26. Top Tier Trader

- Well known CEO

- Funding up to $600,000

- Scaling plan up to $2,000,000

- Balance-based drawdown on Top Tier accounts

- Default profit split of 80%

- Leverage up to 1:100

- A large variety of trading instruments

- High spreads

- No EAs allowed on Top Tier accounts

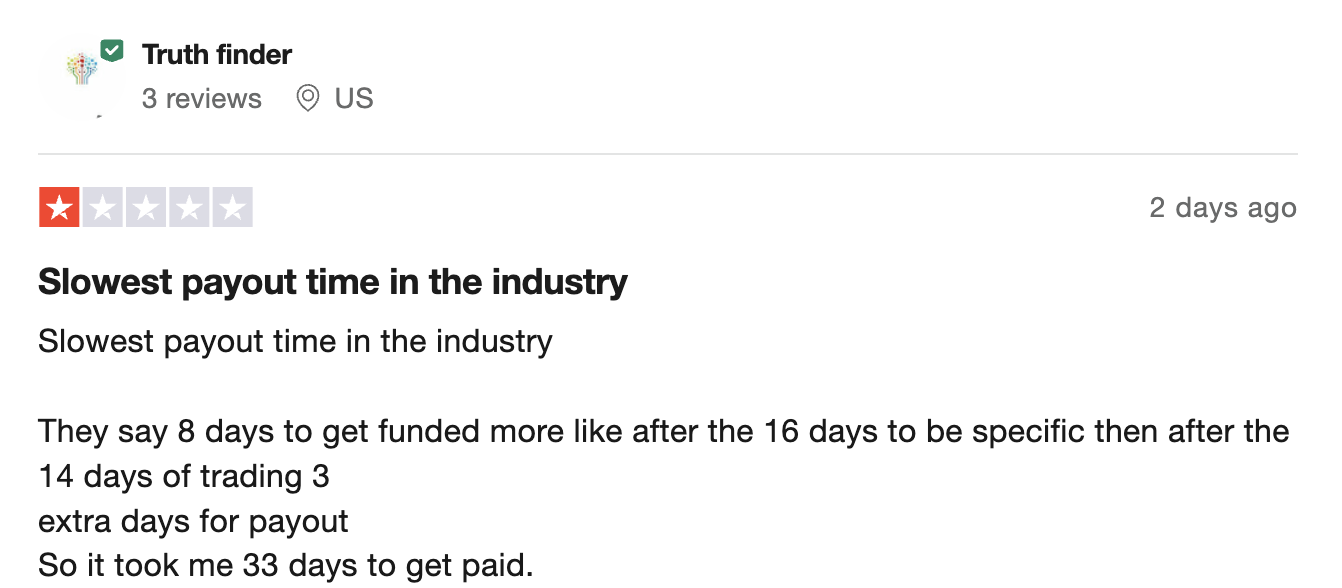

- Relatively few payout proofs

- High prices

- Equity-based drawdown on Top Tier Plus accounts

- No weekend holding on regular Top Tier accounts

- Only one free evaluation retry

TopTier Trader is a proprietary trading firm actively seeking skilled traders. They have developed a comprehensive 2-Phase Evaluation process designed to assess and identify traders who possess the qualities they are seeking.

At TopTier Trader, traders are motivated to excel in their trading careers. They have the freedom to trade according to their own strategies and hold positions for any desired duration. However, it is important to note that the use of EAs and copy trading is strictly prohibited. The firm's primary focus lies on adhering to loss limits, as their ultimate objective is to engage skilled and consistent traders and provide them with an impressive profit split ranging from 80% to 90%.

Who are TopTier Trader?

TopTier Trader is a recently established proprietary firm, commencing operations on October 18, 2021. Headquartered in Delaware, United States, they specialize in offering funding opportunities to undercapitalized traders. With funding options of up to $600,000, successful traders can enjoy a competitive profit split ranging from 80% to 90%. Notably, TopTier Trader also implements a scaling plan for their most accomplished traders, allowing them to access account balances of up to $2,000,000. To facilitate trading activities, they have partnered with Vital Markets as their designated broker.

Who is the CEO of Top Tier Trader?

