermined percentage of profit that traders must achieve in order to successfully complete an evaluation phase, withdraw profits, or scale their account. In the evaluation stage, the profit target is set at 6%, while in the Advanced stage, it is 4%. However, funded accounts do not have specific profit targets to meet.

-

The maximum loss refers to the highest allowable loss that a trader can incur before their account is considered violated. For all account sizes, the maximum loss is set at 5% (which reduces to 4% once the account is funded).

-

Minimum trading days refer to the minimum duration that traders must engage in trading before completing an evaluation phase or making a withdrawal request. In the evaluation stage, there is a requirement of at least 29 trading days (15 calendar days for swing traders) before proceeding, while the Advanced stage has no specific minimum trading day limitations.

-

Setting a stop-loss is a mandatory requirement for traders, which entails placing a predefined stop-loss level on each position prior to initiating a trade.

-

When considering the risk associated with third-party EAs, it's important to note that using such EAs may involve other traders employing the same trading strategy. Consequently, utilizing a third-party EA exposes you to the potential risk of being denied a funded account or withdrawal if you surpass the maximum capital allocation rule.

-

When considering the risk associated with third-party copy trading, it's important to be aware that using such services may involve other traders employing the exact same trading strategy. By utilizing a third-party copy trading service, there is a potential risk of being denied a funded account or withdrawal if you exceed the maximum capital allocation rule.

-

The concept of "only one segment of trading" implies that you can solely engage in trading activities related to a specific segment, such as forex, commodities, or indices, within the account. It restricts trading across different segments, allowing you to focus exclusively on one particular segment and not participate in trading activities across all segments within the account.

