19. Smart Prop Trader

- Free Trial

- Competitive prices

- Competitive pricesUnlimited evaluation free retries

- Leverage 1:100

- Bi-weekly payouts

- Scaling account option up to $2,500,000

- Limited hours of live chat support

- 4% Maximum daily equity-based drawdown

- High commission costs

- Free Trial trading conditions are better than paid Evaluation

Smart Prop Trader aims to ensure traders achieve success in their careers by providing unparalleled deals and expert guidance. Their team of seasoned professionals possesses extensive experience in the trading industry, spanning over a decade.

Smart Prop Trader is dedicated to helping traders achieve successful careers by providing excellent deals and expert guidance. With over a decade of experience in the trading industry, their professional team has accumulated valuable knowledge and developed top-notch practices and deals. This expertise is now shared with traders worldwide, allowing them to benefit from the best trading conditions available. Additionally, traders can enjoy up to 90% profit splits as a reward for their participation.

Who are Smart Prop Trader?

Smart Prop Trader is a proprietary trading firm that provides an opportunity for traders with limited capital to access a substantial sum of $400,000 for trading purposes. Notably, traders can enjoy profit splits of up to 90%, and they also have the potential to increase their account balance. Established in July 2022, Smart Prop Trader operates in partnership with Eightcap, a reputable broker, ensuring traders have access to exceptional trading conditions. Their offices are situated at an address in Austin, Texas 78701, United States.

Who is the CEO of Smart Prop Trader?

Blake Olson is the CEO of Smart Prop Trader

Funding Program Options

Smart Prop Trader provides traders with a range of five two-step evaluation program account sizes to select from.

Evaluation program accounts

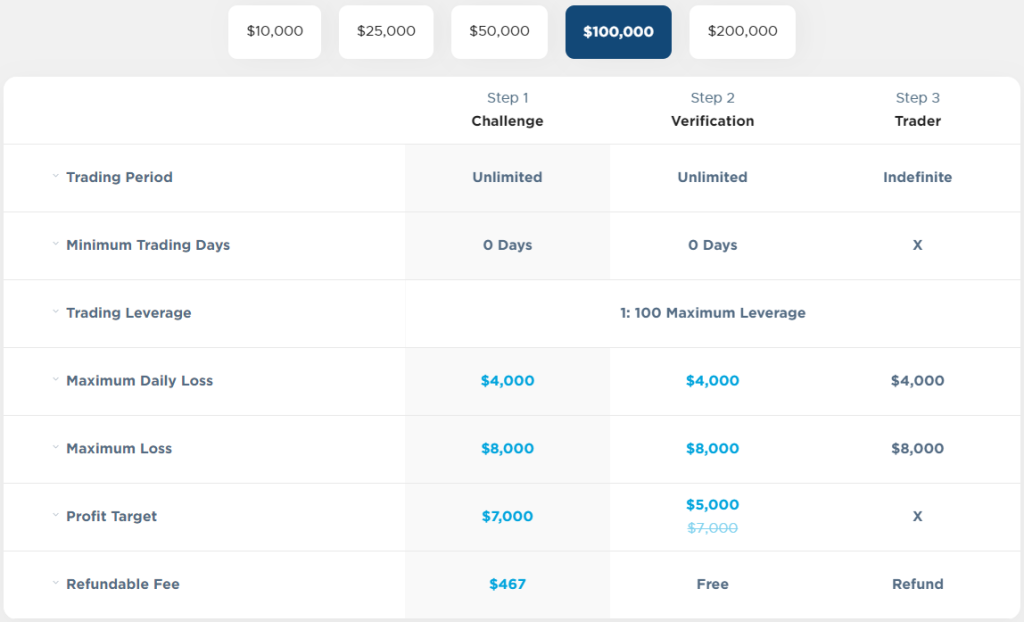

The evaluation program account offered by Smart Prop Trader has the objective of identifying skilled and disciplined traders who are duly rewarded for maintaining consistency during the two-phase evaluation period. With this account, traders have the opportunity to trade using leverage of up to 1:100.