Quillan Black is the CEO of Top Tier Trader

Funding program options

TopTier Trader provides traders with the flexibility to choose from two distinct programs:

- TopTier Challenge evaluation program accounts

- TopTier Challenge Plus evaluation program accounts

TopTier Challenge evaluation program accounts

- Regular TopTier Challenge evaluation program accounts

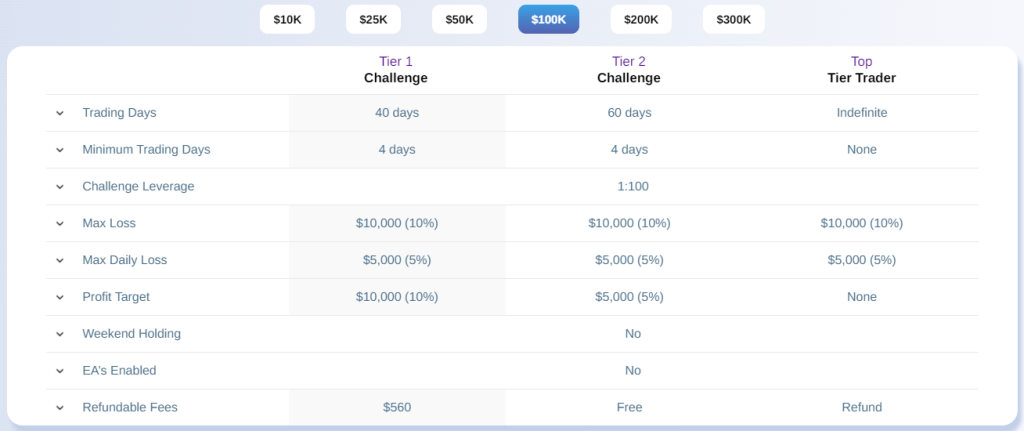

The Regular TopTier Challenge evaluation program account is designed to identify dedicated and skilled traders who demonstrate consistency throughout the two-phase evaluation period. This evaluation program account offers traders the opportunity to trade with leverage of up to 1:100.

Account Size - Prices

$10,000 - $99

$25,000 - $255

$50,000 - $350

$100,000 - $560

$200,000 - $999

$300,000 - $1,489

In the evaluation phase one of the TopTier Trader program, traders must achieve a profit target of 10% while adhering to the 5% maximum daily loss and 10% maximum loss rules. The time limit to reach the profit target is 40 calendar days from the day the first position is placed on the evaluation account. Additionally, a minimum of four trading days is required to progress to phase two.

In the evaluation phase two, traders must reach a profit target of 5% while staying within the 5% maximum daily loss and 10% maximum loss rules. The time limit for this phase is 60 calendar days from the day the first position is placed on the evaluation account. Similar to phase one, a minimum of four trading days is necessary to move on to a funded account.

Upon successfully completing both evaluation phases, traders receive a funded account with no profit targets. The only requirements are to abide by the 5% maximum daily loss and 10% maximum loss rules. The first payout is scheduled for 14 calendar days from the day the first position is placed on the funded account. During this time, there are no minimum trading day requirements or other restrictions. The profit split for the funded account is 80% based on the trader's profit.

Regular TopTier Challenge evaluation program account scaling plan

The Regular TopTier Challenge evaluation program accounts also offer a scaling plan for traders. To qualify for the scaling plan, you need to achieve a profit target of 6% or more within a three-month period, where at least two out of the three months were profitable. If you meet this requirement, your account balance will be increased by 25% of the original account balance, up to a maximum balance of $2,000,000.

Here's an example to illustrate how the scaling plan works:

After 3 months: If your account balance is $200,000, it will increase to $250,000.

After the next 3 months: The balance of $250,000 increases to $300,000.

After the following 3 months: The balance of $300,000 increases to $350,000.

And so on...

In terms of trading instruments, the evaluation program accounts at TopTier Trader allow trading in forex pairs, commodities, indices, and cryptocurrencies.

Regular TopTier Challenge evaluation program account rules

-

The profit target is a predetermined percentage of profit that traders need to achieve in order to complete an evaluation phase, withdraw profits, or scale their account. In phase 1 of the evaluation, the profit target is set at 10%, while in phase 2, it is reduced to 5%. However, once traders progress to funded accounts, there are no specific profit targets to be met.

-

The maximum daily loss refers to the highest amount of loss a trader can incur within a single day before their account is considered violated. For all account sizes, the maximum daily loss is set at 5%, meaning that traders must ensure that their losses do not exceed this limit during a day of trading.

-

The maximum loss represents the highest allowable amount of loss that a trader can accumulate overall before their account is considered violated. Regardless of the account size, the maximum loss limit is set at 10%. This means that traders must ensure that their cumulative losses do not exceed this threshold to maintain compliance with the account rules.

-

The minimum trading days refer to the mandatory duration that traders must engage in trading before they can successfully complete an evaluation phase or make a withdrawal request. Both evaluation phases, phase one and phase two, impose a minimum trading day requirement of four days. However, once traders progress to funded accounts, there are no longer any minimum trading day requirements to fulfill.

