10. Surge Trader

- Account up to $1,000,000

- Profit share 75% up to 90%

- Available add-ons upon purchase

- Overnight and weekend holding allowed

- Advanced trader's Dashboard

- Eightcap broker

- Stop-loss required for every trade

- Maximum open size 1 lot / $10,000 of the account balance

- Trailing drawdown

- Up to 1:20 leverage

- 8% Max loss

SurgeTrader's origin story is similar to the countless tales of successful companies that emerged from humble beginnings in basements or garages. In this case, it all started with a discussion among an FX broker, institutional trader, and venture capitalist at a Naples sushi restaurant.

SurgeTrader fosters a culture of empowering traders to thrive in their professional journeys by facilitating increased profitability in their trading endeavors. To qualify as a funded trader, individuals are required to undergo an audition process where they showcase their trading skills and exhibit disciplined trading practices. Upon successfully meeting the criteria, traders are granted a profit split ranging from 75% to 90% on their future payouts as a token of recognition and reward.

Who are SurgeTrader?

SurgeTrader, a US-based proprietary firm headquartered in Naples, Florida, provides aspiring traders with the opportunity to receive funding of up to $1,000,000. The profit split for traders ranges from 75% to 90%. SurgeTrader has seamlessly integrated their technology with EightCap, a Melbourne-based broker regulated by ASIC. SurgeTrader LLC was officially established in August 2021, incorporating in both Delaware and Florida. Their office is situated at 405 5th Avenue South, Naples, Florida 34102.

Who is the CEO of SurgeTrader?

Jana Seaman is the CEO of My Forex Funds

Funding program options

SurgeTrader provides traders with an evaluation program featuring six distinct account sizes.

Evaluation program accounts

The SurgeTrader evaluation program is designed to identify dedicated traders and provide them with increased earning potential from their trading activities. Traders are rewarded for maintaining consistency throughout the single-phase evaluation period. The evaluation program account allows traders to trade with leverage of up to 1:20.

During the evaluation phase, traders are required to achieve a profit target of 10% while adhering to the maximum daily loss of 5% and maximum trailing drawdown of 6% rules. There are no specific minimum or maximum trading day requirements for the evaluation account. The sole requirement to qualify for funding is reaching the profit target.

Upon successful completion of the evaluation phase, traders are granted a funded account where they are not assigned profit targets. Instead, they are expected to observe the maximum daily loss of 5% and maximum trailing drawdown of 6% rules. Traders can request their initial profit split of 75% or 90% on the first day if they are in profit. Subsequent payouts can be requested on a 30-calendar day basis.

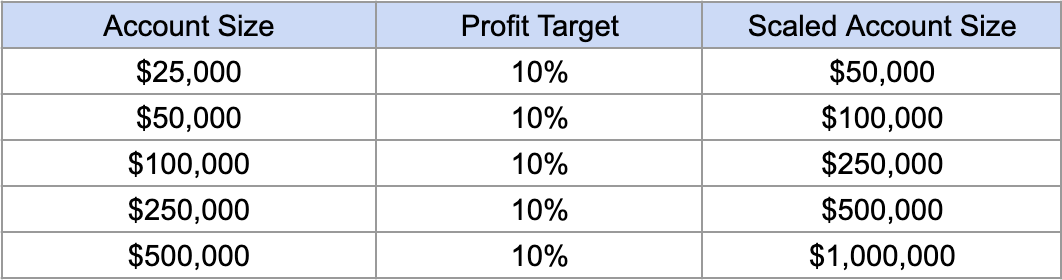

Evaluation program account scaling plan

The evaluation program accounts incorporate a scaling plan whereby traders need to achieve a profit target of 10% based on their initial account balance. It is important to note that the scaling is limited to a maximum of $1,000,000, and if traders choose to scale their account, they will not be eligible for a profit split.

Below is the scaling plan for the evaluation programs:

Evaluation program account rules

-

A profit target refers to the predetermined percentage of profit that traders must achieve in order to successfully conclude an evaluation phase, withdraw their profits, or scale their account. In the case of evaluation programs, the profit target is set at 10%. On the other hand, funded accounts do not have any profit targets to fulfill.

-

The maximum daily loss is the highest allowable amount of loss that a trader can incur within a single day before their account is considered to be in violation. For all account sizes, there is a uniform maximum daily loss limit of 5%.

-

The maximum trailing drawdown represents the greatest decline in the account balance from its highest point, considering both the peak balance and subsequent drawdown. For all account sizes, a uniform maximum trailing drawdown of 6% is implemented. This limit ensures that traders maintain a maximum decline within that specified percentage range across all account sizes.

-

The "stop-loss required" rule mandates that traders must establish a stop-loss order for each position they intend to open before initiating the trade.

-

The lot size limit imposes certain restrictions on traders, requiring them to adhere to predetermined lot sizes for particular trading instruments. These lot sizes are typically determined based on the initial account balance of the proprietary firm account. Below, you can find the maximum number of lots that traders can open across all currency pairs, depending on their account size:

$25,000 – 2.5 lots

$50,000 – 5 lots

$100,000 – 10 lots

$250,000 – 25 lots

$500,000 – 50 lots

$1,000,000 – 100 lots

-

When it comes to third-party copy trading, there is a risk to consider. If you choose to utilize a third-party copy trading service, it is important to be aware that there may be other traders who are already using the same service and employing identical trading strategies. By opting for a third-party copy trading service, there is a potential risk of being denied a funded account or experiencing difficulties with withdrawals if you surpass the maximum capital allocation rule.