Account Size - Prices

$10,000 - $67

$25,000 - $167

$50,000 - $267

$100,000 - $467

$200,000 - $867

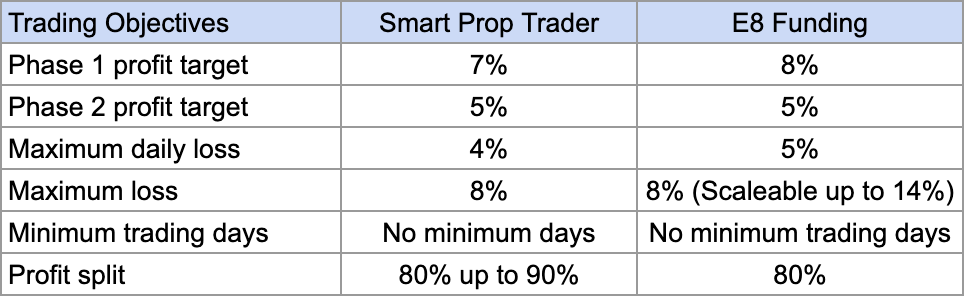

During the evaluation phase one of the Smart Prop Trader program, traders are required to achieve a profit target of 7% without exceeding the maximum daily loss of 4% or the maximum loss limit of 8%. The profit target must be met within an unlimited trading period on the evaluation account. There are no minimum trading day requirements to progress to phase two.

In evaluation phase two, traders need to reach a profit target of 5% while adhering to the same maximum daily loss and maximum loss rules as in phase one. Similar to phase one, the profit target must be achieved within an unlimited trading period on the evaluation account, and there are no minimum trading day requirements to proceed to a live-funded account.