-

The maximum trading days represent the allowable timeframe within which traders must achieve a specific profit target or withdrawal target. Phase 1 of the evaluation program has a maximum period of 40 trading days, while phase 2 allows for a maximum of 60 trading days. It is important to meet the designated targets within these specified timeframes to progress successfully through each phase.

-

The policy of "no weekend holding" indicates that traders are prohibited from keeping open positions over the weekends.

-

The restriction of "no martingale allowed" implies that traders are prohibited from employing any form of martingale strategy during their trading activities.

-

The policy of "no EAs allowed" indicates that traders are prohibited from utilizing any kind of EA (Expert Advisor) services.

-

The restriction on "no copy trading allowed" means that traders are prohibited from utilizing any form of copy trading services.

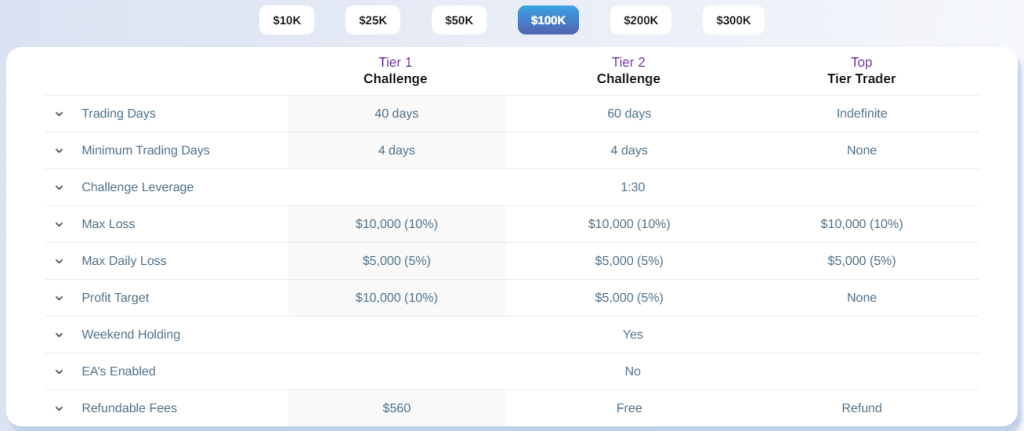

2. Swing TopTier Challenge evaluation program accounts

The Swing TopTier Challenge evaluation program account is designed to identify dedicated and skilled traders who demonstrate consistent performance throughout the two-phase evaluation period. This evaluation program enables trading with leverage of 1:30.

Account Size - Prices

$10,000 - $99

$25,000 - $255

$50,000 - $350

$100,000 - $560

$200,000 - $999

$300,000 - $1,489

During evaluation phase one, traders are expected to achieve a profit target of 10% while adhering to the maximum daily loss and maximum loss rules of 5% and 10% respectively. This target must be reached within 40 calendar days from the day the first position is placed on the evaluation account. Additionally, a minimum of four trading days must be completed to proceed to phase two.

In evaluation phase two, traders are required to reach a profit target of 5% while maintaining the maximum daily loss and maximum loss limits of 5% and 10% respectively. The profit target must be achieved within 60 calendar days from the day the first position is placed on the evaluation account. Similar to phase one, a minimum of four trading days must be completed to advance to a funded account.

Upon successfully completing both evaluation phases, traders are granted a funded account with no profit targets. The only requirements are to abide by the 5% maximum daily loss and 10% maximum loss rules. The first payout is scheduled for 14 calendar days from the day the first position is placed on the funded account. During this period, there are no minimum trading day obligations or other restrictions. Traders will receive a profit split of 80% based on the profits earned in the funded account.

Swing TopTier Challenge evaluation program account scaling plan

Swing TopTier Challenge evaluation program accounts come with a scaling plan. To qualify for the scaling plan, traders need to achieve a profit target of 6% or more within a three-month period, with at least two out of the three months being profitable. Successful traders will receive an account increase of 25% of the original account balance, up to a maximum balance of $2,000,000.

Here's an example to illustrate how the scaling plan works:

After 3 months: If you have a $200,000 account, your account balance will increase to $250,000.

After the next 3 months: The balance of $250,000 will increase to $300,000.

After the next 3 months: The balance of $300,000 will increase to $350,000.

And so on...

In terms of trading instruments, the evaluation program accounts allow trading in forex pairs, commodities, indices, and cryptocurrencies.