-

When utilizing a third-party EA (Expert Advisor), it is important to be aware of the associated risks. By employing a third-party EA, it is possible that other traders are already using the same EA, thereby implementing identical trading strategies. By relying on a third-party EA, there is a potential risk of being denied a funded account or encountering difficulties with withdrawals if you surpass the maximum capital allocation rule.

Add-on options for your evaluation program accounts

Additional options available for your evaluation program accounts are as follows:

-

No stop-loss required: You can opt for this add-on, which allows you to forego the requirement of setting a stop-loss. This option comes with a 10% price increase when purchasing your evaluation account.

-

Double leverage: By selecting this add-on, you will benefit from doubled leverage for forex pairs and metals. This option incurs a 25% price increase when purchasing your evaluation account.

-

90% profit split: Choosing this add-on will entitle you to a profit split of 90%. It comes with a 10% price increase when purchasing your evaluation account.

It's important to note that you have the flexibility to choose one or multiple add-on options based on your personal preference.

What makes SurgeTrader different from any other prop firm?

SurgeTrader sets itself apart from the majority of top prop firms by rarely imposing restrictions on your trading style. You are not bound by any minimum or maximum trading day requirements, and you have the freedom to trade during news events, hold trades overnight, and even over the weekend.

In comparison to other prop firms, SurgeTrader offers a unique one-phase evaluation program. Traders are required to achieve and surpass a profit target to become eligible for payouts. The profit target for this evaluation program is set at 10%, with a maximum daily loss limit of 5% and a maximum trailing drawdown limit of 6%. The program also enforces stop-loss and lot size limit rules. Notably, there are no specific minimum or maximum trading day periods, which is a significant advantage as it allows you the flexibility to choose trades without any pressure.

In summary, SurgeTrader distinguishes itself from many leading prop firms by seldom imposing restrictions on your trading style. Additionally, the absence of minimum and maximum trading day requirements is a major positive aspect, as it grants you the freedom to make independent trading decisions.

Is getting SurgeTrader capital realistic?

When evaluating prop firms that align with your forex trading style, it is crucial to assess the realism of their trading requirements. For instance, while a company may offer a high percentage profit split on a well-funded account, it may come with the expectation of achieving substantial monthly gains alongside minimal drawdown percentages. In such cases, the likelihood of achieving success becomes extremely low.

SurgeTrader provides a realistic opportunity for receiving capital through its evaluation program accounts. These accounts set an average profit target of 10% and adhere to reasonable maximum loss rules, including a 5% maximum daily loss and a 6% maximum trailing drawdown. These objectives and conditions make SurgeTrader an excellent choice for securing funding, as they are grounded in realism and attainable trading goals.

Payout proof

Which broker does SurgeTrader use?

SurgeTrader has partnered with Eightcap, an ASIC-regulated broker based in Melbourne, Australia. Established in 2009, Eightcap has a clear mission of providing exceptional financial services to its clients. With offices in five locations worldwide and multiple regulatory certifications, they offer clients from around the globe the opportunity to trade various markets including FX, indices, commodities, and shares.

Eightcap is considered an average-risk broker, with an overall Trust Score of 73 out of 99. They provide a range of features, including:

- Forex Trading

- CFD Trading

- Cryptocurrency Trading

- Social Trading/Copy-Trading

- A total of 326 Tradeable Symbols

- A total of 45 Forex Pairs

They offer two types of trading accounts: Raw and Standard. The choice between the two will determine the applicable commissions and fees. Standard accounts have fees built into the spread, while Raw accounts have fees incorporated as commissions. It is also important to consider overnight fees, which are interest charges for holding positions open overnight in trading.

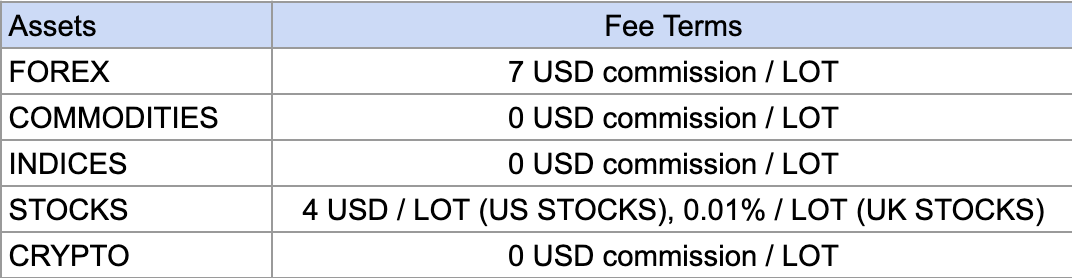

Trading commissions

Spreads

Summary

In conclusion, SurgeTrader is a reputable proprietary trading firm that provides traders with the option to select from various evaluation program account sizes.

The evaluation programs consist of a single phase, requiring traders to achieve a profit target of 10% to become funded and eligible for profit splits. These targets are realistic, especially considering the maximum daily loss limit of 5% and the maximum trailing drawdown limit of 6% that traders must adhere to. Evaluation program participants can earn profit splits ranging from 75% to 90% and have the opportunity to scale their accounts.

SurgeTrader is recommended for those seeking a prop firm with clear and straightforward trading rules. Despite being relatively new, they offer favorable conditions for a wide range of traders with diverse trading styles. Taking everything into consideration, SurgeTrader has established itself as one of the leading prop firms in the industry.