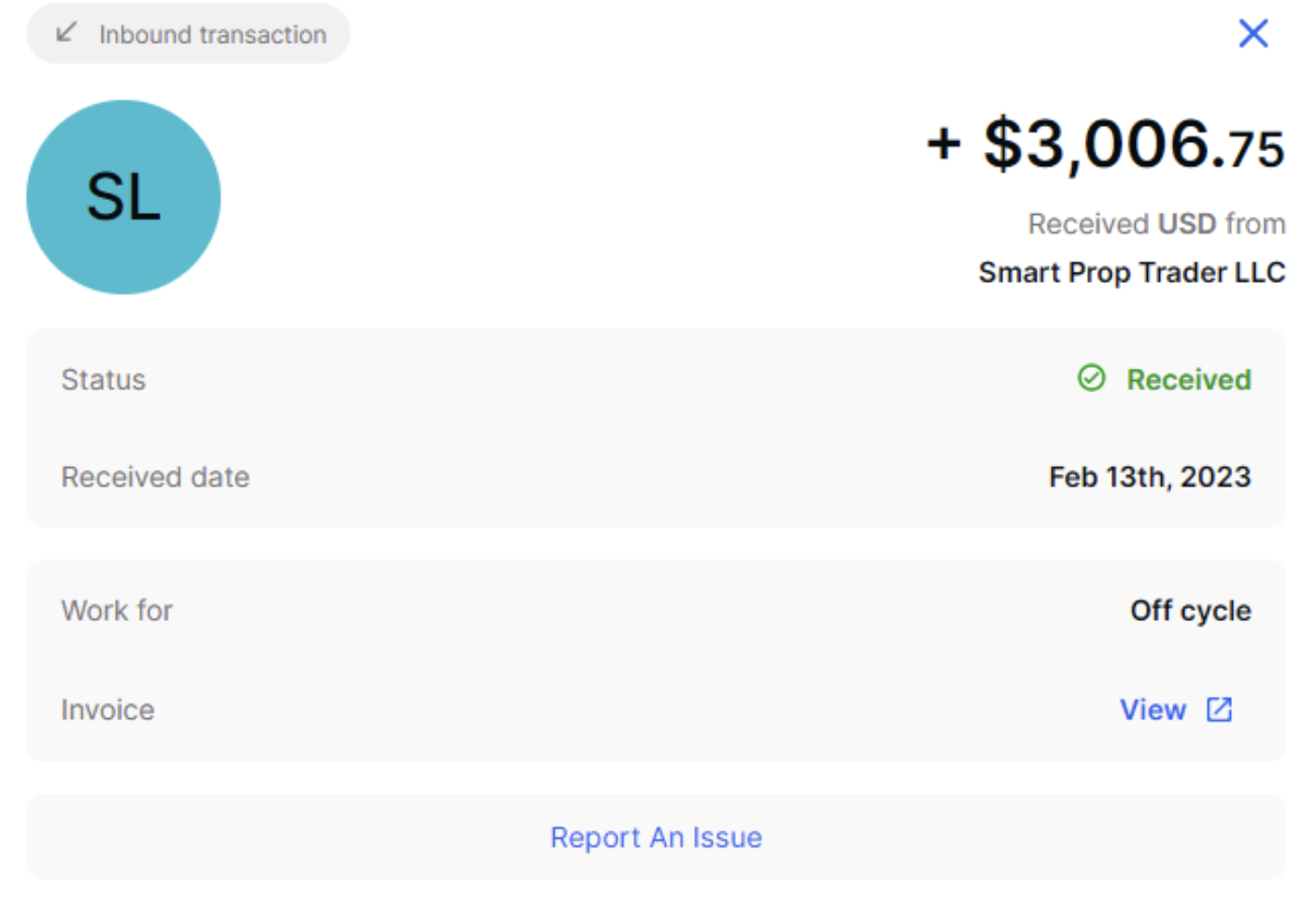

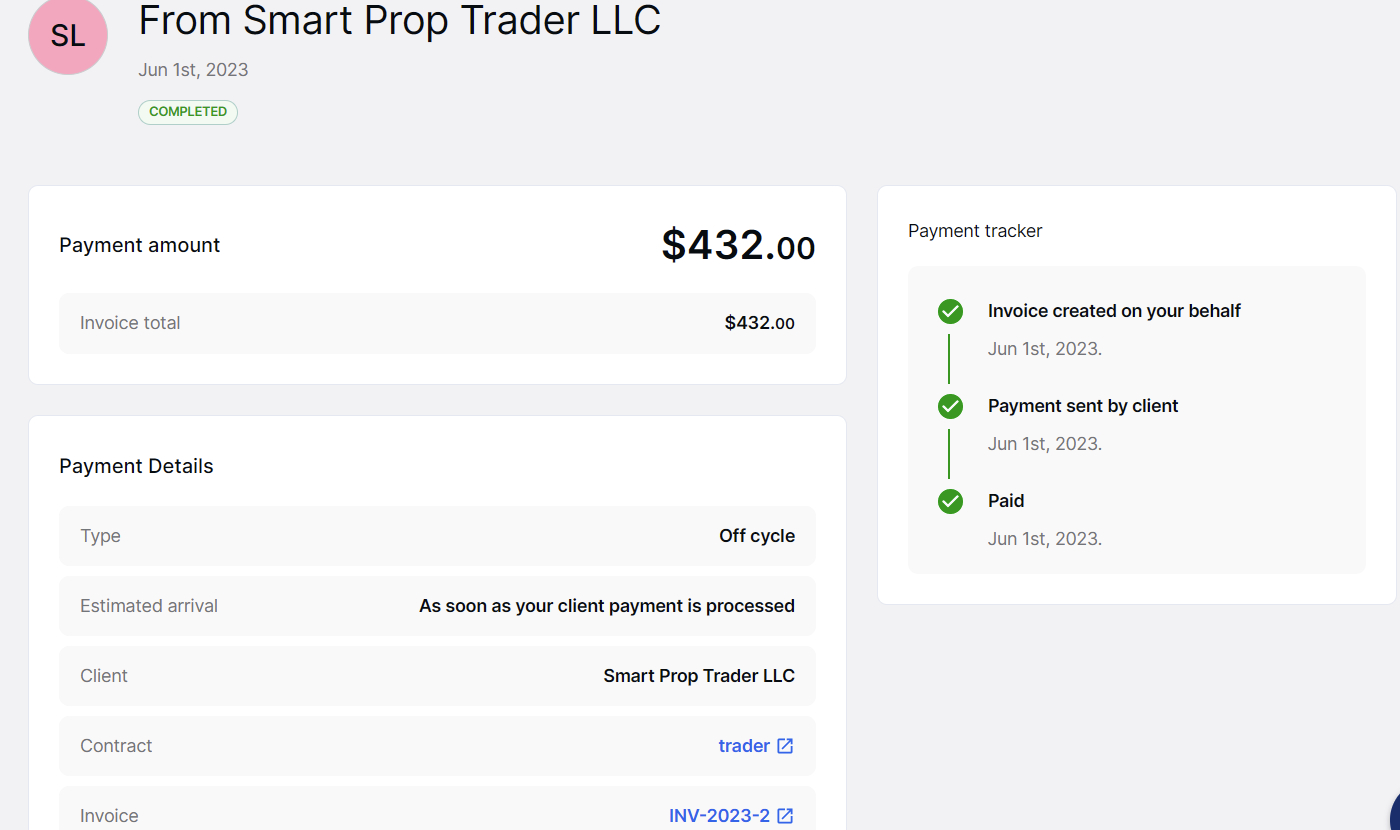

Upon successful completion of both evaluation phases, traders receive a funded account without specific profit targets. However, there is a minimum withdrawal limit of $100. Traders are only obligated to abide by the maximum daily loss of 4% and maximum loss limit of 8%. The first payout occurs 14 calendar days after the initial position is taken on the funded account, followed by subsequent bi-weekly payouts. The profit split ranges from 80% to 90%, depending on the profits generated on the funded account. It is worth noting that traders have the flexibility to change their profit split day up to three times, allowing them to receive their withdrawals on a more convenient day.