Swing TopTier Challenge evaluation program account rules

-

The profit target is a predetermined percentage of profit that traders need to achieve in order to complete an evaluation phase, withdraw profits, or scale their account. In the Swing TopTier Challenge evaluation program, Phase 1 has a profit target of 10%, while Phase 2 has a profit target of 5%. Once traders successfully complete both evaluation phases, and progress to a funded account, there are no specific profit targets to meet.

-

The maximum daily loss represents the highest allowable amount of loss that a trader can experience within a single trading day before their account is considered in violation. Regardless of the account size, all traders are subject to a maximum daily loss limit of 5%. This means that traders must ensure that their losses do not exceed this predefined threshold during any given day of trading in order to remain compliant with the rules and regulations.

-

The maximum loss refers to the maximum amount of loss that a trader is allowed to incur before their account is considered in violation. For all account sizes, there is a set limit on the maximum loss, which is capped at 10%. This means that traders must ensure that their cumulative losses do not exceed this specified threshold throughout their trading activities. Staying within this limit is crucial to maintain compliance with the account regulations and avoid any violations.

-

The minimum trading days refer to the mandatory duration that traders must engage in trading before they can successfully complete an evaluation phase or make a withdrawal request. In both evaluation phases, there is a requirement to trade for a minimum of four days. This ensures that traders have an adequate period to showcase their trading skills and consistency. However, once traders progress to funded accounts, there are no minimum trading day requirements to fulfill. This provides more flexibility and freedom for traders to manage their trading activities in accordance with their strategies and goals.

-

The maximum trading days indicate the timeframe within which traders must achieve a specific profit target or withdrawal target. In the first phase of the evaluation, traders have a maximum of 40 trading days to reach their goals, while in the second phase, they have a maximum of 60 trading days. These time limits provide traders with a defined period to demonstrate their trading abilities and meet the required targets. It's important for traders to manage their trades efficiently and effectively within these designated periods to optimize their chances of success in the evaluation process.

-

The restriction of "no martingale allowed" implies that traders are prohibited from employing any form of martingale strategy during their trading activities. This rule serves as a guideline to ensure that traders do not utilize this specific strategy, which involves increasing the size of trades after experiencing losses. By disallowing martingale strategies, the trading firm aims to promote alternative trading methods and risk management approaches that align with their preferred trading style and objectives.

-

The policy of "no EAs allowed" indicates that traders are prohibited from utilizing any form of EA (Expert Advisor) services. This restriction implies that traders must rely on manual trading methods and cannot employ automated trading systems or algorithmic strategies provided by external sources. By enforcing this rule, the trading firm aims to ensure that traders solely rely on their own trading skills and decision-making abilities, promoting a more hands-on and personalized approach to trading.

-

The restriction of "no copy trading allowed" indicates that traders are prohibited from utilizing any form of copy trading services. This means that they are not permitted to automatically replicate the trades of other traders or follow pre-set trading strategies of external sources. The trading firm enforces this rule to ensure that traders rely solely on their own trading decisions and strategies, promoting individual accountability and independent trading. By prohibiting copy trading, TopTier Trader aims to foster a trading environment that emphasizes the development of traders' skills and the cultivation of their own unique trading approaches.

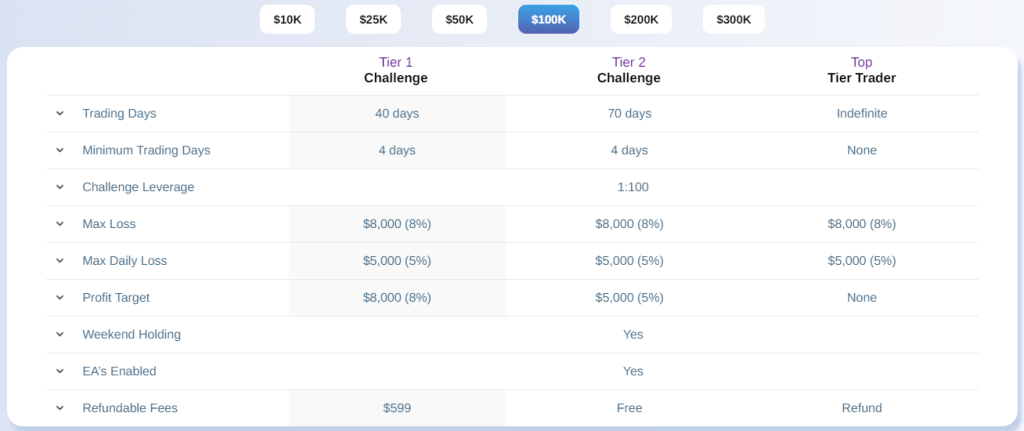

TopTier Challenge Plus evaluation program accounts

The TopTier Challenge Plus evaluation program account is designed to identify dedicated and skilled traders who demonstrate consistent performance throughout the two-phase evaluation period. This program offers traders the opportunity to trade with leverage of up to 1:100. By participating in this evaluation program, traders have the chance to showcase their abilities and earn recognition for their disciplined and successful trading approach.

