11. My Funded FX

- Unlimited trading period to complete evaluation phases

- 80% profit splits

- Bi-weekly payouts

- Overnight and weekend holding allowed

- News trading allowed

- Leverage up to 1:100

- A large variety of trading instruments

- Lot size limitations

- Concerns with personal data protection

- Trailing drawdown on one-step accounts

- No Free Trial

- Slippage

At MyFundedFX, traders are assessed by undergoing a one-step or two-step evaluation challenge, designed to gauge their trading potential. During this process, traders are provided with a demo account containing virtual funds, and their performance is closely monitored.

MyFundedFX presents traders with challenge programs that allow them to engage in trading activities without putting their own capital at risk. Successful traders have the chance to receive payments based on a predetermined percentage of their profits, all while carrying no liability for the firm's capital. This arrangement enables traders to earn substantial profits by managing account sizes of up to $200,000 and taking home profit splits of 80%. They have the flexibility to trade a diverse range of instruments, including forex pairs, commodities, indices, and cryptocurrencies.

Who are MyFundedFX?

MyFundedFX, established in June 2022, is a proprietary trading firm with its headquarters situated in the United States. They provide traders with the opportunity to combine their accounts, allowing for balances of up to $300,000, and they offer a scaling plan to further increase account balances. As their brokerage partners, MyFundedFX has formed partnerships with Eightcap and ThinkMarkets.

Their physical offices are located at 100 Crescent Court Suite 700, Dallas, TX 75201, United States.

Who is the CEO of MyFundedFX?

Matthew Leech is the CEO of My Funded FX

Funding program options

- One-step evaluation challenge accounts

- Two-step evaluation challenge accounts

One-step evaluation challenge account

MyFundedFX offers a one-step evaluation challenge account designed to identify traders who demonstrate consistency and discipline in their trading. Successful traders in this evaluation period are rewarded based on their ability to maintain consistency. The one-step evaluation challenge account provides a trading leverage of 1:100, allowing traders to amplify their trading positions.

Account Size - Prices

$5,000 - $50

$10,000 - $100

$25,000 - $200

$50,000 - $300

$100,000 - $500

$200,000 - $950

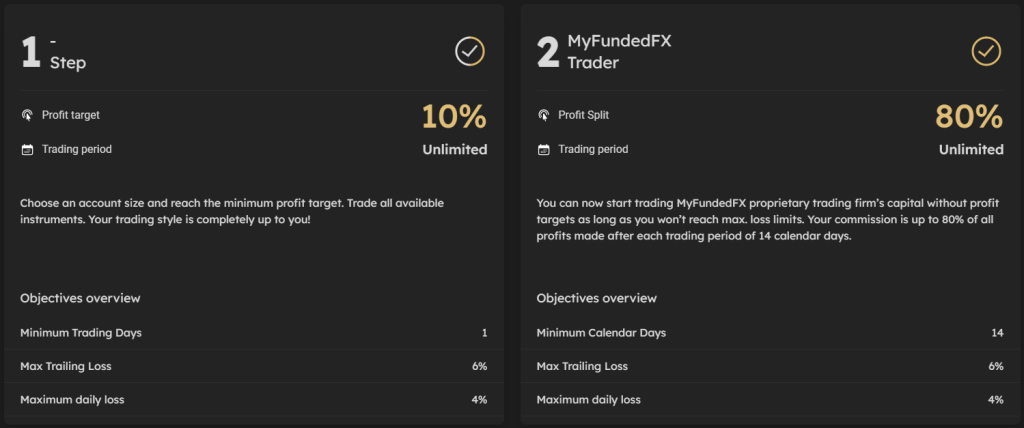

To successfully complete the one-step evaluation challenge account, traders must achieve a profit target of 10% while ensuring they do not exceed the 4% maximum daily loss and 6% maximum trailing loss rules. The duration of the evaluation period is unlimited, giving traders ample time to reach the profit target. Additionally, there are no minimum trading day requirements during this period.

Upon successfully completing the one-step evaluation challenge, traders are rewarded with a funded account. In this funded account, there are no specific profit targets to be met. Traders are solely required to adhere to the 4% maximum daily loss and 6% maximum trailing loss rules. The initial profit split for the funded account is set at 80% based on the profits generated 14 calendar days after placing the first position in the account. Subsequently, traders will receive their payouts on a bi-weekly basis following the initial payout.