Evaluation program account scaling plan

The evaluation program accounts offered by Smart Prop Trader include a scaling plan for traders. Upon achieving continuous profitability over each 3-month period, traders will receive an account increase of 25% based on the original account balance. Additionally, once the account balance reaches 28%, the maximum loss limit will be raised by 2% every 3 months.

Here's an example to illustrate the process:

After 3 months: If you start with a $200,000 account, your account balance will increase to $250,000.

After the next 3 months: The balance of $250,000 will further increase to $300,000.

After the subsequent 3 months: The balance of $300,000 will increase to $350,000.

This progression continues in the same manner.

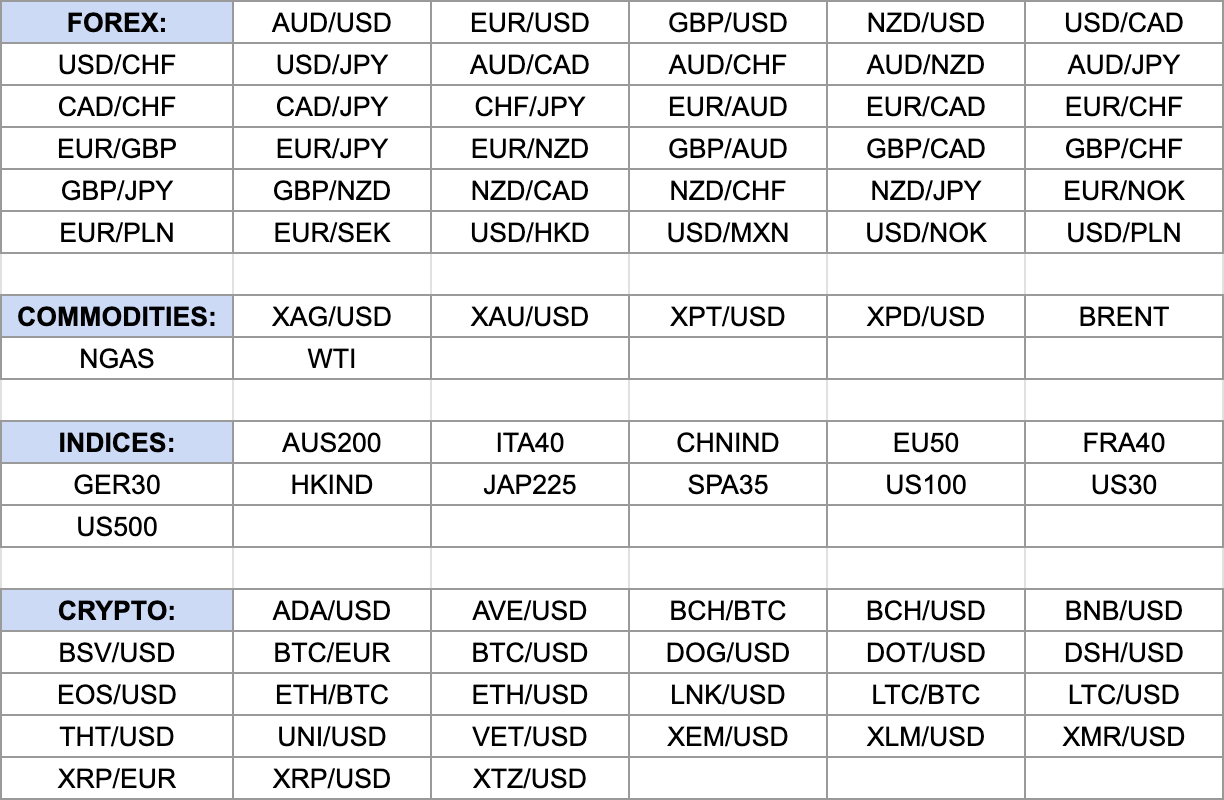

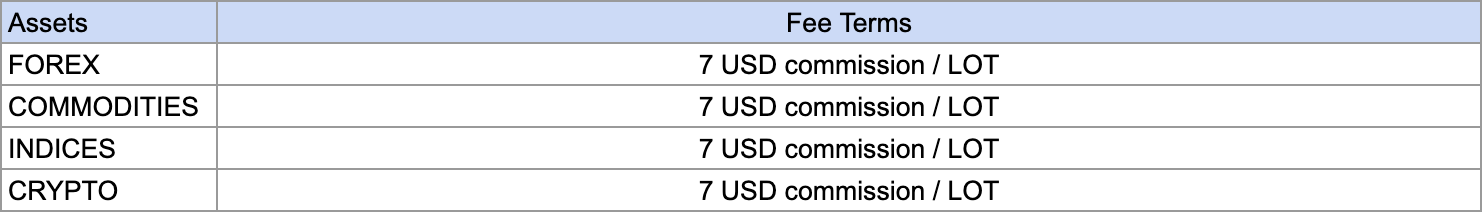

In terms of trading instruments, the evaluation program accounts allow trading in various assets such as forex pairs, commodities, indices, and cryptocurrencies.

Evaluation program account rules

-

A profit target represents a predetermined percentage of profit that traders must achieve in order to complete an evaluation phase, withdraw profits, or scale their account. In phase 1, the profit target is set at 7%, while phase 2 requires a profit target of 5%. On the other hand, funded accounts do not have specific profit targets.

-

The maximum daily loss refers to the highest permissible loss that a trader can incur within a single day before their account is considered in violation. Across all account sizes, there is a uniform maximum daily loss limit of 4%.

-

The maximum loss signifies the highest allowable cumulative loss that a trader can experience before their account is considered in violation. For all account sizes, the maximum loss is capped at 8%. It is important to note that the maximum loss limit can be scaled up to 28% based on the account balance.

-

The prohibition of martingale strategies indicates that traders are explicitly disallowed from utilizing any form of martingale strategy during their trading activities.

-