Account Size - Prices

$10,000 - $99

$25,000 - $255

$50,000 - $375

$100,000 - $599

$200,000 - $999

$300,000 - $1,399

During the evaluation process of the TopTier Challenge Plus program, traders need to achieve specific profit targets and adhere to certain risk management rules. In phase one, the profit target is set at 8%, while maintaining a maximum daily loss of 5% and a maximum overall loss of 8%. Traders must reach this profit target within 40 calendar days from the start of their evaluation account and trade for a minimum of four trading days to progress to phase two.

In phase two, the profit target is reduced to 5%, with the same maximum daily loss and maximum overall loss rules in place. Traders have 70 calendar days from the beginning of their evaluation account to achieve the profit target and are again required to trade for a minimum of four trading days to qualify for a funded account.

Upon successfully completing both evaluation phases, traders are awarded a funded account without profit targets. The focus shifts to respecting the maximum daily loss of 5% and maximum overall loss of 8%. The first payout is scheduled 14 calendar days after the initial position is placed in the funded account.

During this period, there are no minimum trading day requirements or other restrictions. Traders will receive a profit split ranging from 80% to 90% based on the profits generated in their funded account.

TopTier Challenge Plus evaluation program account scaling plan

The TopTier Challenge Plus evaluation program accounts come with a scaling plan to further reward successful traders. To qualify for the scaling plan, traders must achieve a profit target of 6% or higher within a three-month period, with at least two out of the three months being profitable. Upon meeting these requirements, traders will receive an account increase of 25% based on the original account balance, up to a maximum balance of $2,000,000.

Here's an example to illustrate how the scaling plan works:

After 3 months: If you start with a $200,000 account, your account balance will increase to $250,000.

After the next 3 months: The balance of $250,000 will further increase to $300,000.

After the subsequent 3 months: The balance of $300,000 will continue to grow to $350,000.

And so on...

The evaluation program accounts support trading in various instruments such as forex pairs, commodities, indices, and cryptocurrencies.

TopTier Challenge Plus evaluation program account rules

-

The profit target is a predetermined percentage of profit that traders must achieve in order to complete an evaluation phase, withdraw profits, or scale their account. In Phase 1 of the evaluation, the profit target is set at 8%, while in Phase 2, it is reduced to 5%. Once traders have successfully progressed to funded accounts, there are no specific profit targets to meet.

-

The maximum daily loss refers to the highest amount of loss that a trader can incur within a single day before their account is considered in violation. For all account sizes, the maximum daily loss is set at 5%. This means that traders should ensure their losses do not exceed this threshold within a single trading day to comply with the rules and regulations.

-

The maximum loss refers to the highest allowable amount of loss that a trader can incur in total before their account is considered in violation. For all account sizes, the maximum loss limit is set at 8%. This means that traders must ensure their cumulative losses do not exceed this limit to maintain compliance with the rules and regulations of the platform.

-

The minimum trading days represent the mandatory duration during which traders must engage in trading activities before they can successfully complete an evaluation phase or submit a withdrawal request. Both evaluation phases necessitate a minimum trading commitment of four days. However, funded accounts do not have any specific requirements regarding the minimum number of trading days.

-

The maximum trading days refer to the allotted time frame within which traders must achieve a designated profit target or withdrawal target. Phase 1 imposes a maximum period of 40 trading days, while phase 2 allows a maximum of 70 trading days for reaching the respective targets.

-

Traders are prohibited from employing any form of martingale strategy while engaging in trading activities. This restriction, known as "no martingale allowed," strictly prohibits the use of martingale strategies.

-

Traders must adhere to designated lot sizes for specific trading instruments, which are typically determined by the initial account balance of the proprietary firm account. It's important to note that funded accounts have a lot size limit of 5 lots specifically for indices.

What makes TopTier Trader different from any other prop firm?

TopTier Trader sets itself apart from other industry-leading proprietary firms by offering two distinct two-step evaluation funding programs: TopTier Challenge and TopTier Challenge Plus. One notable difference is that they rarely impose restrictions on your trading style. You have the flexibility to trade during news events, hold trades overnight, and even trade over weekends.