One-step evaluation challenge account scaling plan

The one-step evaluation challenge accounts at MyFundedFX also offer a scaling plan to further enhance account balances. To qualify for the scaling plan, traders must achieve consistent profitability over a three-month period, with an average return of 12% or higher during that timeframe. Upon meeting this requirement, traders will receive an account increase equal to 25% of the original account balance, with a maximum balance limit set at $1,500,000.

Here's an example to illustrate how the scaling plan works:

After 3 months: If your initial account balance is $200,000, your account balance will increase to $250,000.

After the following 3 months: The balance of $250,000 will further increase to $300,000.

After another 3 months: The balance of $300,000 will increase to $350,000.

And so on...

Traders participating in the one-step evaluation challenge accounts can trade a variety of instruments, including forex pairs, commodities, indices, and cryptocurrencies.

One-step evaluation challenge account rules

-

The profit target refers to a predetermined percentage of profit that traders must achieve in order to fulfill certain requirements such as completing an evaluation phase, withdrawing profits, or scaling their account. During the evaluation period, the profit target is set at 10%. However, once traders transition to a funded account, there are no specific profit targets to be met.

-

The maximum daily loss refers to the highest amount of loss that a trader can incur within a single day without violating the account rules. For all account sizes, the maximum daily loss is capped at 4%. This means that traders should ensure their losses do not exceed this limit to comply with the account regulations.

-

The maximum trailing drawdown is determined by the difference between the highest account balance reached and the maximum drawdown experienced. It represents the maximum decline in the account balance from its peak value. For all account sizes, there is a consistent maximum trailing drawdown limit of 6%. This means that traders must ensure that the drawdown does not exceed this threshold to adhere to the account requirements.

-

The lot size limit imposes restrictions on traders, specifying the allowed lot sizes for particular trading instruments. Typically, these limits are determined based on the initial account balance of the prop firm account. Traders are required to adhere to these predefined lot sizes when executing trades in order to comply with the regulations and guidelines of the prop firm.

-

When considering third-party copy trading, it is essential to be aware of the associated risks. By utilizing a third-party copy trading service, there is a possibility that other traders are already employing the same trading strategy through the service. Consequently, there exists a potential risk of being denied a funded account or facing obstacles in the withdrawal process if the maximum capital allocation rule is exceeded. It is important to exercise caution and understand the implications before engaging in third-party copy trading services.

-

When considering the utilization of a third-party EA (Expert Advisor), it is important to be aware of the associated risks. By employing a third-party EA, there is a possibility that other traders are already utilizing the same trading strategy through the EA. As a result, there exists a potential risk of being denied a funded account or facing complications during the withdrawal process if the maximum capital allocation rule is exceeded. It is crucial to exercise caution and fully comprehend the implications before opting to use a third-party EA.

Two-step evaluation challenge account

MyFundedFX offers a two-step evaluation challenge account designed to identify traders who demonstrate consistency and discipline throughout the two-phase evaluation period. Successful traders in this evaluation program account are rewarded based on their ability to maintain consistency. The trading leverage available for this evaluation account is set at 1:100, allowing traders to amplify their trading positions.