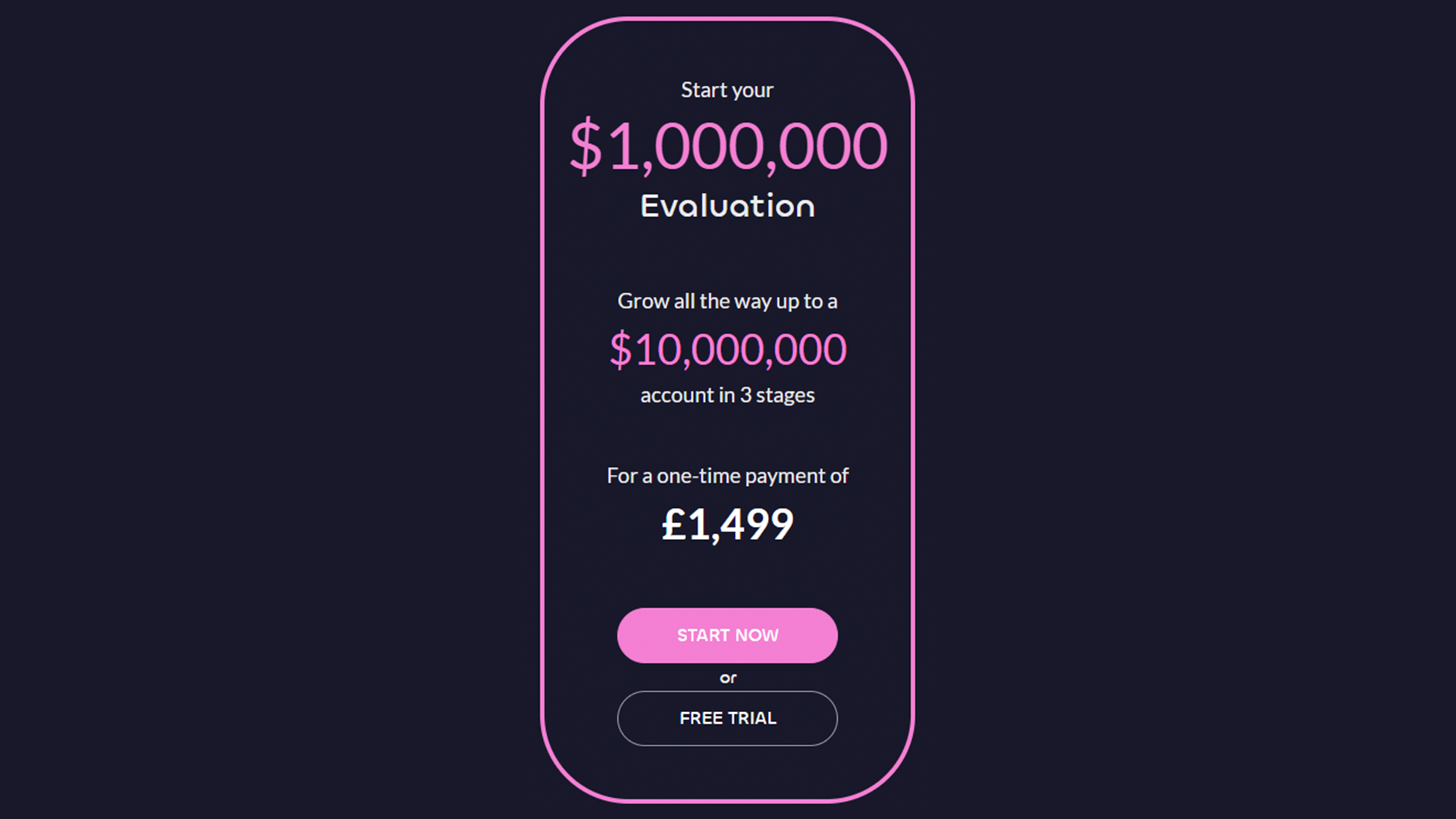

One-step evaluation program account

Lux Trading Firm offers the one-step evaluation challenge account, which is designed to identify consistent and disciplined traders who demonstrate remarkable performance during a single-phase evaluation period. This account provides a trading balance of $1,000,000 and allows for trading with a leverage of 1:10.

To successfully complete the one-step evaluation challenge account, traders are required to achieve a profit target of 15% while ensuring that they do not exceed the maximum loss rule of 5%. There is no specific time limit imposed on reaching the profit target during the evaluation stage. However, traders must engage in trading activities for a minimum of 29 calendar days (15 calendar days for swing traders) before progressing to the next phase. Upon successfully completing the evaluation stage, traders will be granted a live-funded account.

Upon completion of the one-step evaluation challenge, traders are provided with a funded account that comes with a profit target of 10%. Traders must also adhere to the maximum loss rule of 4%. The initial profit split for this account is set at 75%, based on the profit achieved from the 10% profit target during the unlimited trading period on the funded account.

Furthermore, the one-step evaluation program account offers a scaling plan. To advance to the next growth stage and potentially reach a maximum capital of $10,000,000, traders are required to achieve a profit target of 10% within their account.

In summary, Lux Trading Firm's one-step evaluation challenge account presents an opportunity for traders to demonstrate their trading skills and consistency, with the potential for scaling their account and achieving higher levels of capital.

The one-step evaluation program accounts offered by Lux Trading Firm provide traders with a diverse range of trading instruments to choose from. These instruments include forex pairs, commodities, indices, bonds, and shares. Traders can engage in trading activities involving these financial instruments as part of the evaluation process in the one-step program. This allows traders to showcase their skills and expertise across multiple asset classes, enhancing their trading experience and opportunities within the evaluation program.

One-step evaluation program account rules

-

Profit target: The profit target is a specific percentage of profit that traders must achieve in order to complete an evaluation phase, withdraw profits, or scale their account. In the one-step evaluation program, the profit target is set at 15% for the evaluation stage and 10% for funded accounts.

-

Maximum loss: Maximum loss refers to the maximum allowable loss that a trader can reach before their account is considered violated. In the one-step evaluation program, all account sizes have a maximum loss limit of 5% (reduced to 4% for funded accounts).

-

Minimum trading days: Minimum trading days represent the minimum duration that traders must actively trade before completing an evaluation phase or requesting a withdrawal. In the one-step evaluation program, the evaluation stage requires a minimum trading period of 29 calendar days (15 calendar days for swing traders).

-

Stop-loss required: Traders are obligated to set a stop-loss on every position before initiating a trade.

-

Third-party EA risk: If traders plan to use a third-party EA (Expert Advisor), they should be aware that other traders may already be using the same trading strategy. There is a potential risk of being denied a funded account or withdrawal if the maximum capital allocation rule is exceeded.

-

Third-party copy trading risk: When utilizing third-party copy trading services, it's important to consider that other traders might be employing the same trading strategy. Engaging in such services may carry the risk of being denied a funded account or withdrawal if the maximum capital allocation rule is surpassed.

-

Only one segment of trading: Traders in the one-step evaluation program are restricted to trading in a single segment, which can be limited to forex, commodities, or indices. It is not permissible to trade across all segments on the same account.

What makes Lux Trading Firm different from other prop firms?

Lux Trading Firm sets itself apart from other leading prop firms through its distinct funding programs and unique evaluation process. They offer two different programs: the two-step evaluation program and the $1 million one-step funding program, both providing traders with real funded accounts.