In contrast to other prop firms, TopTier Trader's evaluation program follows a two-phase structure, which requires traders to successfully complete both phases to become eligible for payouts. Phase one entails achieving a profit target of 10%, while phase two has a profit target of 5%. Traders must adhere to a maximum daily loss of 5% and a maximum overall loss of 10%. Additionally, a minimum of four trading days is required in each phase before advancing to the funded stage. It's worth noting that the evaluation programs also include a scaling plan. In comparison to other leading prop firms in the industry, TopTier Trader maintains average profit targets and minimum trading day requirements.

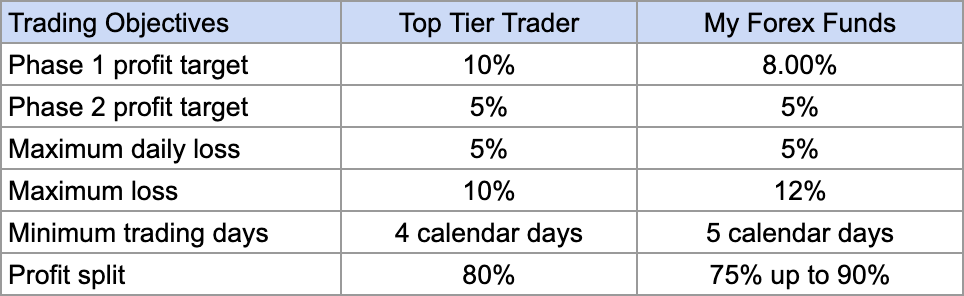

A comparative example between Top Tier Trader and My Forex Funds:

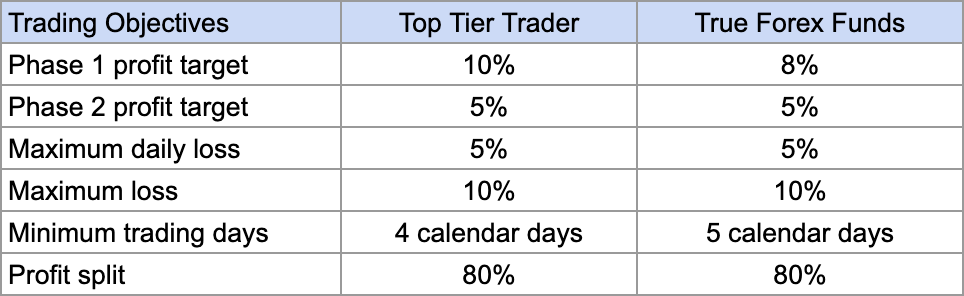

A comparative example between Top Tier Trader and True Forex Funds:

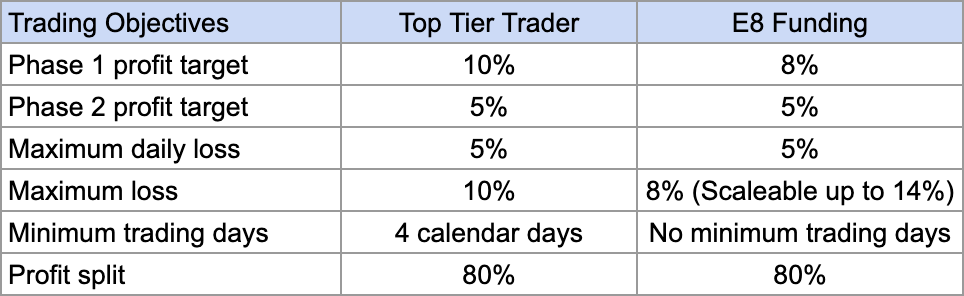

A comparative example between Top Tier Trader and E8 Funding:

Is getting TopTier Trader capital realistic?

When assessing prop firms that align with your forex trading style, it is crucial to evaluate the feasibility of their trading requirements. For instance, while a company offering a high percentage profit split on a well-funded account may seem appealing, if they expect significant monthly gains with minimal drawdowns, your chances of success are nearly nonexistent.

Receiving capital from the TopTier Challenge evaluation program is mostly realistic because they set industry-standard profit targets (10% in phase one and 5% in phase two) and implement average maximum loss rules (5% maximum daily and 10% maximum loss).

Similarly, receiving capital from the TopTier Challenge Plus evaluation program is also mostly realistic as it entails below-average profit targets (8% in phase one and 5% in phase two) with average maximum loss rules (5% maximum daily and 8% maximum loss).