Account Size - Prices

$5,000 - $50

$10,000 - $100

$25,000 - $200

$50,000 - $300

$100,000 - $500

$200,000 - $950

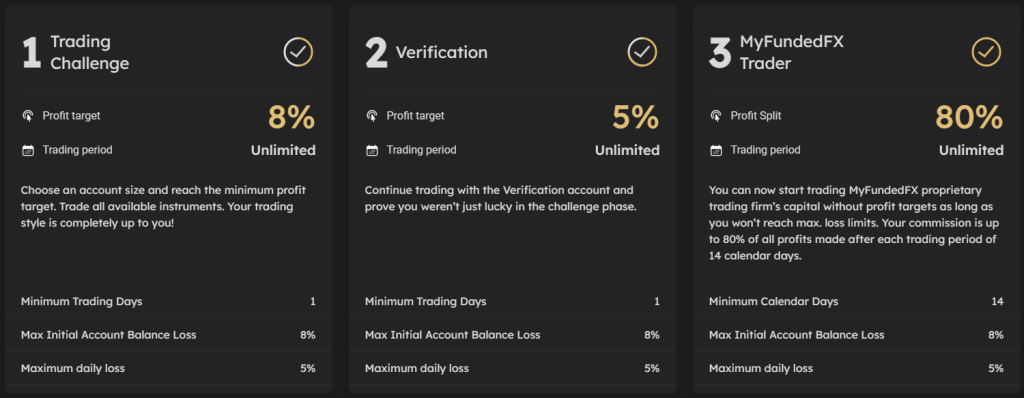

In evaluation phase one, traders must achieve a profit target of 8% while staying within the boundaries of a 5% maximum daily loss and 8% maximum loss. There are no minimum trading day requirements, and the evaluation phase has no time limit. The objective is to reach the profit target to proceed to phase two.

Evaluation phase two entails reaching a profit target of 5% while adhering to a 5% maximum daily loss and 8% maximum loss. Similar to phase one, there are no minimum trading day requirements or time constraints. Meeting the profit target in this phase allows traders to advance to a funded account.

Upon successfully completing both evaluation phases, traders are granted a funded account without specific profit targets. The only requirements are to abide by the 5% maximum daily loss and 8% maximum loss rules. Initially, the profit split is set at 80%, calculated based on profits made 14 calendar days after the first position is placed in the funded account. Subsequently, payouts are distributed on a bi-weekly basis.

Two-step evaluation challenge account scaling plan

The two-step evaluation challenge accounts at MyFundedFX incorporate a scaling plan as well. To qualify, traders must achieve profitability over a three-month period by maintaining an average return of 12% or more throughout this duration. Successful completion of this requirement results in an account increase equivalent to 25% of the original account balance, up to a maximum balance of $1,500,000.

For example:

After 3 months: If you have an initial account balance of $200,000, your account balance will increase to $250,000.

After the next 3 months: The balance of $250,000 will further increase to $300,000.

After the subsequent 3 months: The balance of $300,000 will rise to $350,000.

This scaling process continues in a similar manner.

In terms of trading instruments, the two-step evaluation challenge accounts allow trading in various assets, including forex pairs, commodities, indices, and cryptocurrencies.

Two-step evaluation challenge account rules

-

A profit target refers to a predetermined percentage of profit that traders must achieve in order to successfully complete an evaluation phase, withdraw profits, or scale their account. In phase 1 of the evaluation, the profit target is set at 8%, while in phase 2, it is reduced to 5%. However, once traders advance to funded accounts, there are no specific profit targets imposed on them.

-

The maximum daily loss refers to the highest allowable loss that a trader can incur within a single day before their account is deemed in violation. For all account sizes, a consistent maximum daily loss limit of 5% is enforced. This means that traders must ensure their losses do not exceed this predefined threshold during any given day of trading.

-

Traders are obligated to adhere to predetermined lot sizes for particular trading instruments, which is commonly referred to as the lot size limit. These limits are typically determined based on the initial account balance of the prop firm account. In essence, traders must trade using lot sizes that align with the specified requirements established by the prop firm, taking into consideration the initial funds available in their trading account.

-

When considering third-party copy trading, it's important to be aware of the associated risks. By utilizing a third-party copy trading service, it's possible that other traders have already adopted the exact same trading strategy. As a result, there is a risk of duplicated trading strategies. Furthermore, exceeding the maximum capital allocation rule while using a third-party copy trading service can potentially lead to denial of a funded account or withdrawal. Therefore, it's crucial to be mindful of these factors and ensure compliance with the maximum capital allocation rule when engaging in third-party copy trading services.

-

When it comes to third-party EAs, it's important to consider the associated risks. By utilizing a third-party EA, it's possible that other traders are already employing the same trading strategy. This means there is a risk of trading strategy duplication. Additionally, exceeding the maximum capital allocation rule while using a third-party EA can potentially result in denial of a funded account or withdrawal. Therefore, it's essential to be mindful of these risks and ensure compliance with the maximum capital allocation rule when utilizing third-party EAs.

What makes MyFundedFX different from other prop firms?