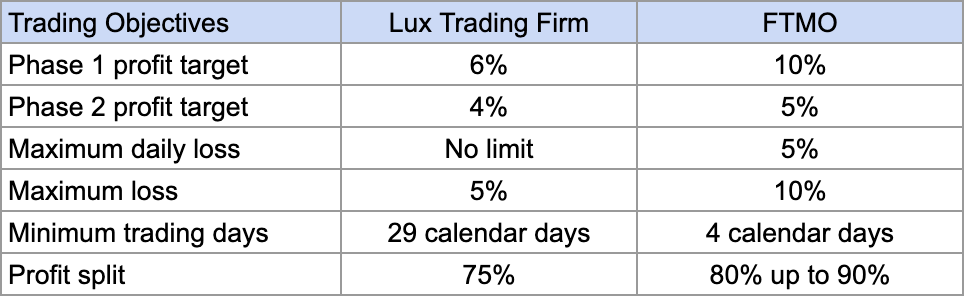

In contrast to traditional prop firms, Lux Trading Firm's two-step evaluation program stands out with its two-phase evaluation process. Traders must successfully complete both phases to become eligible for payouts. The first phase requires achieving a profit target of 6%, while the second phase has a profit target of 4%. Traders must also adhere to a maximum loss rule of 5%. During the Evaluation stage, a minimum trading period of 29 calendar days (15 calendar days for swing traders) is required, while the Advanced stage has no minimum trading day requirements. Additionally, the two-step evaluation program incorporates a scaling plan, allowing traders to increase their account size and reach a maximum capital of $10,000,000.

One notable difference between Lux Trading Firm and other leading prop firms is the relatively lower profit targets they set. Despite this, there are no maximum time limitations imposed, giving traders the flexibility to achieve their profit targets at their own pace.

Overall, Lux Trading Firm distinguishes itself from other industry-leading prop firms by offering multiple funding programs, a unique two-step evaluation process with scaling opportunities, and a balanced approach to profit targets and time limitations.

Is getting Lux Trading Firm capital realistic?

When assessing prop firms that align with your forex trading style, it's crucial to evaluate the realism of their trading requirements. While a company may offer a high profit split on a well-funded account, it's important to consider whether their expectations for monthly gains and maximum drawdowns are attainable. If the expectations are unrealistic, your chances of success can be greatly diminished.

The two-step evaluation programs offered by Lux Trading Firm provide a realistic path to receiving capital. These programs set relatively low profit targets, with 6% in phase one and 4% in phase two, while maintaining a maximum overall loss limit of 5%. What's more, there are no maximum time limitations imposed, allowing you to gradually accumulate profits without feeling pressured to rush through the process.

Similarly, the one-step evaluation programs offered by Lux Trading Firm present a realistic opportunity to receive capital. With a slightly above-average profit target of 15% and a maximum overall loss limit of 5%, these programs provide achievable objectives. As with the two-step evaluation programs, there are no maximum time limitations, giving you the flexibility to accumulate profits at your own pace.

Taking all these factors into consideration, Lux Trading Firm emerges as an excellent choice for obtaining funding. They offer two distinct funding programs that come with realistic trading objectives and conditions for receiving payouts.

Summary

To summarize, Lux Trading Firm is a reputable proprietary trading firm that provides traders with the option to choose between two distinct funding programs: the unique two-step evaluation and the $1 million one-step funding program.

The two-step evaluation programs offered by Lux Trading Firm involve a two-phase evaluation process that must be completed before traders become funded and eligible for profit splits. Traders are required to achieve profit targets of 6% in phase one and 4% in phase two, which are realistic objectives considering the 5% maximum loss rule. These programs offer traders the opportunity to earn profit splits of 75% and have the potential to scale their account balance up to $10,000,000.

On the other hand, the one-step evaluation program is a single-phase evaluation challenge where traders must reach a profit target of 15% to become funded. These profit targets, along with the 5% maximum loss rule, are realistic objectives. Traders participating in this program can earn profit splits of 75% and have the potential to scale their account balance up to $10,000,000.

I would recommend Lux Trading Firm to experienced traders who have well-developed trading and risk management strategies. The firm has clear rules without any maximum time limitations and sets relatively high minimum trading day requirements for account scaling, indicating their focus on attracting consistent traders. Considering all aspects of Lux Trading Firm's offerings, it can be considered an excellent choice for traders who have well-established trading strategies and aim to gradually accumulate profits consistently over time.