Considering all these factors, opting for TopTier Trader is an excellent decision to secure funding. They offer two distinct funding programs with achievable trading objectives and conditions for receiving payouts.

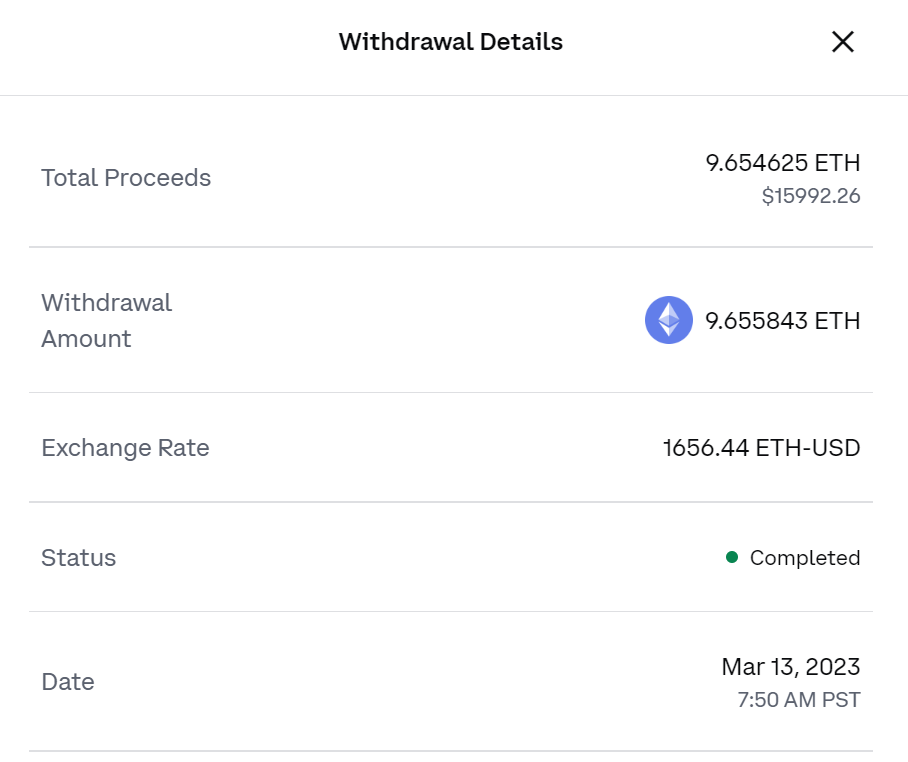

Payout proof

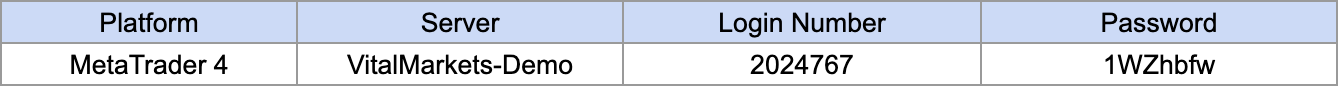

Which brokers does TopTier Trader use?

TopTier Trader operates with Vital Markets as its brokerage partner. Vital Markets is headquartered in Sydney and was established in 2016 as a subsidiary of Vantage International Group (VIG). When it comes to trading platforms, TopTier Trader enables you to engage in trading activities through both Meta Trader 4 and MetaTrader 5.