MyFundedFX stands out among the industry's top prop firms due to its unique offering of two distinct funding programs: the one-step challenge and the two-step challenge. Additionally, they have comparatively relaxed trading rules that allow traders to hold positions overnight and over the weekends, as well as trade during news releases.

In comparison to other prop firms, MyFundedFX presents the one-step evaluation challenge, which requires traders to successfully complete a single phase to become eligible for payouts. The profit target for this challenge is set at 10%, with a maximum daily loss limit of 4% and a maximum trailing drawdown of 6%. It's important to note that there are no restrictions on the minimum or maximum number of trading days during the evaluation period. Moreover, the one-step evaluation challenge accounts come with a scaling plan, offering traders an opportunity for growth. Overall, MyFundedFX's trading rules for the one-step challenge are considered standard, allowing for an unlimited evaluation period.

In addition to the one-step challenge, MyFundedFX also provides the two-step evaluation challenge, which requires traders to complete two phases to qualify for payouts. In phase one, the profit target is set at 8%, while in phase two, it is lowered to 5%. The maximum daily loss limit for this challenge is 5%, and the maximum trailing drawdown is set at 8%. Similar to the one-step challenge, there are no limitations on the minimum or maximum number of trading days during the evaluation period. The two-step evaluation challenge accounts also include a scaling plan. Compared to other leading prop firms, MyFundedFX sets relatively lower profit targets for the two-step challenge and maintains an unlimited evaluation period.

In summary, MyFundedFX distinguishes itself from other prop firms by offering both the one-step and two-step evaluation challenges, along with their accommodating trading rules. With attractive profit targets, flexible trading periods, and scaling opportunities, MyFundedFX provides a competitive choice for traders seeking funding and growth in the industry.

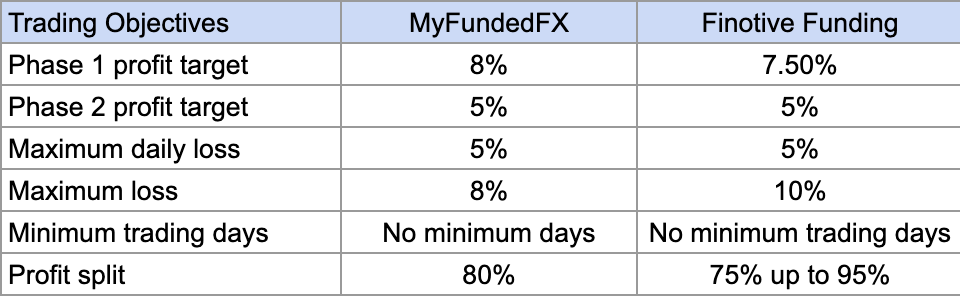

A comparative example between My Funded FX and Finotive Funding:

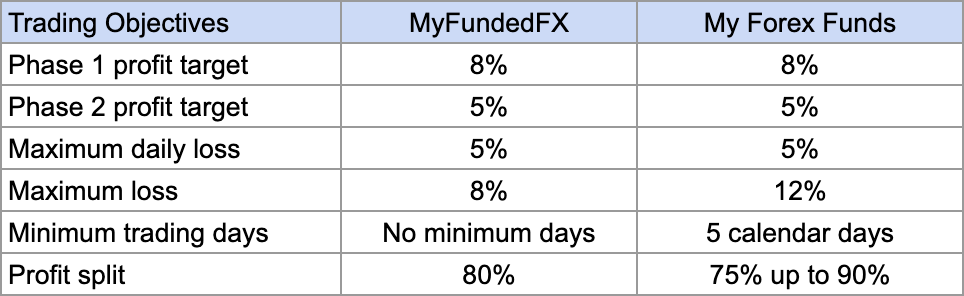

A comparative example between My Funded FX and My Forex Funds:

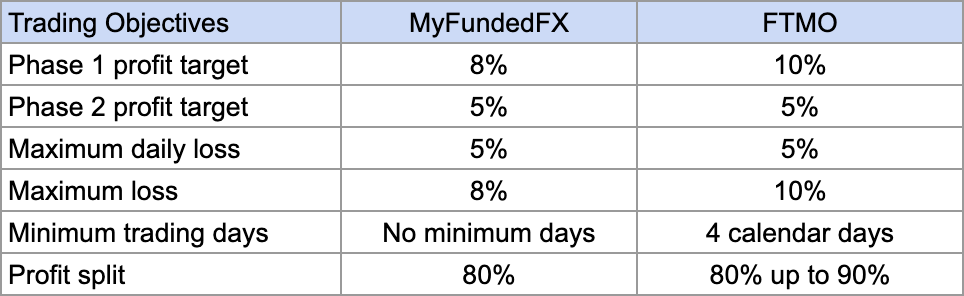

A comparative example between My Funded FX and FTMO:

Is getting MyFundedFX capital realistic?

When evaluating prop firms that align with your forex trading style, it is crucial to assess the realism of their trading requirements. While a company may offer a high percentage profit split on a well-funded account, it is essential to consider whether they expect unrealistically high monthly gains with low maximum drawdown percentages, as this significantly diminishes your chances of success.

In the case of the one-step evaluation challenge accounts, the likelihood of receiving capital is relatively high due to their reasonable profit target of 10% and average maximum loss rules (4% maximum daily and 6% maximum trailing loss). These accounts provide realistic trading objectives and conditions for receiving payouts.

Similarly, the two-step evaluation challenge accounts offer realistic opportunities to receive funding. With relatively low profit targets (8% in phase one and 5% in phase two) and slightly below average maximum loss rules (5% maximum daily and 8% maximum loss), these accounts provide a practical path to secure capital.

Considering these factors, MyFundedFX emerges as an excellent choice for securing funding. The availability of two distinct funding programs provides flexibility, and both programs feature realistic trading objectives and conditions for receiving payouts. By choosing MyFundedFX, you can align your trading goals with achievable targets and increase your chances of obtaining funding.

Payout proof

Which broker does MyFundedFX use?

MyFundedFX has established partnerships with Eightcap and ThinkMarkets as their chosen brokers. Eightcap is an ASIC-regulated brokerage firm based in Melbourne, Australia. Since its inception in 2009, their primary objective has been to offer exceptional financial services to clients. With a global presence, Eightcap operates from five offices and adheres to regulations in multiple jurisdictions. This allows them to provide clients worldwide with the opportunity to trade across various markets, including FX, indices, commodities, and shares.

ThinkMarkets, on the other hand, is a premium online brokerage with headquarters located in London and Melbourne. They specialize in offering a wide range of trading instruments, providing traders with quick and convenient access to diverse markets. ThinkMarkets is renowned for delivering well-known trading solutions such as MetaTrader 4, MetaTrader 5, and their proprietary ThinkTrader platform. With support for both MetaTrader 4 and MetaTrader 5, traders have the flexibility to choose their preferred trading platform.

By partnering with Eightcap and ThinkMarkets, MyFundedFX ensures that their traders have access to reputable brokers that offer robust trading platforms and a comprehensive range of markets. This enables traders to engage in their desired trading activities efficiently and effectively.