When it comes to third-party copy trading risk, it is important to be aware that utilizing such services entails the possibility of other traders employing the exact same trading strategy through the same third-party platform. Consequently, if you exceed the maximum capital allocation rule while using a third-party copy trading service, there is a potential risk of being denied a funded account or facing withdrawal limitations.

-

When it comes to the risk associated with third-party EAs (Expert Advisors), it's crucial to consider that if you choose to utilize such an EA, there could be other traders already employing the same trading strategy through the same third-party platform. This means that by using a third-party EA, there is a potential risk of being denied a funded account or encountering limitations on withdrawals if you surpass the maximum capital allocation rule.

What makes Smart Prop Trader different from any other prop firm?

Smart Prop Trader stands out from many other leading prop firms by adopting a more relaxed approach to regulating trading styles. This means that they seldom impose restrictions on your trading activities. You have the freedom to trade during news events, hold positions overnight, and even trade over the weekends. However, it's important to note that the use of martingale strategies is prohibited.

In comparison to other prop firms, the Smart Prop Trader evaluation program follows a unique two-phase structure. Traders are required to successfully complete both phases in order to become eligible for payouts.

During phase one, the profit target is set at 7%, while in phase two, it is lowered to 5%. Traders must also adhere to the maximum daily loss limit of 4% and the maximum loss limit of 8%. Notably, there are no specific requirements regarding the maximum or minimum number of trading days within each evaluation phase. These flexible evaluation programs also incorporate a scaling plan.

When compared to other prominent prop firms in the industry, Smart Prop Trader distinguishes itself by offering lower profit targets, no mandatory maximum or minimum trading day requirements, and a more relaxed set of trading rules to follow.

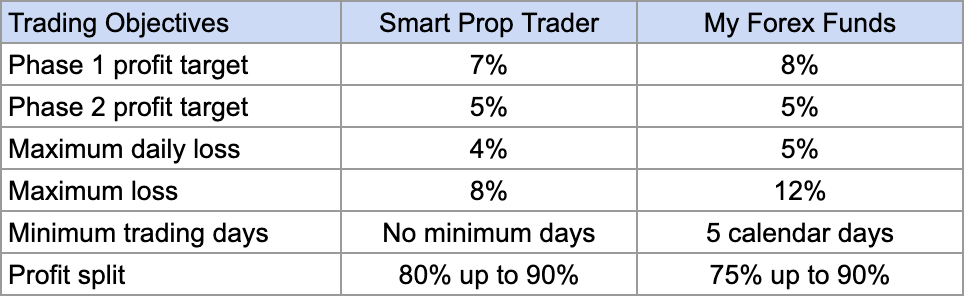

A comparative example between Smart Prop Trader and My Forex Funds:

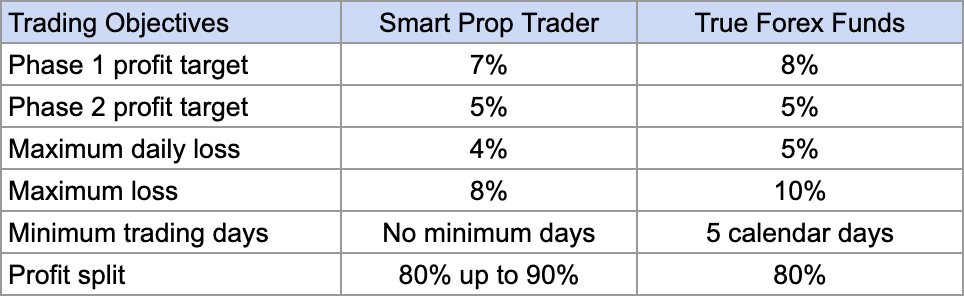

A comparative example between Smart Prop Trader and True Forex Funds:

A comparative example between Smart Prop Trader and E8 Funding:

Is getting Smart Prop Trader capital realistic?

When evaluating prop firms that align with your forex trading style, it is crucial to assess the realism of their trading requirements. Opting for a company that offers a high profit split on a generously funded account may seem appealing. However, if they expect substantial monthly gains coupled with minimal maximum drawdown percentages, your chances of achieving success become extremely low.

The evaluation program accounts offered by Smart Prop Trader present a realistic opportunity to secure capital. These accounts feature relatively modest profit targets, with 7% set for phase one and 5% for phase two. Furthermore, the maximum loss rules are slightly below average, with a maximum daily loss limit of 4% and a maximum overall loss limit of 8%.

Taking all of these factors into consideration, Smart Prop Trader emerges as an outstanding choice for obtaining funding. Their evaluation program accounts provide realistic trading objectives to follow, accompanied by reasonable conditions for receiving payouts.

Payout proof

Which broker does Smart Prop Trader use?

Smart Prop Trader has partnered with Eightcap, an ASIC-regulated broker headquartered in Melbourne, Australia, integrating their technology for enhanced trading services. Eightcap was established in 2009 with a clear mission to deliver exceptional financial services to clients. They maintain five offices worldwide and are regulated in multiple jurisdictions, enabling clients from around the globe to access a wide range of markets including FX, indices, commodities, and shares.

With an overall Trust Score of 73 out of 99, Eightcap is considered an average-risk broker. They offer various features, including:

- Forex Trading

- CFD Trading

- Cryptocurrency Trading

- ocial Trading/Copy-Trading

- A total of 326 Tradeable Symbols

- A total of 45 Forex Pairs

Eightcap provides two account types: Raw and Standard. The commissions and fees associated with each account type will vary. For Standard accounts, fees are incorporated into the spread, while for Raw accounts, fees are charged as commissions. Additionally, traders should be mindful of overnight fees, which are interest charges incurred for holding open positions overnight.

As a MetaTrader exclusive broker, Eightcap offers trading platforms such as MetaTrader 4 and the newer MetaTrader 5, developed by MetaQuotes Software Corporation.

Trading instruments

Trading fees

Traders’ Comments about Smart Prop Trader

Summary

To summarize, Smart Prop Trader is a reputable proprietary trading firm that provides traders with the option to choose from five different account sizes within their two-step evaluation program.

The evaluation program follows the industry-standard two-phase structure, requiring traders to successfully complete both phases in order to become funded and eligible for profit splits. With realistic profit targets of 7% in phase one and 5% in phase two, traders have clear trading objectives while adhering to maximum daily loss (4%) and maximum loss (8%) rules. The evaluation programs also offer the opportunity to earn profit splits ranging from 80% up to 90%, with the added benefit of being able to scale your accounts.

For those seeking a prop firm with transparent trading rules, I highly recommend Smart Prop Trader. They are an established proprietary trading firm that caters to a diverse range of individuals with different trading styles. Considering all their offerings, Smart Prop Trader stands out as an appealing option within the proprietary trading firm industry.