Trading instruments

Trading fees

Spread

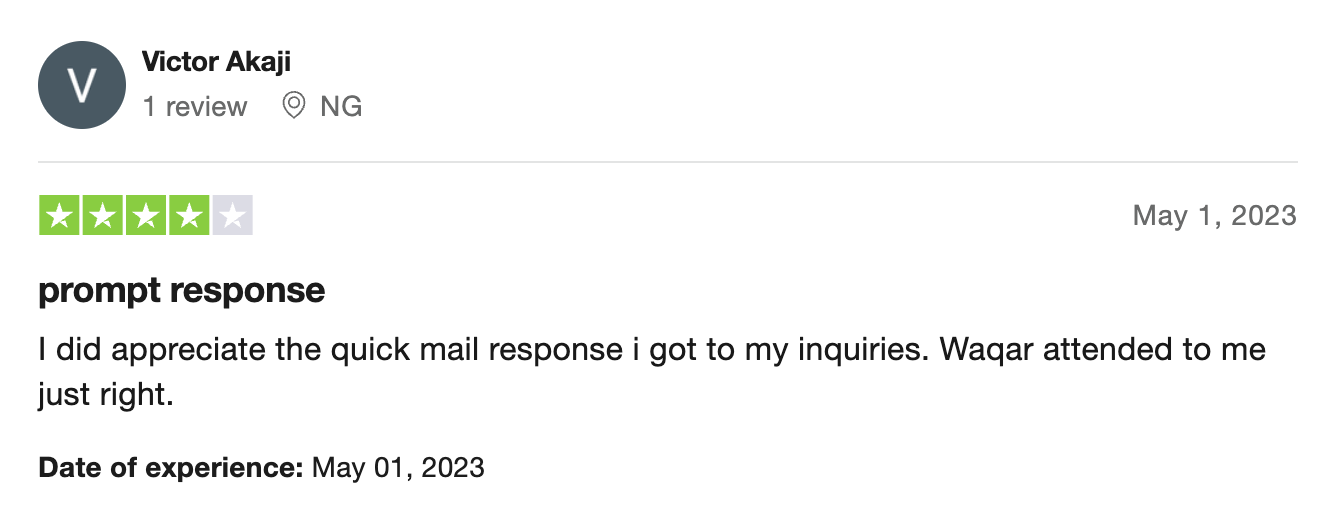

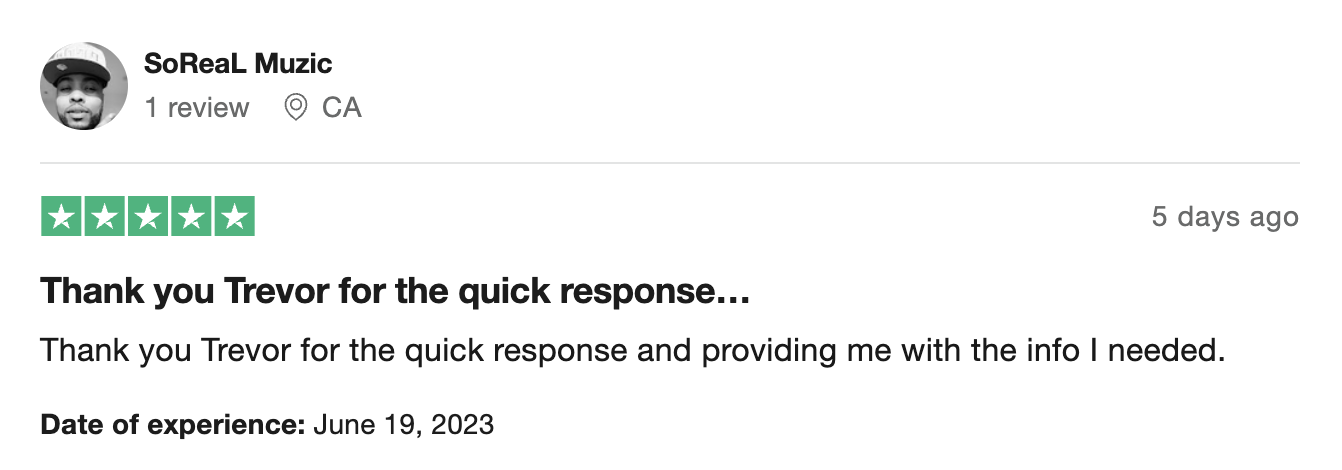

Traders’ Comments about TopTier Trader

Summary

To summarize, TopTier Trader is a reputable proprietary trading firm that provides traders with the choice between two funding programs: TopTier Challenge and TopTier Challenge Plus evaluation program accounts.

The TopTier Challenge evaluation programs follow a standard two-phase evaluation process, requiring traders to complete both phases to become funded and eligible for profit splits. TopTier Trader sets realistic profit targets of 10% in phase one and 5% in phase two, aligning with achievable trading objectives. Traders must adhere to maximum daily and maximum loss rules of 5% and 10% respectively. By participating in the TopTier Challenge evaluation programs, traders can earn profit splits of 80% while having the opportunity to scale their accounts.

Similarly, the TopTier Challenge Plus evaluation programs also follow a two-phase evaluation process, leading to funding and profit splits. The profit targets for this program are 8% in phase one and 5% in phase two, which remain realistic trading objectives. Traders must abide by the maximum daily and maximum loss rules of 5% and 8% respectively. By opting for the TopTier Challenge Plus evaluation programs, traders can earn profit splits ranging from 80% up to 90%, with account scalability.

I highly recommend TopTier Trader to individuals seeking a prop firm with clear and straightforward trading rules. They are a well-established proprietary trading firm that offers favorable conditions for a wide range of traders with diverse trading styles. After considering all the aspects of TopTier Trader's offerings, it is evident that they rank among the top proprietary trading firms in the industry.