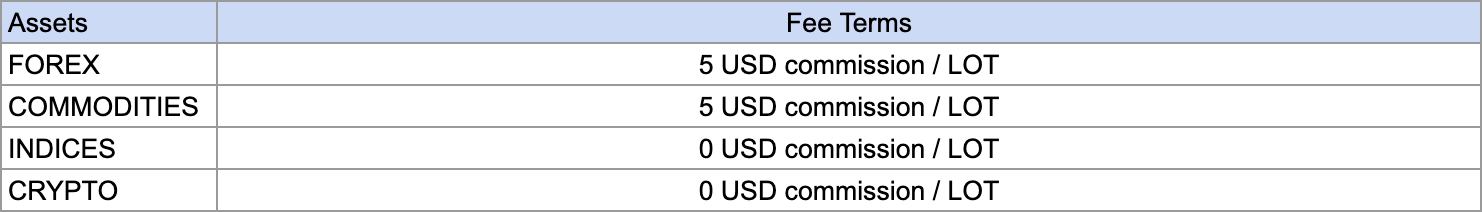

Trading instruments

Trading fees

Spreads

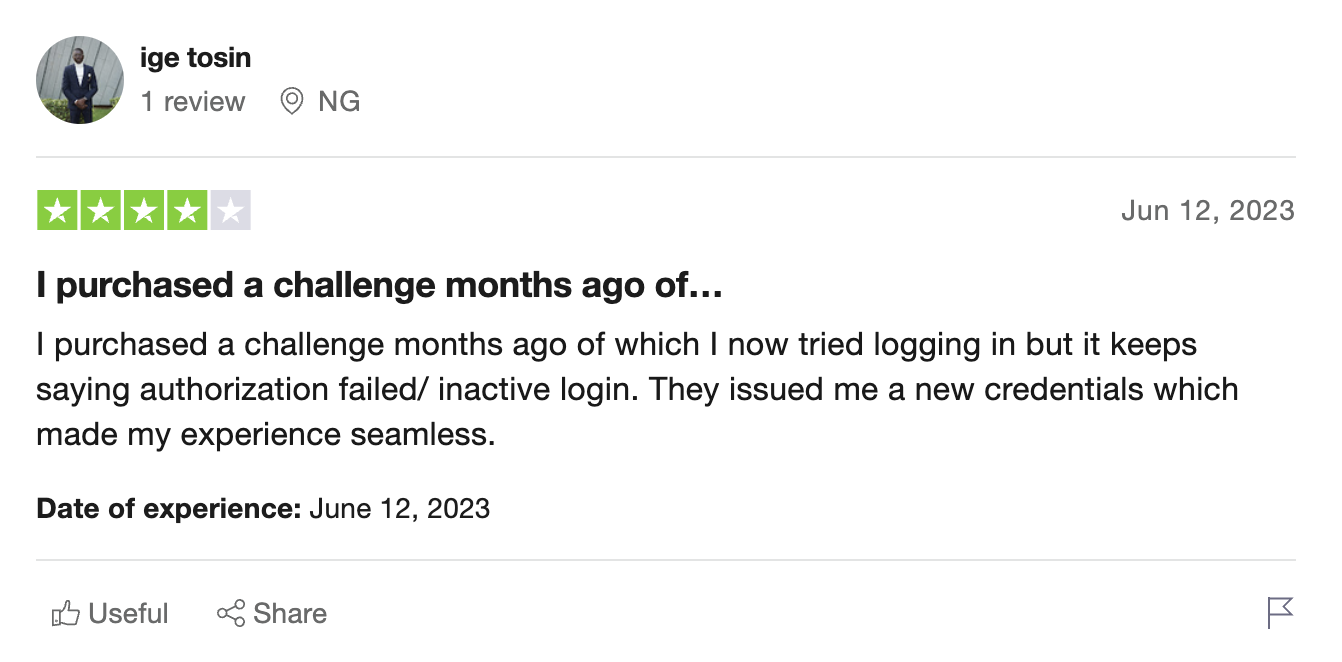

Traders’ Comments about MyFundedFX

Summary

In summary, MyFundedFX is a reputable proprietary trading firm that provides traders with the option to choose between two funding programs: one-step challenge accounts and two-step challenge accounts. They offer relaxed trading rules and an unlimited trading period, allowing traders to hold trades overnight, during weekends, and even during news releases.

For the one-step evaluation challenge accounts, traders must complete a single phase to become funded and eligible for profit splits. MyFundedFX sets a realistic profit target of 10% to be reached, while traders need to adhere to a maximum daily drawdown of 4% and a maximum trailing drawdown of 6%. By successfully completing the one-step evaluation, traders can earn 80% profit splits and have the opportunity to scale their accounts.

The two-step evaluation challenge follows the industry-standard two-phase evaluation process. Traders must complete both phases to become funded and eligible for profit splits. In phase one, a profit target of 8% is required, followed by a profit target of 5% in phase two. The maximum daily drawdown is set at 5%, and the maximum loss limit is 8%. Similar to the one-step evaluation, traders can earn 80% profit splits and have the ability to scale their accounts.

Based on the straightforward rules and realistic trading objectives, I highly recommend MyFundedFX to traders seeking a legitimate prop firm. They provide favorable conditions for a diverse range of traders with unique trading strategies. Taking into account all that MyFundedFX offers, they stand out as one of the top proprietary trading firms in the industry.